Catastrophe bonds (cat bonds) are financial instruments that transfer the risk of natural disasters from insurance companies to investors, who receive higher yields in return but risk losing their principal if a specified catastrophe occurs.

With their low correlation to traditional asset classes and their potential for consistent, attractive returns, cat bonds could help improve the risk/return profile of a typical investment portfolio.

There are no ETFs or index funds that specifically track the asset class, but you can easily gain exposure to cat bonds through specialist mutual funds, which allow for diversification without the need to access the institutional market or manage individual bond positions.

Bond markets around the world are getting hammered by rising interest rates, but one debt instrument is still looking like the cat’s pajamas, delivering double-digit returns. Catastrophe bonds (or “cat bonds” for short) have been, well, purring: the Swiss Re Global Cat Bond Index is up 16% this year, outperforming the Bloomberg Global Aggregate Index (made up of investment-grade government and corporate bonds) by almost 20%. Here’s what you need to know about these niche assets – and how to invest.

What are catastrophe bonds?

These debt instruments are a way for insurance companies to protect themselves in the event of major disasters, like hurricanes or earthquakes, by transferring some or all of the risk to investors. It essentially allows them to borrow money directly from investors. When an insurance company issues a cat bond, the investors are handing over money in exchange for interest payments (called coupons, just like with any ole bond). More specifically, investors get paid a floating coupon – that is, one that moves in line with the overall level of interest rates in the economy – plus a premium for taking on catastrophe risk.

Now, if the specific disaster – which is precisely defined in terms of severity or impact – happens and causes losses that exceed a certain amount, the insurance company can use the money from the bond to help pay for the claims. In this case, investors might lose some or all of the money they invested in the cat bond, but they still keep all the interest payments they received up until the catastrophe hit. If the specified disaster doesn’t happen during the bond’s term, the insurance company returns the principal (i.e. the borrowed amount) to the investors at the end of the term.

In essence, cat bond investors are betting that a major natural disaster won’t happen. If it does, they stand to lose some or all of their money, which would be used to cover the cost of damages inflicted by the disaster. If it doesn’t, they earn an interest rate that’s typically higher than most other types of bonds. Some of the biggest bets focus on high-speed wind storms (especially in Florida) and earthquakes, but there’s growing demand for cat bonds that cover wildfires and flash floods, which are happening more frequently because of climate change.

What’s the appeal of these catastrophe bonds?

1. They improve portfolio diversification.

Cat bonds offer diversification benefits since their performance is generally not correlated with traditional asset classes, like stocks or regular bonds. They’re driven, after all, by hurricanes and earthquakes and the like, not by market rallies and crashes. Cat bonds have benefitted from this lack of market correlation this year, putting them on track for their best annual performance – even as stocks and government bonds have recently tumbled in tandem.

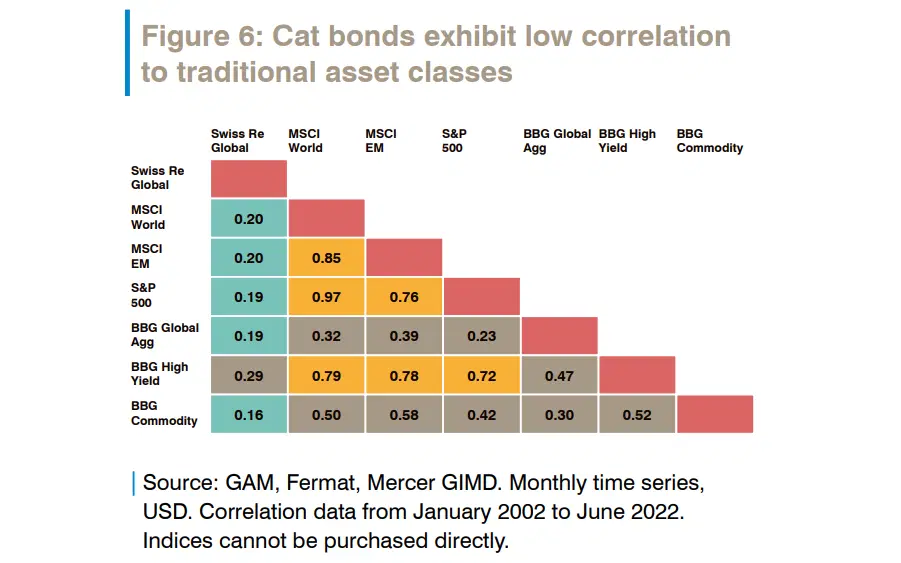

Cat bonds display very low correlations with traditional asset classes. Source: GAM.

