Very rarely can investors have their cake and eat it too. You can’t get high yield without risk of loss, and you tend not to be able to pick up cheap dividend-paying stocks that have strong growth prospects either.

But there’s an investment trust out there that might tick all those boxes: the BlackRock Enhanced Dividend Trust.

There’s a catch, mind you. The trust hasn't performed as well as a simple buy-and-hold stock strategy. For income seekers, though, maybe that doesn’t matter.

Investing can be confusing, with so many options out there. One day, you want to invest in some of the world’s best firms, to participate in their long-term growth. The next day, you’re thinking about dividend income. And maybe you’re also a bit of a bargain hunter, always looking for stocks you can get on the cheap. Well, good news: there might be a way for you to have it all. The BlackRock Enhanced Global Dividend Trust puts growth stock giants like Microsoft and Apple among its top investments, pays an 8% dividend, and can be picked up at a 15% discount.

So is this an ETF, then?

Well, no, it’s an investment trust. Unlike exchange-traded funds (ETFs), which mint brand new shares every time someone invests, trusts are closed. In essence, they issue and sell a bunch of shares at the start, and then invest that money into stocks. The shares of the trust are then listed on a stock exchange – for example, the New York Stock Exchange (NYSE) – and they trade just like the shares of any company. If the underlying investments do well, then the shares of the trust should rise, and vice versa.

What are the trust’s underlying investments?

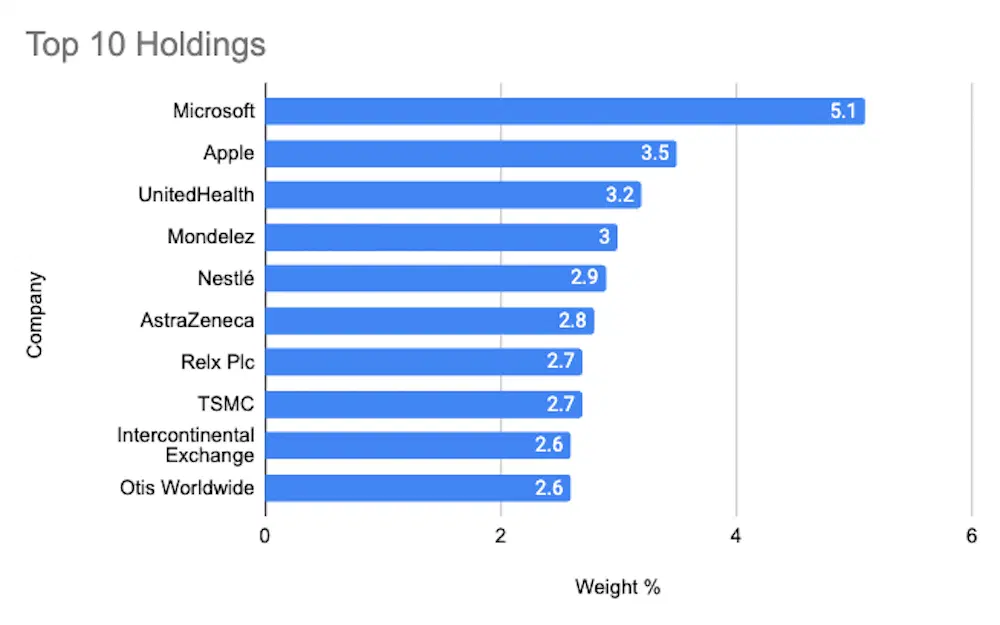

There are some star-studded stocks in its ten biggest holdings, with particular fondness shown for Microsoft. But these aren’t all Big Tech and AI plays: defensive sectors like consumer staples and healthcare are also represented here.

The top ten holdings of the BlackRock Global Enhanced Dividend Trust. Source: BlackRock.

The top ten are a veritable who’s who of quality investors’ favorite firms. But they represent only about 30% of the portfolio. You can see the full lineup in the trust’s annual report. There are plenty of marquee names in there, including luxury firm LVMH, Danish drug megastar Novo Nordisk and US stalwarts Disney and American Express. Worth noting, though, is that the annual report is dated June 30th and positions may have changed.

But those firms don’t pay out a lot in dividends, so how can this trust pay an 8% yield?

