After remaining flat over the last decade, US electricity demand is expected to soar in the coming years thanks to the explosive growth of generative AI and all the data centers needed to power the technology.

When electricity demand in a particular region is booming, its utility company has to invest in capacity, transmission lines (to ease bottlenecks), and other things. That increases its “rate base”, which is what regulators allow utilities to earn a return on.

Dominion Energy stands out in this industry because it serves Northern Virginia – the biggest data center market in the US by a wide margin. But other utility firms are also expected to benefit as AI grows, and investors are starting to catch on to that trend.

US electricity demand has been (forgive the pun) mostly static over the past decade but is finally expected to soar, thanks to the explosive growth of generative AI. The innovative technology’s huge need for power means utility companies – traditionally one of the most boring corners of the stock market – could offer investors a pretty exciting way to play the AI boom. Here’s how you might take advantage of the, ahem, surge.

What’s the link between AI and electricity?

The buzz around generative AI and its mind-blowing capabilities comes with a catch: its almost human-like speech, text, images, and videos require loads of physical hardware to produce. So data centers – those massive warehouses packed with computing gear – are in high demand, with Microsoft alone opening a new one every three days.

But here’s the thing about all these data centers: they consume an enormous amount of power because of the complexity of training and deploying AI models that process huge datasets. A ChatGPT query consumes about ten times the electricity as a traditional Google search, according to the International Energy Agency. And that’s just for a basic text query: generating images and videos requires even more power. What’s more, that thirst for energy will only grow as AI models get more complex and powerful.

How much growth are we talking about?

Well, Goldman Sachs forecasts that US power demand from data centers will expand at a 15% compound annual growth rate (CAGR) from now until 2030. That’ll leave them responsible for 8% of total US electricity demand by the end of the decade, up from about 3% currently.

