<summary> You’d be forgiven for feeling some whiplash from the recent swings in market sentiment: investors have flipped from recession fears to soft-landing optimism in a matter of weeks. BlackRock, however, is somewhere in the middle. It sees a period of slower growth, hotter-than-ideal inflation, higher interest rates, and greater volatility ahead. But it also sees four trends and one market that are loaded with promise…

One market: Japan.

With most of the world’s advanced economies likely to still be dealing with sweaty inflation levels, a lot of central banks are likely to keep interest rates higher for longer. And because of that, BlackRock is keeping an underweight (or smaller than proportional) position on stocks from developed markets (DMs). Its one exception is Japan, which is still its strongest DM stock view.

This past year’s been pivotal for Japan. BlackRock upgraded its view on the country twice in 2023, thanks to its appealing valuations, earnings growth, and the corporate reforms it made, improving shareholder returns. Now, BlackRock does acknowledge that with inflation trending above the Bank of Japan’s target, the central bank could raise interest rates, which could lead to a strengthening in its currency, the yen. And, because of that foreign exchange risk, it recommends investing in the country’s assets without hedging that exposure. To do that, you could consider buying the iShares MSCI Japan ETF (ticker: EWJ; expense ratio: 0.5%), which provides broad, unhedged exposure to Japanese stocks.

Trend 1: The AI revolution.

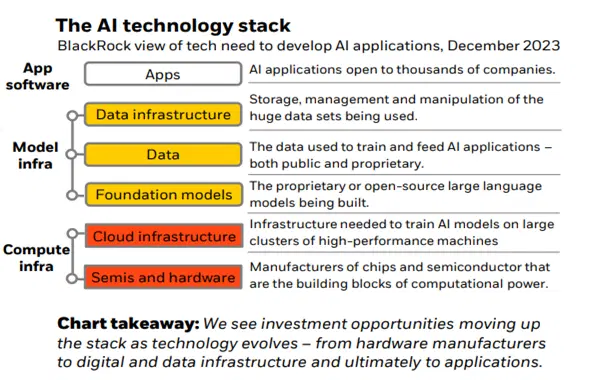

There are so many opportunities in this trend that the team at BlackRock opted to create a visual “stack” of them all. The fund sees investment opportunities ascending up the stack as the technology evolves.

BlackRock’s AI technology stack. The asset manager sees investment opportunities moving higher in the stack as the technology progresses – moving from hardware makers to digital and data infrastructure, and finally to apps. Source: BlackRock

Right now, the technology is still making baby steps: we’re in the bottom two layers. BlackRock sees the entire tech industry – led by a handful of large tech firms – beginning to pivot their whole business focus toward AI. But, as is typically the case with transformative innovations, the exact path at this stage is unclear. Still, BlackRock is bullish and recommends keeping an overweight position on the AI theme for the next six to twelve months.

To gain some digital disruption and AI exposure, you could consider the Invesco QQQ Trust Series ETF (QQQ; 0.2%) or the iShares Semiconductor ETF (SOXX; 0.35%), or for a more active investing approach, consider the ARK Innovation ETF (ARKK; 0.75%).

Trend 2: The future of finance.

That future is basically: everything goes digital. BlackRock’s got its eye on India’s system of digital payment systems, which it sees as extremely well-positioned to benefit from this trend. The country has a stunningly robust growth outlook and its stock market has been a strong performer this year as a result. The iShares MSCI India ETF (INDA; 0.64%) provides broad exposure to Indian companies and has a reasonably sized weighting in the country’s banks.

In the US, higher interest rates have piled on the capital pressures for banks, and that’s opening a path for private credit and non-banks who want to fill the lending void. Private credit is still a thinly traded asset class, which makes it particularly volatile and generally not suitable for all investors. But you can attempt to scoot around this challenge by buying the Goldman Sachs Business Development Company (GSBD). It lends to middle-market companies, mainly in the US, and has a pretty attractive indicated yield of 12%.

Trend 3: Climate resilience.

The low-carbon transition is an important opportunity for Latin America, especially for countries that have large reserves of key resources, like copper and lithium. If you’re feeling adventurous, the iShares MSCI Chile ETF (ECH; 0.58%) could be worth a small bet – 17.5% of the ETF is invested in Sociedad Quimica y Minera de Chile (SQM), one of the cheapest lithium plays in the world. Investing in emerging market stocks does have added risks, but can produce outsized returns.

The shift to a low-carbon world isn’t exclusively about investing in renewables – for example, via the Invesco Solar ETF (TAN; 0.6%). There’s also scope for traditional energy companies (like Exxon) to outperform, BlackRock says. After all, economies will still have to prepare for, adapt to, and withstand climate risks, and will have to rebuild after climate disasters, so certain industrial and tech companies are set to benefit. One company that has seen strong growth in recent years is Daikin: the air-conditioner manufacturer is listed on the Tokyo Stock Exchange. As the world heats up, demand for air-conditioner units has soared and it’s expected to continue to do so.

Trend 4: Geopolitical fragmentation.

Russia’s invasion of Ukraine and rising tensions between the US and China are pushing economies increasingly into a new era of competing geopolitical and economic blocs. And that’s likely to produce risks but also opportunities, as the world’s supply chains are reshaped. The move by the US to onshore (or near-shore) production, for example, could continue to boost Mexico’s economy and stock market. And the iShares MSCI Mexico ETF (EWW, 0.5%) would benefit from that.

-

Capital at risk. Our analyst insights are for information purposes only.