Seven characteristics support the best growth stocks: strong current profit growth, strong annual profit growth, something new about them, supportive supply and demand, a leading industry, strong institutional support, and a market in an uptrend.

William O’Neil’s growth investment strategy calls for buying stocks when they’re breaking out of a cup-and-handle formation, and putting a stop-loss 8% below your entry price.

And the most appealing stocks based on these criteria right now are in the tech, healthcare, industrials, and financials sectors.

Retail investors have been buying fewer of the Magnificent Seven’s shares ever since the US election, according to market research firm Vanda. And since those fan-favorite stocks are typically the biggest drivers of high-octane “growth” strategies, there’s some worry that the rest of their ilk might also fall by the wayside. If that’s the case, now could be a great time to use the “CAN SLIM” method: an investing approach that zeros in on the seven common characteristics of the companies whose shares have gone on to make massive gains in the past.

Stéphane introduced you to this method before, and this seems like a superb time to revisit it.

What are the seven characteristics?

Current quarterly earnings: Look for stocks that have increased their profits by at least 25% in the most recent quarter. While generally the stronger those profits are, the better, the quality of profit growth is important too. So pick out companies that have also grown their sales by at least 20% and that have a return on equity (ROE) of at least 17%.

Annual earnings growth: Go for stocks that have grown their profits by at least 25% in each of the past three years. Looking beyond the most recent quarter is important if you want to avoid investing in companies that have only managed to temporarily boost their profits.

New product, management, or price high: Stocks tend to achieve their largest price gains after a game-changing product is launched – Apple’s iPhone, say – or when something new happens. So keep an eye out for potential catalysts of growth and profitability: a new management team, product launch, market entry, or the stock price hitting new highs.

Supply and demand: When a company’s stock price is rising with above-average volume, it could indicate that big institutional investors are buying up its shares. That’s a good sign, as they tend to do their due diligence and they’re generally in it for the long haul.

Leader or laggard: The stocks showing the most explosive price growth tend to be leading stocks in leading industry groups. Unlike value investors who buy badly performing stocks in declining industries, CAN SLIM investors usually buy the best stocks in the best industries. For them, growth potential and interest from other major players is more important than valuations.

Institutional ownership: The best stocks will tend to have strong and growing support from institutional investors. So look at the number and quality of funds invested in the company, and how much they own. And screen out stocks that have a daily trading volume of fewer than 400,000 shares: their price might be too sensitive when large investors sell their stocks.

Market direction: Even the best stocks rely on a bullish market to really perform, so it’s important that you buy only when the overall market is in a positive trend. When the market is pointed downward or in a correction, it’s generally best to wait on the sidelines until you’ve got confirmation that the uptrend is back.

Anything else?

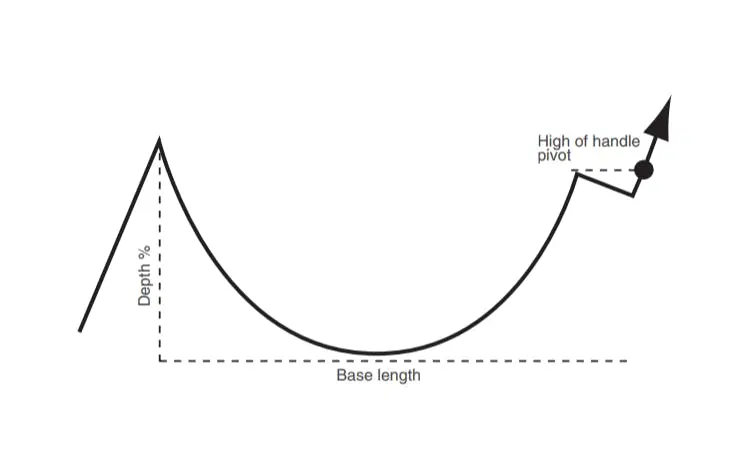

William J. O'Neil, the former stockbroker and entrepreneur who invented the CAN SLIM method, says it’s not enough just to watch for those attributes. He also recommends specific buy and sell rules. He says the best moment to buy is when the stock is breaking out of a “cup-and-handle” formation, like the one below – when it has spent time consolidating after previous gains, and is ready for the next move.

Cup-and-handle chart pattern. Source: William J. O'Neil.

As for when to sell, O’Neil says you should always cut your losses if the price drops 8% below your entry level. When you’re investing in risky, high-growth stocks, making sure to preserve your capital by cutting your losses is as important as identifying the fastest-growing companies.

What are the pros and cons of the strategy?

Having a defined investment process can help you learn from your mistakes and will reduce the likelihood that you’ll make decisions based on emotion, rather than strategy. And by following the CAN SLIM rules, you’re likely to pick the next big winner, as almost all of the fastest-growing stocks do display these characteristics.However, the downside is that not all the rules are clearly defined. For example, O’Neil doesn’t specify what constitutes a down market, how many stocks you should hold in your portfolio, or how much you should invest in each position. Plus, following O’Neil’s rules would lead to a high turnover – and hence transaction costs – and require active management of your portfolio.Lastly, investing in the fastest-growing companies works well in the up-trend market we’ve seen over the past decade, but it doesn’t work as well in range-bound or bear markets.

So what’s the opportunity here?

The stocks that screen as attractive, according to the seven characteristics, are spread across the tech, industrials, healthcare, financials, and consumer sectors.In tech, Nvidia, Super Micro Computer, Applovin, and Camtek score highly.

Powell Industries, FTAI Aviation, and Mueller Industries are the industrials names that screen well.In healthcare, Neurocrine Biosciences, Doximity, Adma Biologics, and Insulet are worth looking at.

The financials are RenaissanceRe, Cincinnati Financial, and Arch Capital in insurance, and Axos Financial and Ares Management in banks and asset management.

And the consumer names are Vital Farms and Cal-Maine Foods on the staples side, and Deckers on the discretionary side.

Take a look at all these companies in greater depth, or try to apply the CAN SLIM method to other growth stocks, and you might just find something that takes your fancy.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.