What’s going on here?

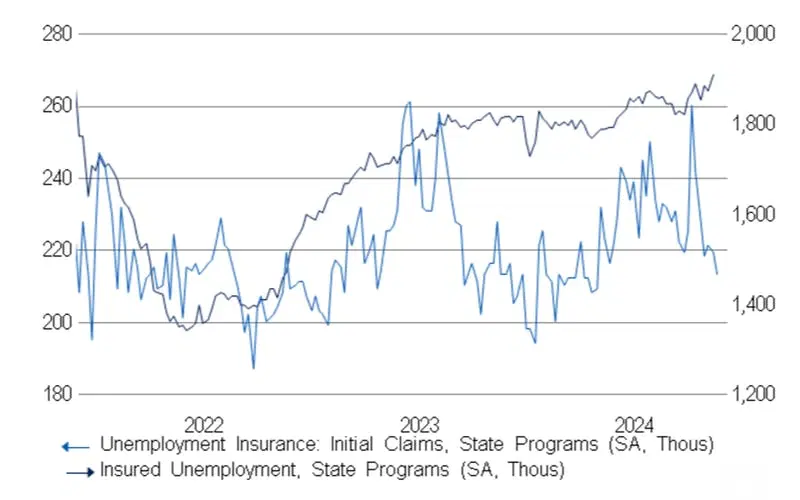

US initial jobless claims dipped to 213,000 last week, reflecting a resilient labor market despite disruptions from strikes and hurricanes.

US unemployment insurance claims fall. Source: abrdn, Haver, Department of Labor.

What does this mean?

The drop in jobless claims signals a robust labor environment, yet rising continuing unemployment claims – a three-year high of 1,908,000 – indicate sectors still facing employment struggles. This mixed picture emerges alongside a rebound in October's home sales, which climbed 3.4%. However, realtors caution that sustained storm impacts and interest rate hikes could curb this growth. Additionally, increasing home inventory might stabilize transactions in 2025, possibly influencing prices downward. While strikes and weather events challenged short-term activity, overall economic health endures, prompting the Federal Reserve to reconsider policy adjustments amid ongoing inflationary pressures.

Why should I care?

For markets: Navigating uncertainties.

While strikes and weather events challenged short-term activity, overall economic health endures. That resilience may slow the Federal Reserve's easing pace, affecting financial markets and interest-sensitive sectors.

The bigger picture: Housing market volatility ahead.

While renewed home sales buoyed spirits, the looming shadow of higher rates and natural disasters may dampen future market behavior. The ongoing inventory rise offers hope for affordability, but buyers should brace for fluctuating conditions as 2025 approaches.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.