One pro suggests flipping the script on the traditional 60/40 stocks-and-bonds portfolio, betting big on bonds instead because of attractive Treasury risk premiums. This means a safer play with potential juicy returns from bonds and global high-yield sectors.

Another says the AI boom is still in its early stages, so that’s where the action is. Instead of sticking only to big names like Nvidia, you could explore chipmakers, software companies, and industries integrating AI to capture broader growth potential.

And the third pro sees commodities as long-term undervalued assets. Copper and natural gas are poised to benefit from the AI-driven demand surge for data centers and electricity, potentially making them smart additions to a diversified portfolio.

Let’s face it: markets are in a weird place right now. Stocks have been jaunting upward, bond yields are still high, and no one knows when those interest rate cuts will start. That’s why Bloomberg recently asked three top-of-their-game experts for their best investment ideas. These pros live and breathe this stuff daily and have seen every market quirk. I dug into their insights and figured out how you can tweak their genius ideas to fit your own portfolio.

Idea 1: Flip the 60/40 on its head.

Andrea DiCenso, portfolio manager and strategist at Loomis, Sayles & Co., likes to play it safe. And these days, safety pays a decent yield. So she recommends reversing the traditional 60/40 portfolio – allocating 60% to fixed income and 40% to stocks, instead of the other way around. That’s because Treasury risk premiums (TRPs) are currently more attractive than equity risk premiums (ERPs), for the first time in about two decades. DiCenso is particularly drawn to the global high-yield sector, especially emerging market sovereign bonds (but not China’s), thanks to better fiscal responsibility in countries like Argentina, Ecuador, Pakistan, Lebanon, and Egypt. In the 40% stock portion of her portfolio, she favors international equities, and small and mid-cap US shares, which should benefit from a resurgence in global growth.

My take:

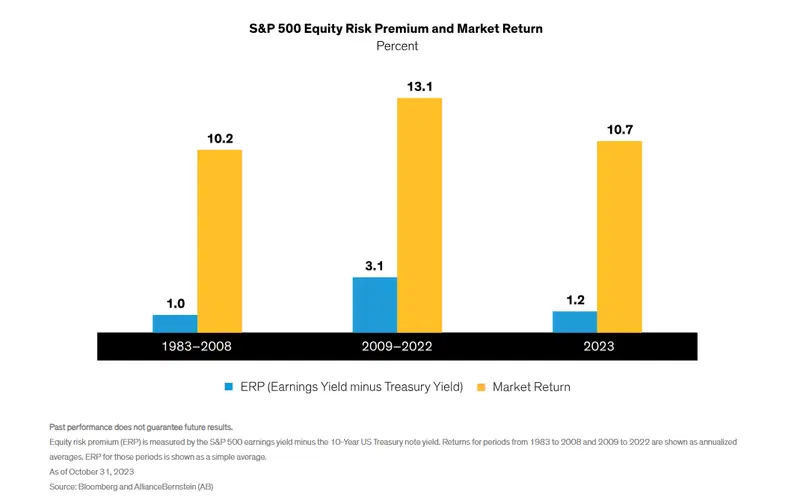

If you’re going to flip the traditional 60/40 stocks-and-bonds portfolio allocation on its head, you need to be confident that TRPs will remain more attractive than ERPs for some time. In the investment world, we often look at the ERP to gauge the risk/reward scenario in stocks. That’s essentially the extra bang you expect for your buck over what you’d earn from a risk-free investment like Treasuries. A juicier ERP means you’re looking at potentially higher rewards from stocks.

Lately, though, ERPs have gotten a bit tighter, what with interest rates rising and pushing the 10-year Treasury yield up to a stout 4.5%, as of late April. Deciding whether to shift that 60% into bonds may hinge on whether you think these high interest rates will stick around.

S&P 500 equity risk premium vs market return over different periods. Sources: Bloomberg, AllianceBernstein.

Now, don’t forget that stocks still have a pretty decent track record, doing well even when ERPs were on the slim side. Take the stretch from 1983 to 2008; the ERP was a skimpy 1%, but the S&P 500 still managed an impressive average annual return of 10.2%. This goes to show that stocks can still pack a punch, even when bonds offer higher yields.

The point is, I wouldn’t sideline US big-cap stocks based solely on current ERPs. This indicator can underestimate stock prospects by ignoring earnings growth and dividend income, which are important components of stock returns. Also, even if stock valuations seem high, they can still climb higher, potentially boosting returns further. With the US leading the charge in major AI innovations, we’re looking at potential mega boosts in economic productivity and corporate earnings. So really there’s every reason to believe that the US stock market could keep up its strong game, just as it has over the past decade and a half.

