Small-cap companies can make an awfully big noise. Since January 2001 (and that’s as far back as the data goes), those less-sizable companies have outperformed their heftier peers globally and across every region. And the contrast between the two groups has been pretty striking in Europe, where smaller firms have gained 457% over the past 24 years, compared to the bigger firms’ 153%. Still, for some reason, folks who invest in European stocks have been reluctant to put their money in the bloc’s smaller publicly traded businesses. So here’s why now might be an opportune time for them to reconsider.

Why have small-cap companies done so well?

First, it’s easier to grow earnings from a smaller base – so these stocks get a bigger bang for their profit bucks. Second, smaller firms are often nimble and agile, and that allows them to respond to changing market dynamics and capitalize on emerging trends. Finally, smaller companies receive less attention from analysts and investors. And because of that, they’re frequently underhyped and undervalued – which gives them the potential for more meaningful price appreciation when they deliver.

But let’s be frank: small-caps don’t always outperform. The past three years, for example, have been particularly challenging. The rapid rise in inflation and subsequent dramatic climb in interest rates, took a toll on these companies, as did the war in Ukraine, supply-chain disruptions, and a bunch of macroeconomic worries. But there has also been another factor at work: index composition. Over the past three years, a few heavyweight names have driven the big-cap index, with Novo Nordisk, Shell, Novartis, SAP, and HSBC all rising over 50%.

By contrast, the sheer weight and diversity of smaller companies mean it’s impossible for a handful of names – no matter how strongly they perform – to drive the entire index.

