What’s going on here?

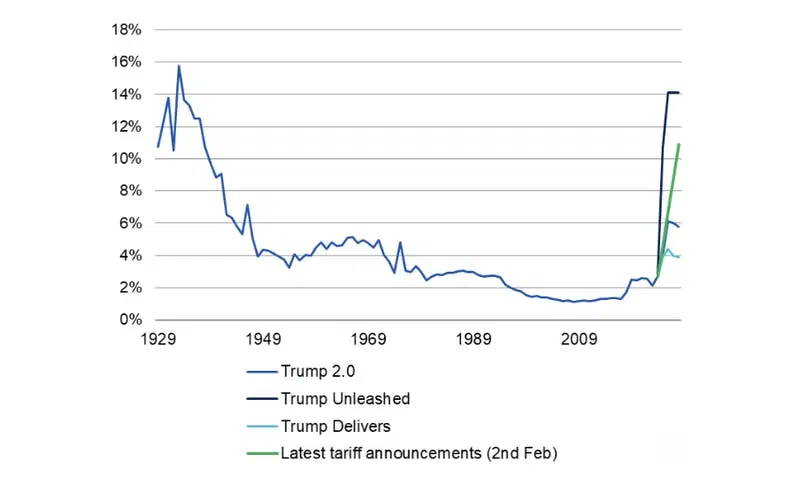

The US government has postponed increasing 25% tariffs on Canada and Mexico until March 4th, maintaining a 10% tariff on China. This move is widely viewed as a strategic step in ongoing trade negotiations, leveraging tariffs to extract concessions.

What does this mean?

Canada and Mexico are deploying substantial resources to bolster border security, with commitments including 10,000 troops and increased funding to combat fentanyl trafficking.

Meanwhile, China has responded with its own tariffs on US goods and an anti-trust probe into Google. The volatile negotiation landscape suggests potential short-term deals with China, although political complexities may hinder any long-term resolution.

Why should I care?

For markets: Canada and Mexico on the brink.

The possibility of further US tariff hikes remains, exerting pressure on all economies involved. If the US reinstates tariffs, Canada and Mexico risk recession, while the US could see inflation increase slightly. Monetary policy responses are mixed, with the Federal Reserve likely to hold off changes, but potentially facing pressure if tariffs escalate further.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.