Long-dated Treasuries are highly sensitive to interest rates, which means they can stage major rallies when rates fall.

TLT currently offers a forward dividend yield of around 4%, comfortably above US inflation. At today’s prices, you’re locking in decent income with the potential for upside if interest rates drop.

AI-driven deflation and rising unemployment could push interest rates lower in the future, providing a favorable setup for government bonds like those in the TLT.

On March 9th, 2020, the iShares 20+Year Treasury Bond ETF peaked at $179.70 in a massive “blow-off top”. You might remember that stocks, gold, and crypto were all in freefall back then – as the “Covid crash” rattled global markets. Now, nearly five years later, gold is up 80%, the S&P 500 is up 160%, and bitcoin is up about 2,500%. That bond ETF, though, is down roughly 50%. Here are three reasons why scaling into the fund could be a wise play.

1. Long-duration Treasuries have more upside potential than short-dated ones.

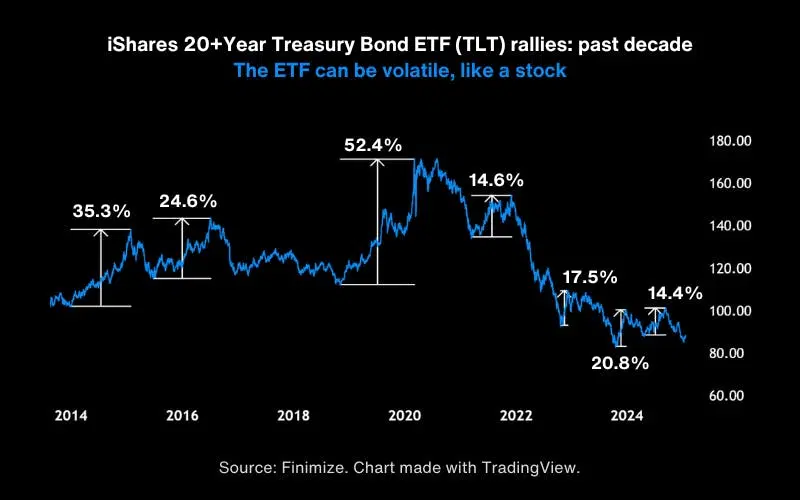

When some folks think of US Treasury bonds, they picture “boring” assets that pay interest and hardly move at all. But long-dated Treasuries are different: they tend to be highly sensitive to things like interest rates and inflation. And in the right market environment, that sensitivity can lead to major rallies for the notes.

The iShares ETF (ticker: TLT; expense ratio: 0.15%) tracks US Treasury bonds with 20 or more years until they mature. These are “long-duration” bonds, meaning they’re more sensitive to interest rate changes than short-term bonds are. When rates fall, the prices of long-duration bonds (like the ones in TLT) can rise significantly – sometimes in a matter of months. This makes them a higher-risk, higher-reward play for investors looking to capitalize on falling rates or economic shifts.

Just check out the chart below. Notice how TLT trades more like a volatile stock than a bond.

TLT can stage impressive rallies in the right market environments – it’s volatile like a stock.

Source: Finimize. Chart made with TradingView.Now, of course, these moves in TLT can go up or down. But if you think US interest rates will generally head south from here, the ETF's next direction could be north. Plus, Treasuries can also act as a “safe haven” – offering some protection if riskier assets like stocks take a tumble.

2. TLT boasts a chunky dividend yield and an attractive risk-reward proposition.

TLT currently offers a forward dividend yield of around 4% at these prices. That’s calculated by taking the Treasury income the ETF is expected to earn (per share) over the next year – and dividing it by the current share price. The lower the share price, the higher the dividend yield here. So if you’re buying “low”, you’re essentially locking in decent income while you hold the ETF. The yield is also well above the current US inflation rate (2.9%) – so there’s that.

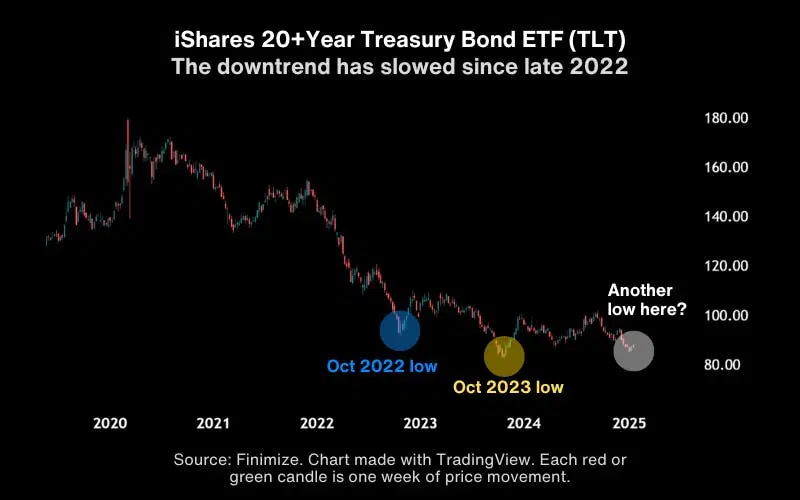

And, yes, TLT’s price might drop further from here. But it’s already been beaten down a lot - and could be close to finding a bottom. Notice in the chart how the downtrend has slowed, with a big low in October of 2022 (blue), a second one in October of 2023 (yellow), and a third possibly forming now (white). This kind of price action is typical near bear market bottoms: sellers gradually burn out while buyers tentatively take over. Put differently, buying TLT near these levels isn’t a highly risky move like trying to catch the proverbial “falling knife” – its price has been going sideways for a while.

TLT’s downtrend has slowed since October of 2022 – and now it looks like sellers have lost their steam. Source: Finimize. Chart made with TradingView.

Here’s another reason why long-dated US Treasuries might offer a good bang for your risk buck: bond convexity. That’s a fancy way of saying that when interest rates change, bond prices don’t simply and predictably move in the opposite direction – they move unevenly. When interest rates and yields are high (like they are now), their downward move tends to push bond prices up more than an upward move would push them down.

3. Unemployment could rise and inflation could drop, thanks to AI.

Look, nobody can perfectly predict the future. But if I had a crystal ball, here’s what I think it might say: AI is getting better, and – because it’s AI – it’s likely to keep getting better at a faster rate. This could mean two things for the economy.

First, the bad news: AI might replace more jobs as it becomes cheaper for businesses to use machines than human workers – and that could drive unemployment up.

Then, the good news: AI could also make the cost of producing goods and services much cheaper – and that could drive inflation down.

When you have rising unemployment and falling inflation, government bonds typically thrive. When the job market falters, governments tend to reduce interest rates to stimulate the economy and boost hiring, which is good for bond prices (remember, bond prices rise as yields fall). Lower inflation is good for bond prices, too: they pay interest over many years, and investors prefer it when those payments aren’t watered down by higher consumer prices.

Either way, they say the bond market is never wrong when it comes to forecasting the economy. So if you do see TLT begin a new ascent from here, the economy might not be as strong as we think.

If you’re based in Europe or the UK (like me), there’s also a UCITS version of TLT: iShares $ Treasury Bond 20+ Year UCITS ETF (IDTL, 0.15%). Just keep in mind that the fund isn’t “US dollar hedged”, which means your asset could lose some value (in your local currency) if the greenback weakens or gain value if it strengthens.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.