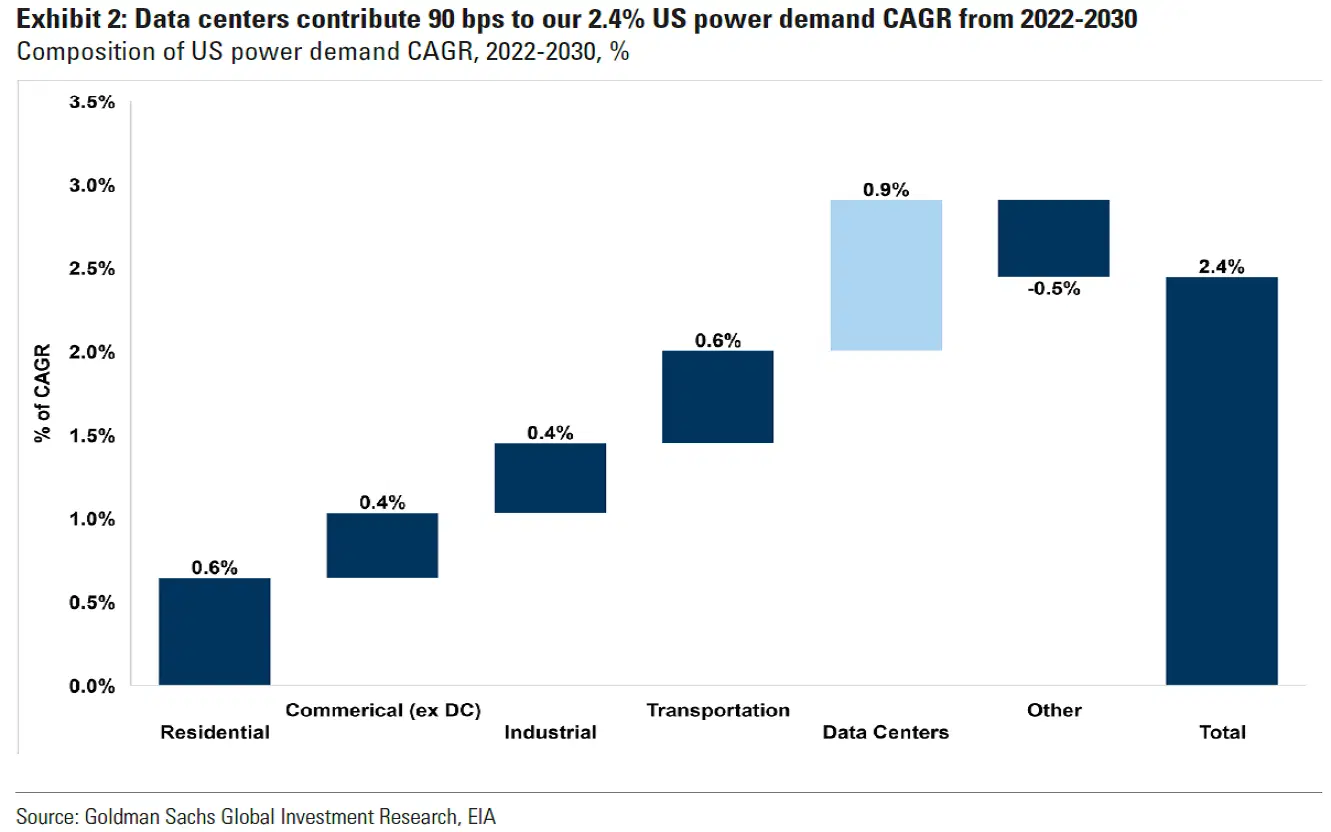

All that growth – plus increased power consumption due to electrification and the reshoring of manufacturing activity to the US – will result in power demand in the world’s biggest economy expanding at a 2.4% CAGR through 2030, Goldman says. But data centers will be the biggest driver, fueling 0.9 percentage points of this increase. And in case you’re thinking 2.4% annual growth doesn’t sound like much, then just consider that total US electricity demand has seen zero growth over the past decade.

US electricity demand is expected to grow at a 2.4% compound annual growth rate (CAGR) through 2030, with data centers driving much of the increase. Source: Goldman Sachs.

How will electric utilities benefit from this exactly?

That’s a good question. Because the industry naturally lends itself to the creation of monopolies, it’s heavily regulated. That means government authorities typically have the final say on what companies can spend, what they can charge customers, and, perhaps most importantly, what returns they can make.

The precise nature of this regulation differs from one state to another. But one thing that’s common everywhere is the concept of “rate base”, which is one of the most important metrics for utility companies (and, therefore, their investors). Rate base is essentially the value of all of a utility’s investments – in power plants, transmission lines, distribution networks, EV charging stations, and so on. It rises when the utility spends money on infrastructure, but also falls a bit every year because of depreciation.

Rate base is the single most important factor in determining a utility’s profit, because it’s what regulators allow utilities to earn a return on. Imagine, for example, that a utility spends $200 million building a new power plant, financed using a 50/50 mix of debt and equity. That new plant will increase the utility’s rate base by $200 million. Now, suppose the regulator allows the utility to earn a 10% return on equity (ROE). In that case, the new plant would increase the utility’s profit in year one by $200 million x 50% (the percent funded by equity) x 10% (the allowed ROE) = $10 million. (In reality, there could be other factors that affect the utility’s precise profit.)

But here’s the key takeaway: a utility’s profit growth is mainly determined by rate base growth. That’s because the allowed ROE and debt-to-equity financing mix doesn’t change much from year to year, but a utility’s rate base does. So, when electricity demand in a utility’s jurisdiction is booming, the firm has to invest in new generation capacity, transmission lines (to ease bottlenecks), and other things. That increases its rate base, and – you guessed it – its profits.

Which utility companies in particular stand out?

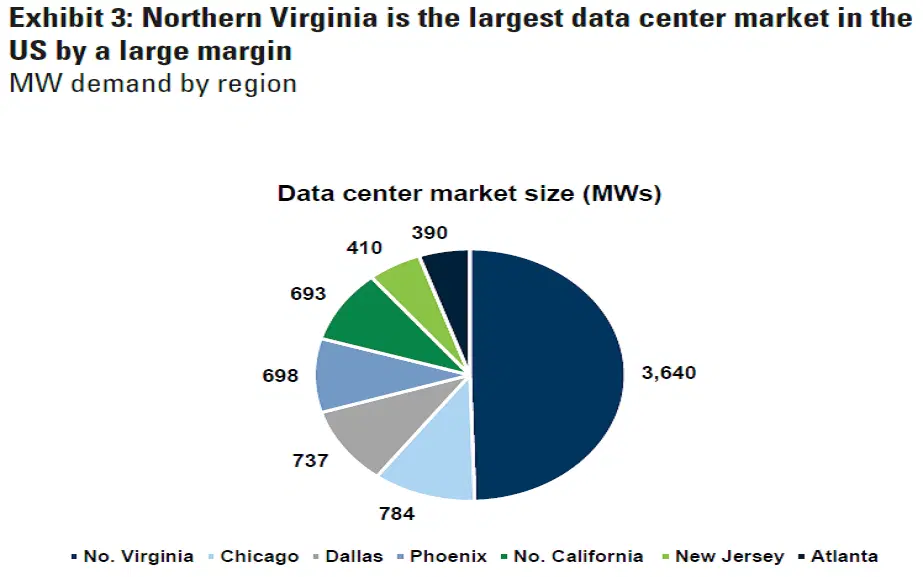

US data centers are primarily located in Northern Virginia, Dallas, Silicon Valley, Phoenix, Chicago, Atlanta, Portland, Seattle, Los Angeles, and the New York/New Jersey area. Of those, Northern Virginia is by far the biggest, with more data centers than the next five areas in the US combined. The area has become a favorite destination for data centers over the past decade because of its affordable electricity, access to major underwater fiber cables, and state tax incentives.

