JP Morgan Private Bank sees the US dollar as overvalued. If it weakens, that would make gold more attractive globally, potentially sending its prices higher in 2025.

Gold no longer falls sharply when real yields rise, and it rallies more when they drop. With interest rates expected to ease, gold’s strength could continue.

Central banks are buying record amounts of gold, and investors continue to see it as a hedge against inflation and uncertainty. Plus, its limited supply only adds to its appeal.

Not everyone is enchanted with gold and its… charms. The world’s most legendary investor – Warren Buffett – has famously dismissed the asset because it doesn’t generate income or yield like stocks or bonds. It’s a fair point, sure, but, here’s the thing: for all the skepticism, this gleaming, yellow metal has defied expectations, rising through its record highs over the past two years. And the folks at JP Morgan Private Bank say 2025 is shaping up to be another glittery year. Here are their three reasons why.

Reason 1: The US dollar is likely to weaken.

Gold and the US dollar have a long-standing, seesaw-like relationship. Since gold is priced in dollars, its value tends to move in the opposite direction of the currency. When the dollar strengthens, gold becomes more expensive for international buyers, and that, in turn, weighs on demand. When the dollar weakens, gold becomes more attractively priced for international buyers, pushing its demand (and therefore its price) higher.

In the past few years, the US dollar has gained and held its strength, buoyed by an inflation crisis and an aggressive run of interest rate hikes. But consumer price stability has mostly come back and interest rate cuts have begun, so JP Morgan Private Bank says the greenback now looks overvalued – by as much as 15% compared to historical averages. Now, the world’s biggest currency could actually stay strong for a while – especially if the US economy outpaces some of its peers – but it probably won’t get much stronger.

Over time, the dollar usually returns to more typical levels, a process known as "mean reversion". It’s a gradual, dependable adjustment that creates a stable backdrop for gold prices. And, right now, it suggests that the dollar is likely to fall – which could be good for gold in 2025, giving it even more room to rise.

Reason 2: Real yields are no longer a gold killer.

First, a simple explanation about why this matters. Real yields are the returns on government bonds after adjusting for inflation. When inflation speeds up faster than interest rates, real yields fall. When inflation slows or when interest rates rise sharply, real yields increase.

Gold tends to shine when real yields are low – because in that scenario, holding gold doesn’t come with the “opportunity cost” of missing out on interest from bonds or cash deposits. When real yields rise, then, gold typically struggles. But, in the past few years, something unusual has happened.

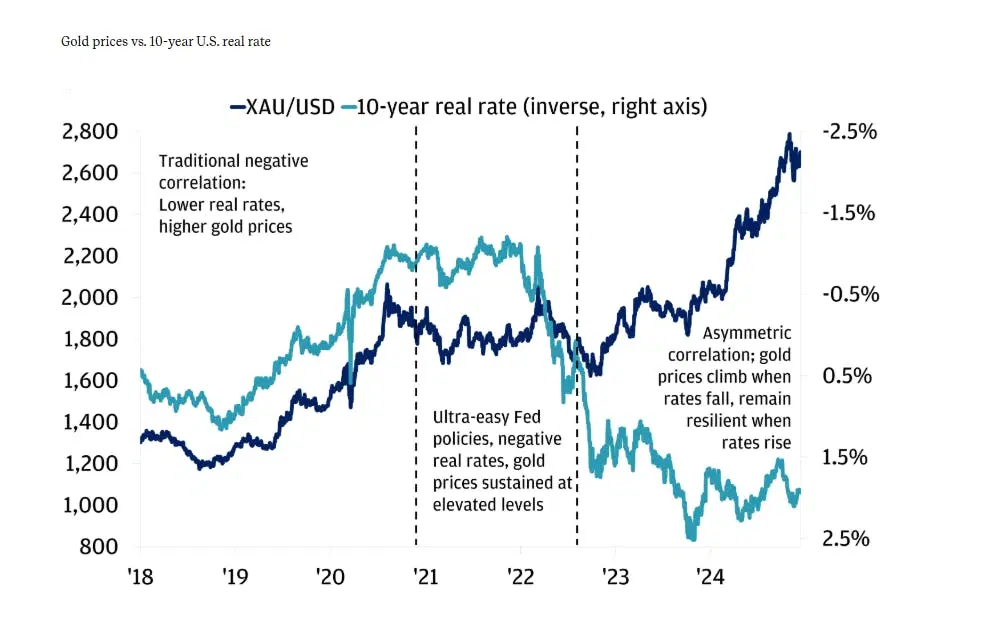

In early 2022, the Federal Reserve launched an aggressive rate-hiking cycle to combat the country’s super-hot inflation. Real yields surged to their highest levels since the 2008 financial crisis, with 10-year US real yields jumping by an unprecedented 2.5 percentage points in 2022. By historical standards, this should have sent gold tumbling. Instead, gold held steady, ending 2022 mostly flat and then rallying 13% in 2023, closing the year at a record high.