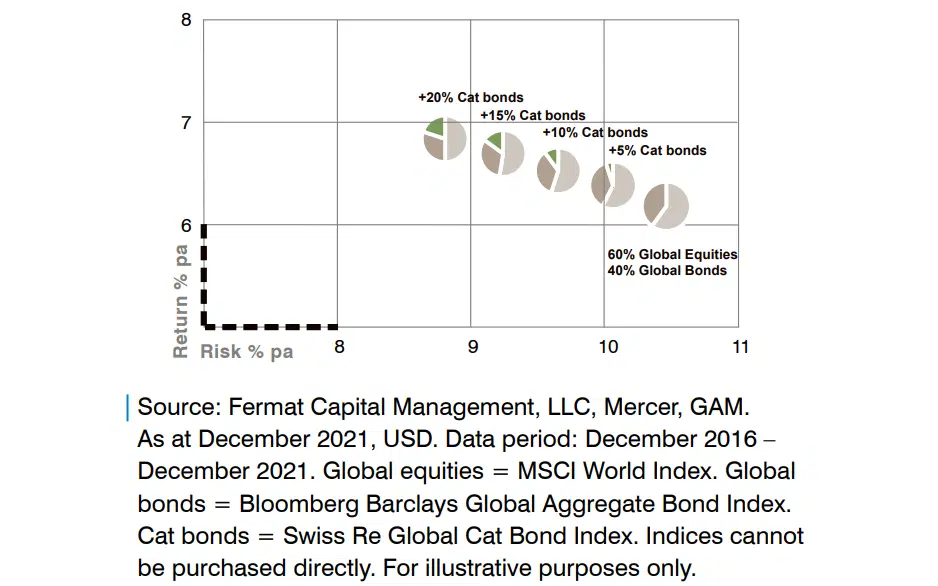

And because of that low correlation to traditional asset classes, a cat bonds allocation could generally improve the risk/return profile of a typical investment portfolio. In fact, incrementally adding 5% allocations to the traditional 60/40 portfolio (i.e. 60% invested in stocks and 40% in bonds) has been shown to decrease risk and increase return.

Potential benefits of incrementally adding cat bonds to a balanced portfolio. Source: GAM.

2. They offer attractive risk-adjusted returns.

Cat bonds’ primary return comes from their high yields, which tend to be bigger than those found on traditional bonds to compensate for their unique risk (namely, disaster risk).

As of the third quarter of 2023, the average coupon on these bonds stood at 8.4%, according to data provider Artemis, while expected loss stood at 1.2%. The latter is an estimate of the potential losses on the cat bonds due to qualifying catastrophic events. It represents the average annual loss anticipated over the life of the bonds, based on historical data and modeling of potential future events. Subtracting one from the other gives you 7.2% as cat bonds’ net yield – more than two percentage points higher than you’d get on ten-year Treasuries today.