Here’s how you might play this. You could build your own portfolio allocation through ETFs like the Vanguard Emerging Markets Government Bond ETF (ticker: VWOB; ticker: 0.2%), SPDR Bloomberg High Yield Bond ETF (JNK; 0.4%), iShares Core MSCI Emerging Markets ETF (IEMG; 0.09%), iShares Core S&P Small-Cap ETF (IJR; 0.06%), and the JPMorgan International Research Enhanced Equity ETF (JIRE; 0.24%).

Idea 2: Broaden your AI bets.

Linda Duessel, a senior equity strategist at Federated Hermes, sees the AI rally as still only in its early innings. She says AI isn’t just a craze – it’s a genuine revolution. And the AI investment scene isn’t limited to the usual big hitters: it’s the chipmakers, the software gurus, the security specialists, and much more. And it’s promising a huge impact. Duessel sees a golden decade of productivity ahead for the US as AI seeps across industries. This broadening scope, she argues, makes it a prime time for investing not just in the top dogs, but also in a broader swath of the kennel.

My take:

If you’re worried that Nvidia’s shares have already climbed too far – with the AI poster child now 22 times higher than it was five years ago – you’re not alone. Thankfully, tech companies won’t be the only beneficiaries of the technology’s advance.

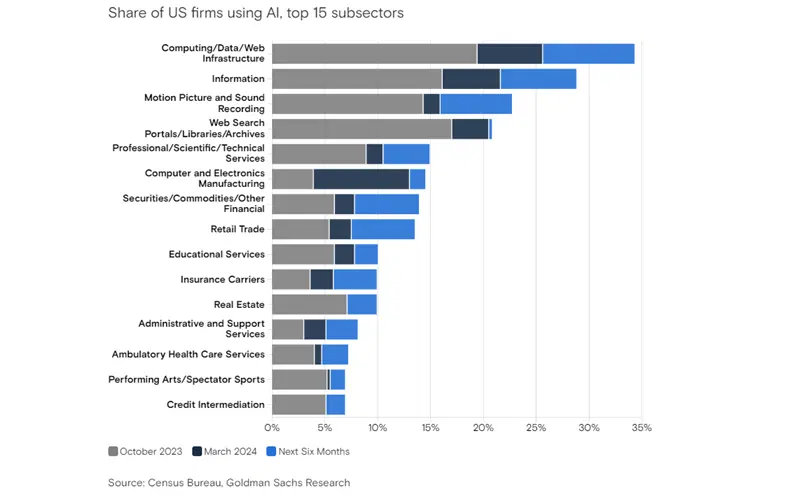

With so many industries likely to be transformed by AI, it’s worth contemplating where to stake your claim.

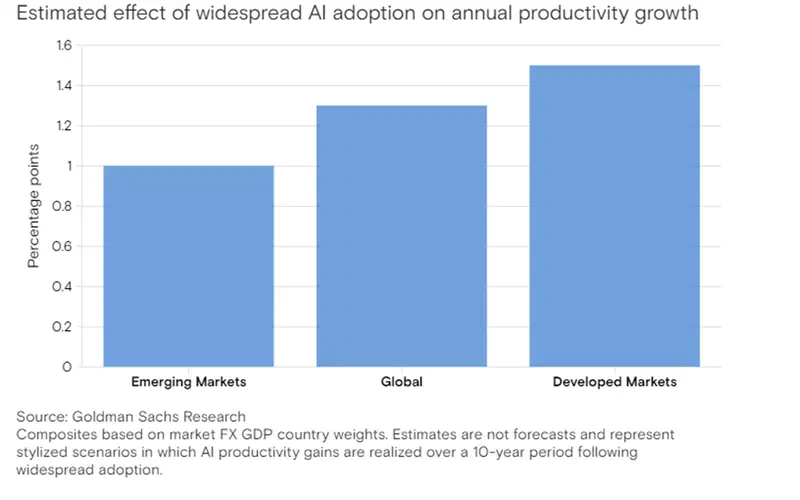

Goldman Sachs breaks down the technology’s revolution into four stages. First, there are the front-runners like Nvidia, whose chips are basically jet fuel for AI. Second, there are the backbone builders – think semiconductor and data center dynamos, plus the unsung heroes at the utility companies that power these tech temples. Third, you’ve got the savvy companies that weave AI into their products to jazz up what they sell. Many are software and IT services companies, like Meta, MongoDB, Intuit, Nutanix, ServiceNow, and Uber. Lastly, the spotlight shifts to all the industries using AI to boost productivity – with the biggest potential likely to be in more labor-intensive work.

