What’s going on here?

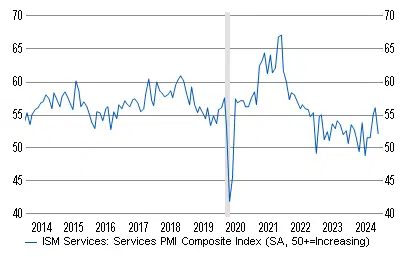

The US services ISM index dropped significantly in November to 52.1, indicating softer business activity.

Source: abrdn, Haver, Institute of Supply Management.

What does this mean?

While a decline in the ISM index might raise eyebrows, analysts see it as noise rather than a harbinger of change. The upbeat business mood highlighted in the Federal Reserve's Beige Book, coupled with stable consumer spending, indicates resilience in economic fundamentals.

Job market data, however, paints a mixed picture, with fewer jobs added in November than expected and previous figures revised down. As inflation prospects improve with stable consumer spending and easing wage growth, the Federal Reserve is proceeding cautiously on interest rate adjustments, and investors are eyeing the December meeting closely.

Why should I care?

For markets: Markets eye labor trends.

The shift in labor market trends, marked by underwhelming job growth, may keep investors cautious. As the Fed monitors employment closely, markets await clearer signals on rate policies, impacting the sectors most sensitive to interest rate changes. Stable consumer spending and easing wage growth, on the other hand, offer a silver lining, potentially stabilizing financial markets amid uncertainties.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.