This is the part I really like. The fund managers deploy an options overlay strategy to boost the fund’s income. The particular strategy is called a “covered call overlay”. I won’t go into all the option strategy details, but you can check out this helpful explainer from the team at OptionsDesk. For now, here’s a quick thumbnail of the covered overlay strategy. The trusts’ managers write a bunch of contracts agreeing to sell the underlying investments and receive a payment when they sell those contracts. If they write plenty of these contracts – covering between 30% and 45% of the fund’s underlying investments in this case – they can generate enough income to seriously boost dividends to the trust’s shareholders.

But it’s not the trust’s options strategy that I like. The strategy itself comes with risks – like having to sell your investments when you don’t want to, as an example, missing out on potential stock upside. No, it’s the trust’s actual level of income that caught my eye. Normally, to receive a dividend income of around 8%, you’d have to be buying high-yielding stocks or bonds, both of which tend to come with serious risks of losing some of your money. But with the stocks in this trust, it’s fair to say that with a long enough time horizon, you’d have a strong chance of not losing any of your hard-earned capital. And that’s key. In my opinion, this trust should be viewed first and foremost, as an income vehicle, with exposure to underlying investments that should go up over time.

What’s the “discount” part all about?

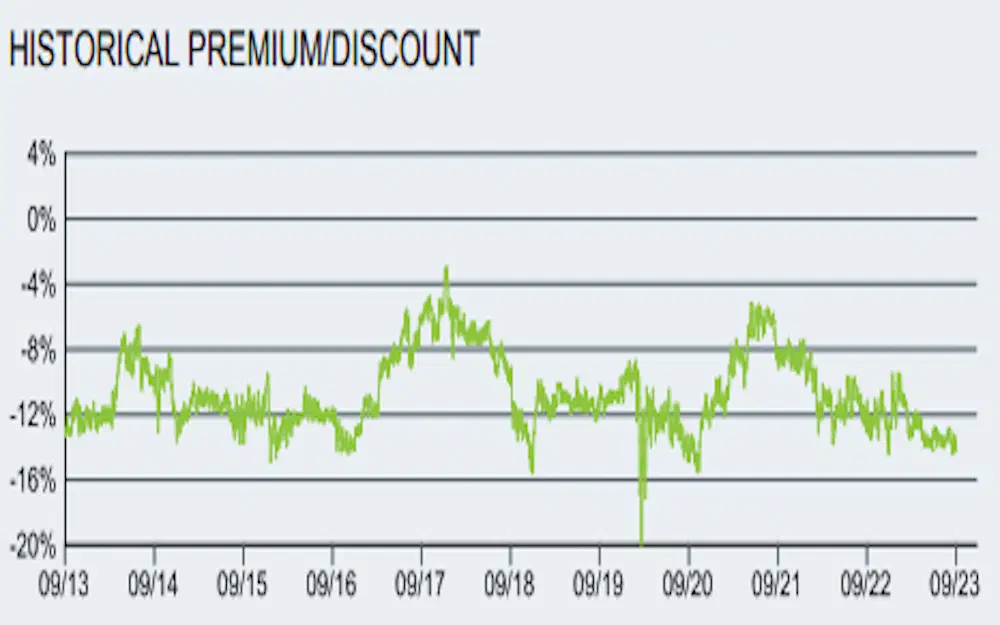

This comes back to the closed-end nature of an investment trust. Because trusts’ shares trade on an exchange (the NYSE, in this case), they move somewhat independently of the actual value of their underlying investments. You can see that if you look at the historical premium or discount of a trust’s shares relative to its underlying net asset value (NAV). Here’s what it looks like for this particular trust.

The BlackRock Enhanced Dividend Trust’s discount, relative to its underlying net asset value over time. Source: BlackRock.

You’ll note that the price of the trust has never been at a premium (i.e. above 0%). And there are two main reasons for that. First is the fact that trusts are allowed to borrow cash to increase their investments. This is known as “gearing” in the investment trust industry and it adds to the volatility and risk of the fund. It also normally results in a price discount to NAV. (Interesting side note: there is no gearing with this trust at the moment). Second is the fees. See, there’s a cost to managing investment trusts – you’ve got to cover fund manager salaries, trading transaction costs, wine and cheese for board of director meetings, and so on – and that all comes out of the trust’s cash flows. For this trust, the total fee is just over 1%.