But let’s not get ahead of ourselves: riding the AI wave won’t be all sunshine and rainbows. Goldman Sachs thinks the big economic splash from AI won’t hit till 2027. Until then, companies will be shelling out cash for the tech and paying to upskill employees – and that might eat into profits in the short run. To invest successfully in AI, you’ll need agility, discipline, and an understanding of company valuations. You’ll also need to know when to sell to avoid getting caught in a potential AI bubble.

Here’s how you might play this. You can gain exposure to AI and tech shares through the iShares Semiconductor ETF (ticker: SOXX; expense ratio: 0.35%), or the iShares Expanded Tech-Software Sector ETF (IGV; 0.4%). But you don’t have to be that directed: with AI expected to improve productivity across sectors and the wider economy, you could simply own the S&P 500 through the SPDR S&P 500 ETF Trust (SPY; 0.09%) or the Invesco S&P 500 Equal Weight ETF (RSP; 0.2%).

Idea 3: Get into copper and natural gas.

David Daglio, partner and chief investment officer at TwinFocus, is becoming mildly obsessed with commodities. He sees them as significantly undervalued over the long term, relative to other asset classes, and says they’re a savvy bet on the AI trend. Right now, he notes there’s just enough copper and natural gas supply to meet demand. But that won’t be the case forever: AI development will require tons of new data centers, and that’s going to spark a surge in demand for copper and electricity. This, in turn, will necessitate more power plants, loaded with copper and operating on natural gas.

Natural gas will benefit from an increase in US liquid natural gas exports – beginning next year and continuing through the end of the decade – which will help absorb excess supply and boost gas prices.

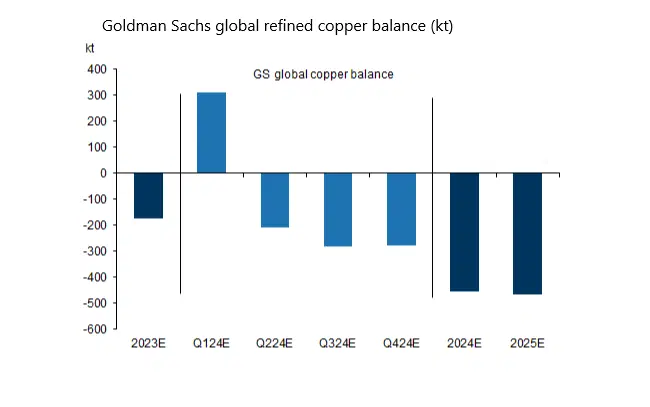

Copper, then, is already a hot commodity that will get hotter, thanks to the unfortunate global increase in munitions production, the rise in EV production, and an expansion of power and data centers that could necessitate a generational update of transmission equipment. And with both copper and natural gas facing supply constraints, Daglio said they’re both likely to see their prices rise with the expected increase in demand.

My take:

No matter your view on AI, sprinkling some commodities like copper and natural gas into your portfolio can be a smart move. It can add some diversification to the mix, while also protecting your investments from inflation’s bite.

Now, both copper and natural gas are poised to benefit from the AI boom, but if I had to pick a favorite, it’d be copper. See, it enjoys what you might call a “slow and steady” advantage. Unlike natural gas, which can be rushed to market in just a few months, getting a new copper mine into production takes ages – anywhere from ten to 15 years. So, there’s no quick fix when a shortage pops up.

Copper also tends to be sourced from places that are on the unstable side, including the Democratic Republic of Congo, Kazakhstan, Mongolia, and parts of Latin America. Last year alone, an estimated 3% to 5% of the global supply got snagged by operational and political hurdles. Just look at what’s happening in Chile: the country cranks out about 65% of the world’s copper and it’s currently tangled in some hefty union wage negotiations that could complicate that supply.

But there’s more to copper than just AI. This metal is also a superstar in the green transition, playing a crucial role in technologies essential for decarbonization (like wind turbines, solar panels, heat pumps, EVs, and energy-efficient equipment). That explains why the experts at Goldman Sachs expect an undersupply of the metal this year and next.

Here’s how you might play this. The firms that supply the much-needed natural gas to power utility companies should stand to benefit as energy demands surge. And that includes companies such as Southwestern Energy, Chesapeake Energy, and EQT. To invest in copper, you can do so directly through the United States Copper Index Fund (CPER; 0.97%) or indirectly through the Global X Copper Miners ETF (COPX; 0.65%) or, for investors outside of the US, the Global X Copper Miners UCITS ETF (CO-PG; 0.65%).

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.