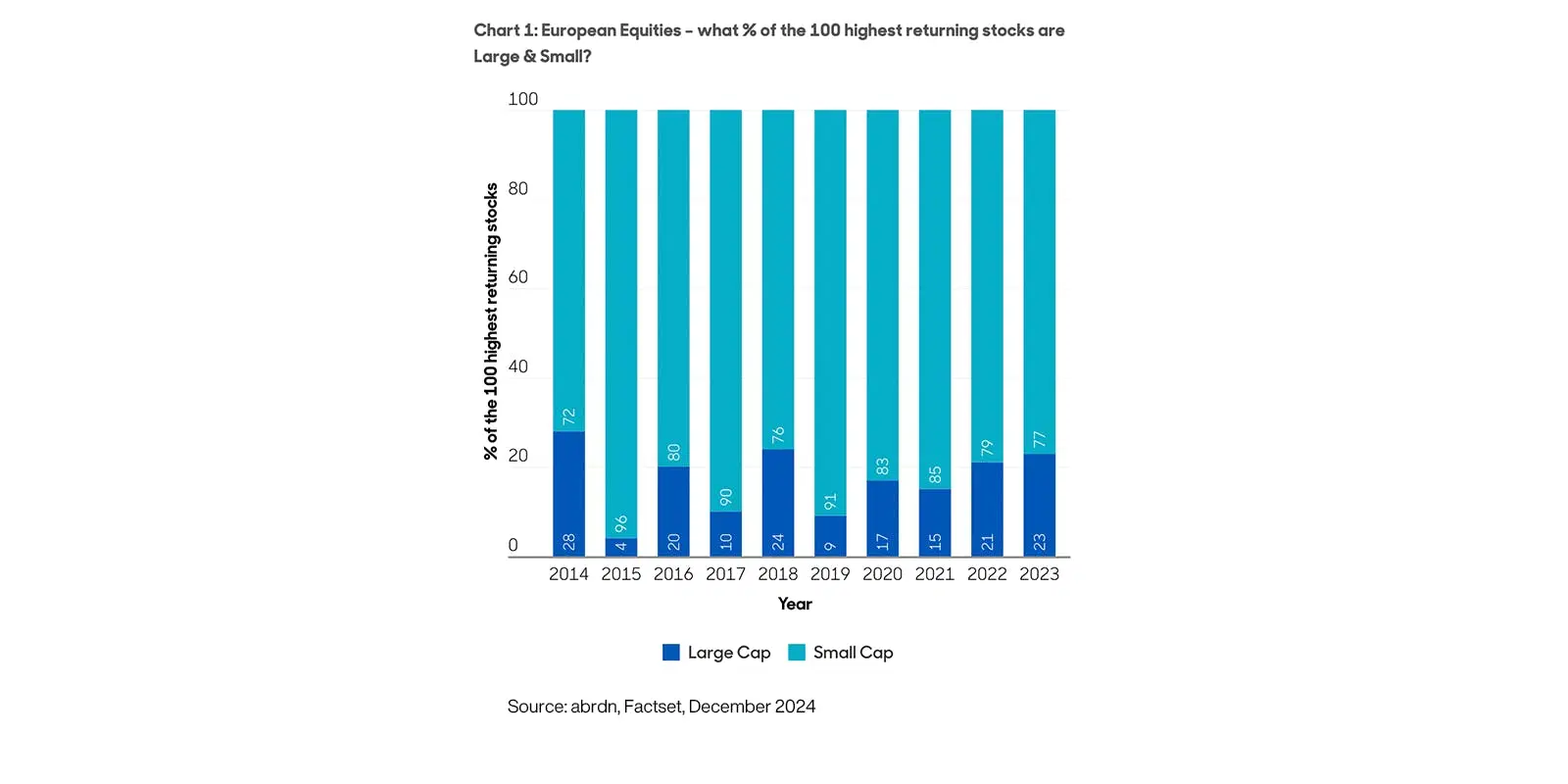

And that brings me to my next point: the importance of an active approach.

Sources: abrdn, Factset, December 2024.

That gives skilled active managers the potential to deliver compelling returns. They can pick the stock winners from the vast, dynamic investment universe. Over the past five years, only 40% of stocks in the European small-cap index have outperformed, highlighting the need to be selective.

The return argument is strong, but what about risk?

Sure, smaller companies are inherently riskier than their bigger, more established peers. But over the long term, small caps – with their higher levels of return and attractive diversification benefits – tend to more than compensate for the additional risk.

It’s worth noting that much of the risk in these kinds of stocks relates to early-stage companies that have yet to deliver a profit or that operate in highly cyclical parts of the market. When you filter out these businesses, the risk level of the remaining subset isn’t as high as you might think. Remember, these companies also have the potential to deliver substantial returns over time.

It’s also worth keeping in mind that a chunky allocation to small-cap stocks can offer some attractive diversification benefits. Because of their revenue sources and sector allocations, small caps give investors access to different risk characteristics compared to big-cap stocks. Additionally, small caps tend to be more domestically focused than their beefier, more globally minded peers and often operate in the European market’s more dynamic sectors – notably industrials and consumer discretionary.

Despite that, only 7% of the total European equity fund assets under management (AUM) are invested in smaller companies, according to Morningstar data. And only 10% of total strategy AUM is invested in small caps, according to eVestment data. And that’s well below the 14% weight that small caps represent within the broader European equity market cap, as defined by MSCI.

Is now the time to invest?

Two factors are certainly shining a spotlight on the attractiveness of small-cap firms.