But those two don’t explain a 15% discount. That comes down to the fact that this trust has underperformed all the S&P 500 ETFs and the more global stock ETFs like the iShares MSCI World ETF. And unfortunately, that comes down to some less-than-spectacular stock picking from the funds’ managers. And because the share price of the trust is ultimately a function of old-fashioned supply and demand, when enough people think they can get better returns elsewhere (like simply buying all the underlying investments), a discount opens up.

To put that into perspective, imagine this fund were to roll up its tent tomorrow and liquidate all its underlying investments: the rust’s shareholders would see an immediate 15% gain. But that’s probably not going to happen: this trust is far more likely to continue to trade at a discount, for a while anyway. But at 15%, that gap is wider than it’s been in years, and that means there’s a very good chance it will close again, at least partially.

So what’s the catch?

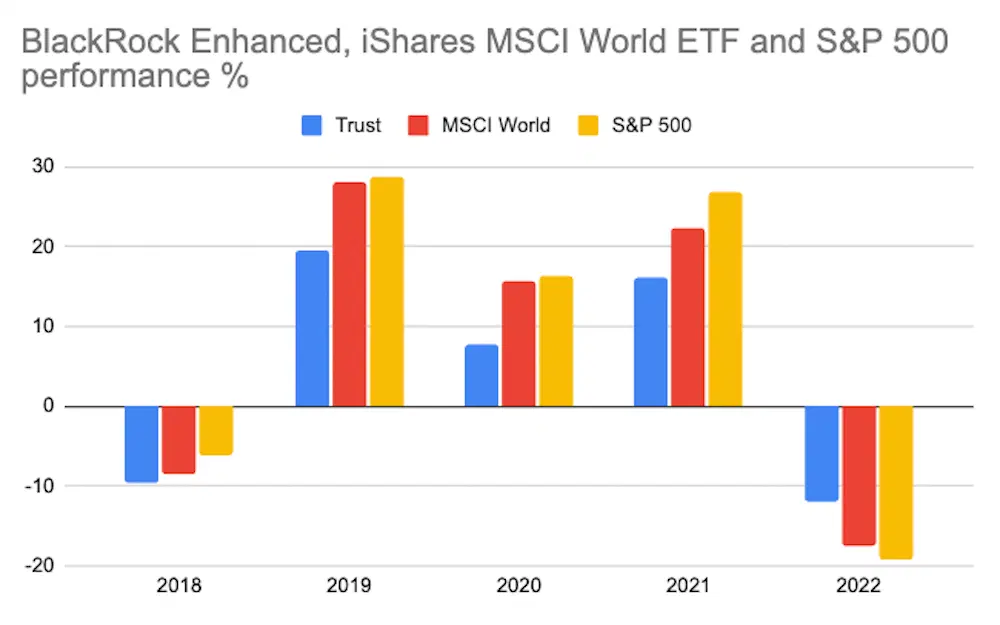

Let’s start with the performance part. The following table shows the performance of the trust on a total return basis (meaning share price and dividend).

Annual performance of BlackRock Enhanced Dividend, iShares MSCI World ETF, and S&P 500. Sources: BlackRock, Koyfin.

Your first thought might be just how poor the fund’s performance has been relative to the MSCI World ETF or the good old S&P 500. And you’d be right. But come at it another (admittedly more generous) way, and you might say the fund’s performance has been a lot less volatile. And it has: that’s a secondary side effect of the option overlay strategy, where stocks often are sold too early (to those call option holders), ahead of further upside moves.

That means that when markets move up by a lot (as they have done over the past five years) these option overlay strategies can underperform. Unfortunately, though, that doesn’t fully explain the relative performance shortfall. Even measured relative to a special-built benchmark that includes a portion of option overlays (details, again, are in the annual report) the fund has still underperformed. And there’s no getting away from the fact, then, that the managers of this trust haven’t exactly nailed it when it comes to its overall stock allocations.

But I’m not that bothered about that and you might not be either. As a retail investor, I’m not worried that this fund has underperformed some bespoke constructed benchmark. Retail investors just want to make money, right? And, that’s where this trust could be useful: as an income-generating investment, with very limited long-term risk of losing any money.

-

Capital at risk. Our analyst insights are for information purposes only.