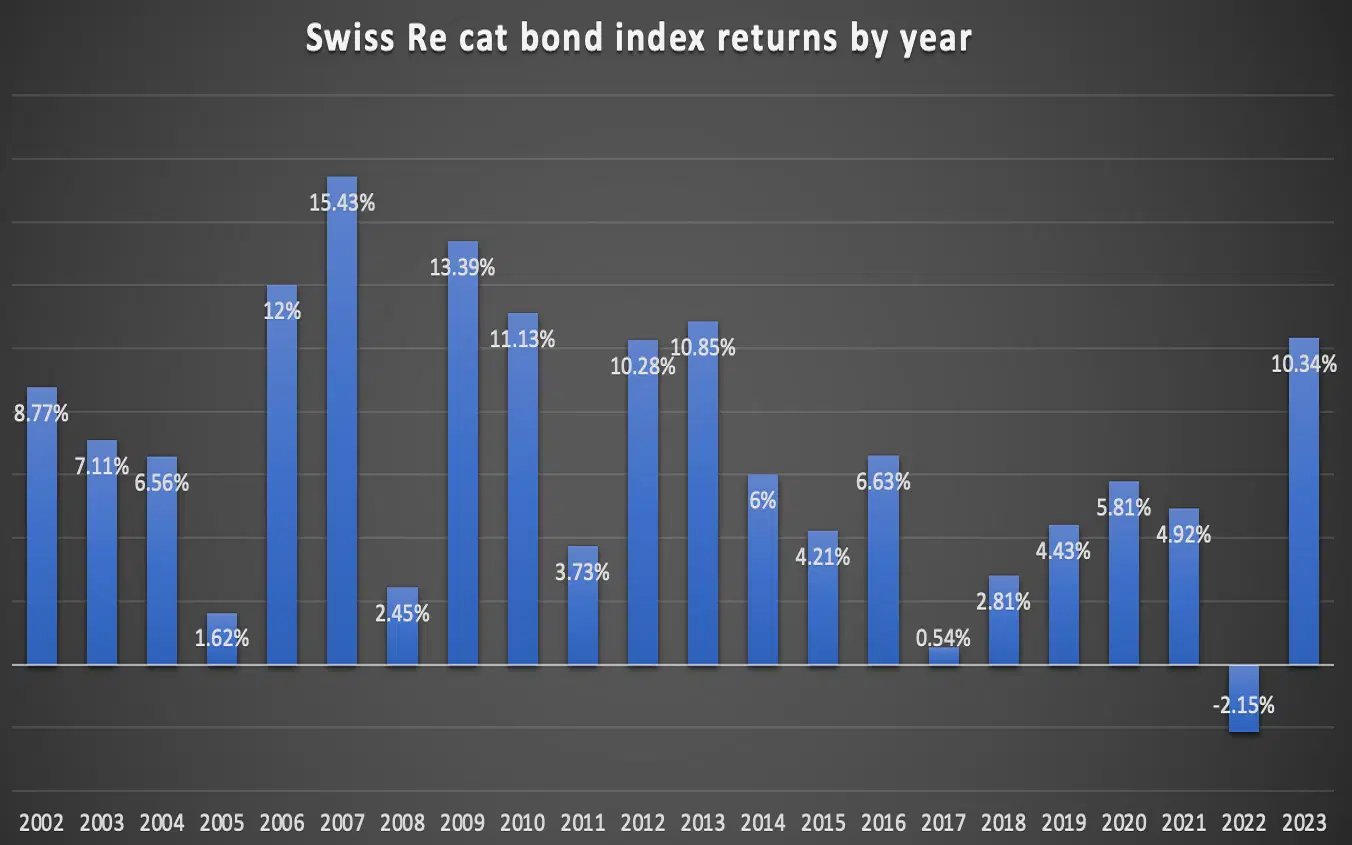

The chart below shows the Swiss Re Global Cat Bond Index’s two-decade performance, boasting an average annual return of 6.7%. Notably, the index has had just one negative year in its 23-year history – and that was in 2022 when Hurricane Ian caused over $50 billion in insurance losses in Florida. For investors, the silver lining to that event was a significant repricing of disaster risk, which meant that cat bonds introduced in 2023 offered higher yields.

The Swiss Re Global Cat Bond Index’s performance since 2002. Source: Artemis.

3. They can hedge against periods of market turmoil and/or rising interest rates.

With a cat bond, you get paid a floating coupon – that is, one that moves in line with the overall level of interest rates in the economy. So when interest rates are heading higher, these bonds should fare relatively well because the coupons they pay investors will also head higher. That makes them a good potential hedge against rising interest rates, which, as we’ve seen over the past two years, can lead to heavy losses in both the stock and bond markets.

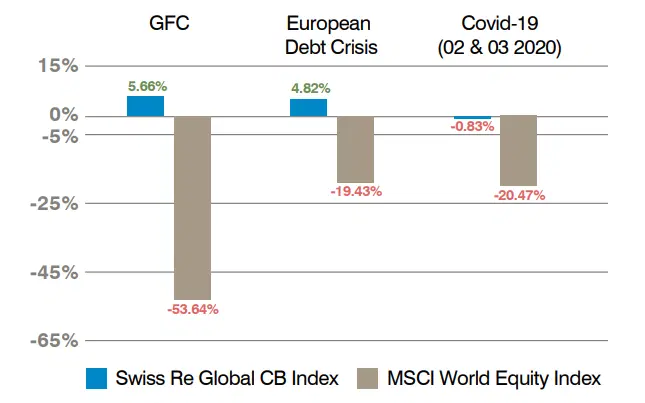

What’s more, because they’re not driven by economic or corporate events, cat bonds are largely independent of mainstream markets, making them attractive to investors looking for protection from broad financial market volatility.

The Swiss Re Global Cat Bond Index’s performance shows how well cat bonds have performed during times of market stress. Source: GAM.

What are the risks?

Your biggest worry with investing in cat bonds is event risk. That is, if the specified catastrophic event occurs and meets the predefined criteria in the bond’s terms, you could lose some or all of the money you’ve invested in it. And that risk is not something to sneeze at these days, with climate change leading to more frequent weather catastrophes and associated insurance losses. In the first half of 2023, for example, insured losses hit their second-highest peak since 2011, at over $50 billion, with severe thunderstorms accounting for 70% of that total.

You should also be aware of two other big risks. First is liquidity risk: the cat bonds market is less liquid than more traditional securities markets, which might make it harder for you to sell your positions. Second is counterparty risk: there’s a risk that the counterparty (the insurance or reinsurance company) might default on its obligations, especially following a major catastrophic event that leads to heavy insured losses.

But you can reduce some of your risk, just like you would with other asset classes, with some proper diversification – that is, investing in multiple cat bonds, encompassing different disaster categories, regions, and issuers. Consider this: the Swiss Re Global Cat Bond Index’s maximum drawdown (the biggest peak-to-trough decline in the value of the index) over its 23-year history was just 10%. For reference, over the same period, the S&P 500 experienced a max drawdown of 57%, while global bonds (as measured by the Bloomberg Global Aggregate Index) saw 26%.

How do you invest in catastrophe bonds?

The easiest way for a retail investor to gain exposure to these assets is through investment funds. While there are no ETFs or index funds that track the Swiss Re Global Cat Bond Index, several specialist mutual funds focus purely on cat bonds. And by investing in these funds, you can achieve diversification across various cat bonds without the need to access the institutional market or manage individual bond positions. Schroders and GAM Investments run the biggest cat bond funds, according to Morningstar. Credit Suisse, Amundi Asset Management, and AXA Investment Managers are also active in the market. As always, do your own research before investing (check out our dedicated guide to learn more about analyzing funds quantitatively and qualitatively).