Northern Virginia is the biggest data center market in the US by a wide margin. Source: Goldman Sachs.

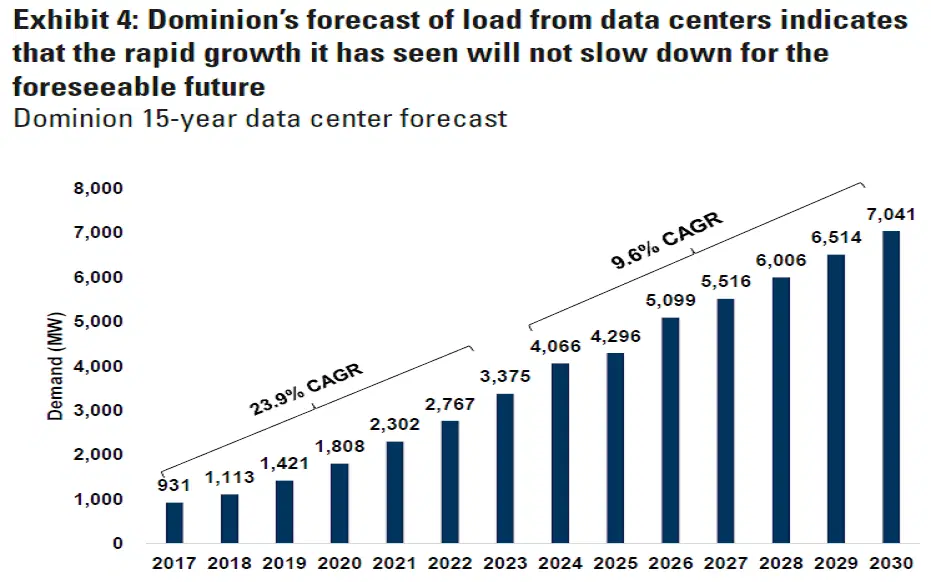

The main electric utility serving Northern Virginia is Dominion Energy Virginia (DEV), owned by the listed firm Dominion Energy. To see how good the data center boom has been for the company, consider this: power demand from data centers in its service territory grew at a nearly 24% CAGR from 2017 to 2023, and is forecast to expand at a 9.6% CAGR through 2030.

Dominion has seen explosive power demand growth from data centers. Source: Goldman Sachs.

But, remember, power demand growth only results in higher earnings if it leads to rate base growth. DEV is investing $35.5 billion over the next five years to expand and enhance its infrastructure. As a result, it expects its rate base to grow at a 9% CAGR over that time. However, because Dominion owns a utility in South Carolina that isn’t expanding as fast, the firm’s overall rate base growth is expected to be just 7.5% (which, in fairness, is still quite high compared to other utilities).

As a result, Dominion expects its earnings-per-share (EPS) to grow at an annual rate of 5% to 7% over the next five years. And, yes, that’s slightly lower than its forecasted rate base growth, but that’s because the firm plans to issue $3.5 billion worth of new equity over the period to fund its investments, and the increase in shares outstanding will naturally dilute EPS.

If EPS increases at the midpoint of the expected range (6%) and Dominion’s price-to-earnings ratio (currently 17.5x, based on forecasted profits over the next 12 months) remains stable, then its stock price could rise by a similar amount. Throw in its current 5% dividend yield, and you could be looking at a roughly 11% annual total shareholder return over the next five years. Not many stocks can boast double-digit annual returns with such high visibility (the heavily regulated nature of Dominion’s business model means it’s quite likely to achieve its EPS growth target).

Can you get similar gains by investing in an ETF?

Gaining broad exposure to the utilities sector through an ETF – such as the Utilities Select Sector SPDR Fund (ticker: XLU; expense ratio: 0.09%) – could be a good option. After all, Dominion’s not alone in benefiting from the resurgence of electricity demand growth in the US. Other standouts include Duke Energy, Southern, NextEra Energy, Exelon, and CMS Energy. But despite the sector’s strong growth story, shares of its companies continue to be swayed by big-picture economic factors like interest rates.

See, because utility stocks pay out a lot of what they make in dividends, investors sometimes think of them as similar to income-paying bonds. And because of that, they tend to underperform when interest rates rise high enough to make their dividends look smallish. Case in point: last year, utilities were the weakest sector in the S&P 500, falling 10%, even as the index soared 24% overall.

That situation is changing. The US central bank is expected to begin cutting interest rates soon and that should boost the valuations for these dividend-paying stocks.

But, just as importantly, interest rates are still predicted to remain higher this decade compared to the previous one – and that’s also a good thing for utilities because it can lead to higher authorized ROEs. In turn, that could increase the profit they can make from their expanding rate base.

And, what’s more, investors are becoming switched on to the essential role that this sector will play in the AI revolution, and that’s driving a major comeback for utility stocks. They’re currently the best-performing sector in the S&P 500 this year.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.