Vigilant asset allocation (VAA) is an aggressive momentum-based strategy that’s always fully invested in a single asset.

VAA has generated eye-popping investment returns over the past half-century while keeping drawdowns low relative to its benchmark.

But the strategy’s high volatility means it’s not for the faint of heart, and its reliance on bonds could detract from investment performance in the future.

VAA is perhaps best not implemented in isolation but could be successfully used in the equity portion of your portfolio.

When the going gets tough, the tough prefer to take their portfolios into their own hands. And that’s what vigilant asset allocation (VAA) is all about – it’s designed to help you actively take advantage of changing market trends or economic conditions. It’s got a strong track record and is easy to implement with ETFs, but this market approach is not for the fainthearted or the set-it-and-forget-it investor. Let’s take a look.Vigilant asset allocation is a tactical asset allocation strategy – so it relies on active portfolio adjustments to take advantage of market trends, maximize returns, and minimize risk. And you can put it to work pretty simply, using ETFs. For more on tactical methods, read about defensive asset allocation and composite dual momentum.

What are the basic concepts behind the VAA strategy?

VAA is a “momentum strategy”, and that means you invest in asset classes that have recently performed well, based on the assumption that they’ll continue to perform well in the near future. Momentum is a well-studied phenomenon within the academic and finance communities. One of the reasons it works is the fact that investors have deep behavioral biases – like herding and extrapolation.Now, VAA relies on “dual momentum” – in other words, both relative and absolute momentum. The first measures how an asset has performed relative to other assets over a certain period. The second measures whether an asset has actually risen in absolute terms (i.e. value) over a certain period.You’ll see how VAA incorporates dual momentum in a second. For now, you should know that VAA is an aggressive strategy: each month, it allocates 100% of the portfolio to a single asset from a small basket of either offensive or defensive assets.Credit where credit is due: VAA comes from Wouter Keller and JW Keuning's research paper, “Breadth Momentum and Vigilant Asset Allocation”.

Which asset classes does VAA trade?

VAA trades seven different ETFs, each representing a different asset class or subclass. The ETFs are organized into two groups, or “universes”: offensive and defensive.

The ETFs traded by the vigilant asset allocation (VAA) strategy. Source: Finimize.

How is VAA implemented?

The strategy requires you to trade and rebalance every month. So on the last trading day of the month, here’s what you would do:

Step 1 Just as you would with the defensive asset allocation strategy, you should first calculate a momentum score for each of the seven ETFs. The authors use a “13612W” score – a bit of a mouthful, but here’s how you work it out:13612W = (12 * (p0 / p1 – 1)) + (4 * (p0 / p3 – 1)) + (2 * (p0 / p6 – 1)) + (p0 / p12 – 1)Where p0 = the ETF’s price today, p1 = the ETF’s price one month ago, p3 = the ETF’s price three months ago, and so on.The first term – (p0 / p1 – 1) – is the ETF’s percentage price change over the past month, and the second term – (p0 / p3 – 1) – is the ETF’s percentage price change over the past three months.

You get the idea.Also, notice how the 13612W score overweights the most recent returns: the ETF’s one-month performance is multiplied by 12, its three-month performance is multiplied by a third of that (in other words, four), and so on. This gives more recent returns a greater impact on the strategy than older ones.

Step 2 Look at the 13612W scores of the four ETFs in the offensive universe.

If they’re all positive (absolute momentum), then invest 100% of the portfolio in the ETF with the highest score (relative momentum).

But if any of the offensive ETFs have a negative score, then invest 100% of the portfolio in the defensive ETF with the highest score – regardless of whether it’s positive or not.

Step 3 Hold onto the ETF until the last trading day of the following month. Then go back and repeat the steps above. Even if the ETF you end up investing in doesn’t change, repeating the steps ensures that you stick to the strategy.

How has VAA performed?