Since 2022, gold prices have remained incredibly resilient, despite significantly higher real yields. Sources: JP Morgan Private Bank, Bloomberg. Data as of December 11th, 2024.

So, what’s changed? JP Morgan Private Bank believes that while gold still reacts to real yields, the relationship has evolved. The metal now moves asymmetrically – meaning it falls less than expected when yields rise and climbs more aggressively when yields fall.

One reason for this shift is strong demand from central banks and investors, which has helped gold hold its ground even when the environment gets tricky. In short, the old rules don’t apply as neatly as they once did. Even if interest rates stay elevated for longer, gold could be okay – a fact that might only reinforce its role as a resilient store of value.

Reason 3: Growing demand for gold.

One of the most powerful factors supporting gold’s price is the unrelenting demand from central banks and investors.

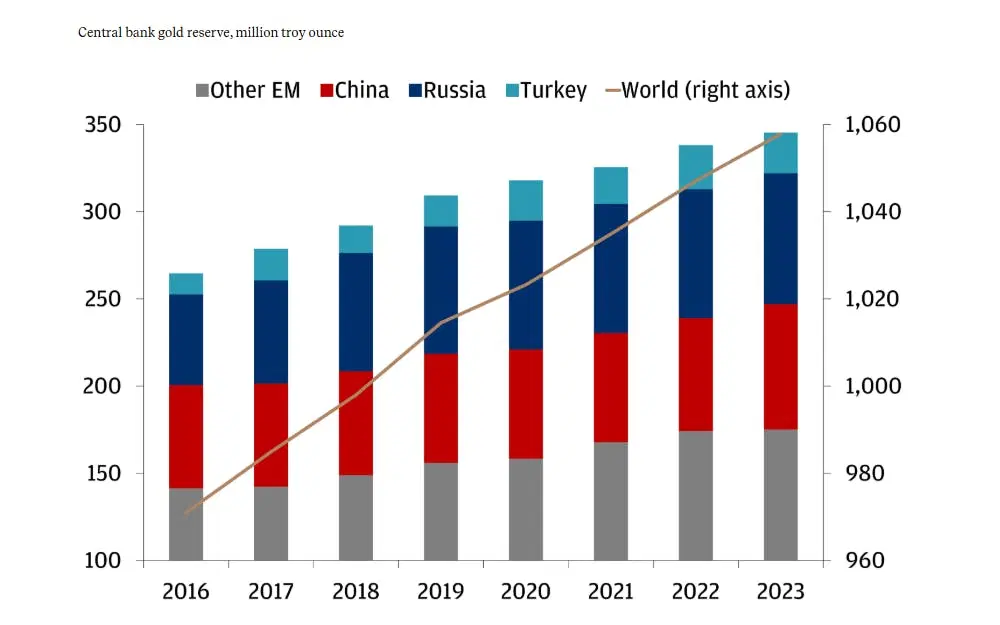

Central banks have been on a historic gold-buying spree, snapping up record amounts of the stuff over the past two years. And they’ve got their reasons for loading up. Some countries, particularly those looking to reduce their reliance on the US dollar, see gold as a more politically neutral asset to stockpile. Others view it as a hedge against inflation and economic uncertainty, ensuring their strategic funding reserves maintain value even in turbulent markets. A recent World Gold Council survey found that over 80% of central banks plan to continue increasing their gold holdings – so don’t go looking for demand to fall anytime soon.

Central bank gold reserves have seen a steady rise. Sources: JP Morgan Private Bank, Haver Analytics, Bloomberg. Data as of December 2023.

It’s not just government entities fueling gold demand – investors are turning to gold too. Retail investors have been, ahem, mining the world’s big gold ETFs to gain exposure to the metal, a trend that rocketed during the Covid-19 pandemic when inflation fears and global uncertainty were at a new high. And, yeah, demand has cooled since then, but history suggests that any resurgence in economic or market instability could quickly bring investors back into gold.

Bottom line, then: with central banks going full Scrooge McDuck and hoarding the stuff, and investors are stacking it up as a hedge against inflation and uncertainty, this investment is likely to keep its shine for a while. And given that its supply is limited, I’d say the ultimate safe-haven asset this year is probably yellow, metal, and very pretty.

To add some exposure to your portfolio, you could consider investing in ETFs that hold physical gold, like the SPDR Gold Shares (ticker: GLD; expense ratio: 0.4%), iShares Gold Trust (IAU; 0.12%), or the VanEck Merk Gold Trust (OUNZ; 0.25%).

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.