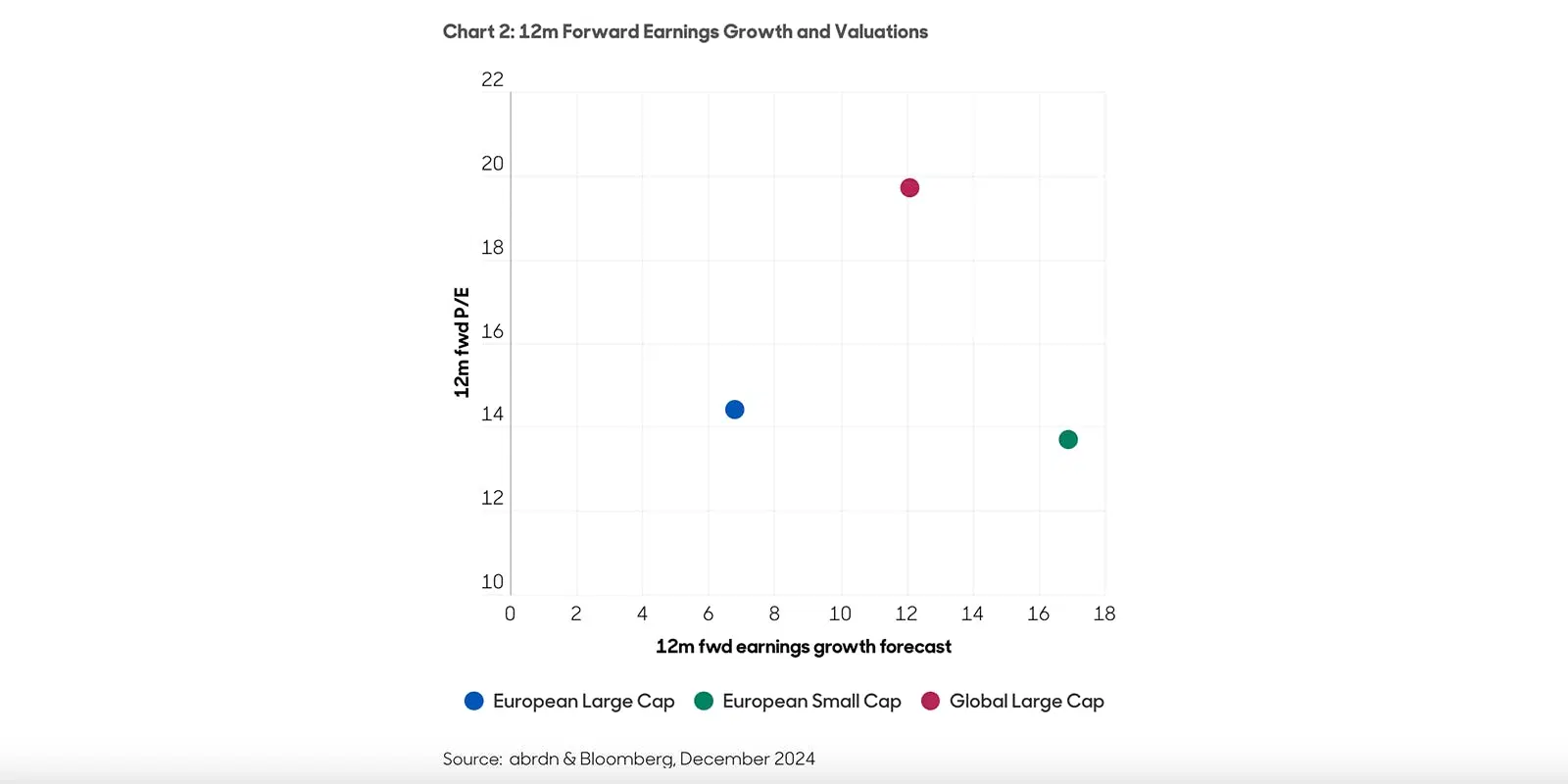

First, they’ve got some seriously attractive valuations. European small caps are the cheapest of all regions, trading at a 12-month forward price-earnings ratio of 13.7x. That’s cheaper in absolute terms than European big caps (currently at a 4% discount) and far below the long-term average premium of 26%. The last time there was a comparable relative valuation was during the Global Financial Crisis. Admittedly, the outlook isn’t perfect (it never is), but it’s certainly better than it was in 2008 – which makes now a potentially sound time to invest.

One of the most common reasons why clients won’t invest across the bloc is the belief that “Europe is cheap, but lacks growth”. And that might be true when considering gross domestic product or big-cap growth. But smaller companies are different. On a forward-looking basis, European small caps are expected to grow more quickly than global equities while trading at a lower valuation.

Sources: abrdn & Bloomberg, December 2024.

Second, historical data shows that small-cap stocks tend to outperform big-cap stocks when interest rates fall. The trend is often attributed to the increased growth potential and agility of smaller firms in an environment where lending is cheaper.

In recent months, however, markets have tempered their expectations on US rate cuts. Many believe that the country’s policies over the next four years, from tariffs to taxes, could be inflationary and slow the pace of cuts. On the flip side, those policies might also boost economic growth – creating an environment that’s typically good for smaller companies. Meanwhile, the European and UK central banks have signaled they will continue to cut interest rates in 2025.

What’s the opportunity then?

Right now, Europe’s smaller companies are generally underrepresented in a lot of folks’ portfolios. And if that’s true for your portfolio, you could miss a golden opportunity.

Small caps have outperformed big caps over the long term, with Europe leading the pack. Plus, many of these small caps are nimble and agile, able to capitalize on changing market dynamics and respond to the ever-evolving investment landscape. What’s more, they also offer diversification benefits thanks to their varied revenue sources, with many firms operating in niche markets not found in the big-cap space.

And sure, risk will always be a concern. But it’s possible to mitigate that with an active investment approach and a blended portfolio. Focusing on high-quality, profitable companies has also proved to be a profitable strategy.

After all, with today’s attractive valuations and the potential for outperformance in a falling interest rate environment, this could be an excellent time to consider increasing your holdings in Europe’s small caps.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.