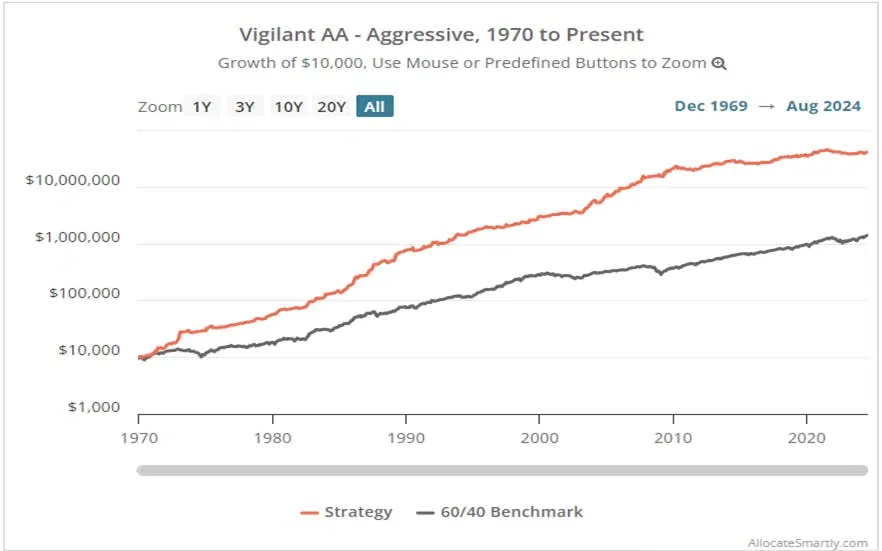

Performance tracker AllocateSmartly has compiled robust data on VAA’s historical performance, even projecting it back to 1970. While looking at this in isolation is all well and good, it’s more informative to compare performance to a benchmark – in this case, a basic 60/40 strategy that invests 60% in US stocks and 40% in US government bonds.

VAA versus 60/40 performance (logarithmic scale). Source: AllocateSmartly.com.

Measured over the past 50 years or so, VAA has generated an eye-popping average annual return of 16.5% – trouncing the 60/40 benchmark’s 9.8%. But, as you’d expect from an aggressive strategy that’s always fully invested in a single ETF, VAA’s volatility of 11.9% was higher than the 60/40 portfolio’s 10%. Still, VAA’s strong performance means that the strategy generated much higher investment returns per unit of risk.What’s more, VAA actually displayed less risk by another important measure: maximum drawdown (MDD) – the biggest peak-to-trough decline in the value of a portfolio. The VAA strategy’s MDD over the past half-century was 17% – almost half the 60/40 benchmark’s 30%.

What’s the opportunity here?

VAA has an impressive track record: it has generated excellent investment returns both on an absolute and risk-adjusted basis. Part of the reason VAA managed to avoid big investment drawdowns is its use of absolute momentum: when any of the offensive assets start to show signs of weakness, the strategy shifts to safer assets like bonds.All in all, if you apply this strategy to your investments, you may well boost your returns. Having said that, the old investment adage – “past performance is no guarantee of future results” – applies here: VAA might not necessarily perform well in the future and it could experience a bigger peak-to-trough loss than 17% at some point.

What are the risks involved?

The strategy’s high volatility means it’s not for the faint of heart. And VAA has two drawbacks on top of that. First, it moves into bonds when any of the offensive assets start exhibiting negative momentum. Now, that reliance on bonds has worked well in the past, considering the decades-long bond bull market. But going forward, bond returns might not be as strong, and that could detract from VAA’s future performance.Second, the strategy is the exact opposite of diversified: it holds a very concentrated portfolio that’s invested in a single ETF. In practice, you should rarely ever invest your entire portfolio in a single fund – so I wouldn’t recommend you implement VAA in isolation. But you could, perhaps, use it for the equity portion of your portfolio. Let’s say 30% of your portfolio is invested in a few stock market ETFs targeting different geographies. You could swap out that allocation for VAA: the strategy does, after all, seek to target the best-performing geographies while switching to bonds when it senses trouble.