Roaring demand, tight supply, and strong investor interest have all boosted oil prices recently.

Prices are likely to remain high over the next few months. Goldman Sachs, for one, expects them to trade between $80 and $105.

Surging oil prices tend to spell trouble for the economy, markets, and the Fed. They can drive up inflation, necessitate higher interest rates, and significantly dampen growth.

Oil prices have been on the up since late June and flirting awfully heavily with the $100-a-barrel mark. This has some slippery implications for your wallet and your portfolio – to say nothing of the economy. So, let’s pull over a minute and I’ll tell you what you need to know about oil now…

What’s pumping up oil prices?

It’s the same old story: demand is roaring, but supply is on a tight leash.

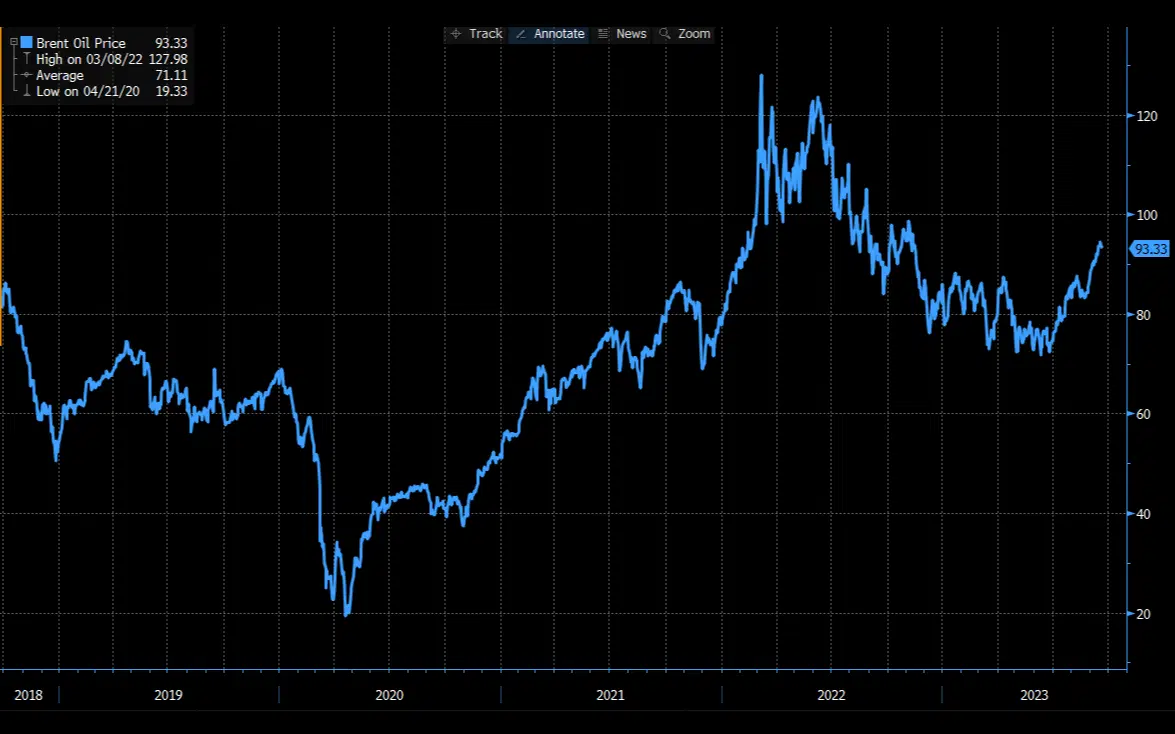

Oil prices are up 30% from their June lows. Source: Bloomberg and Finimize.

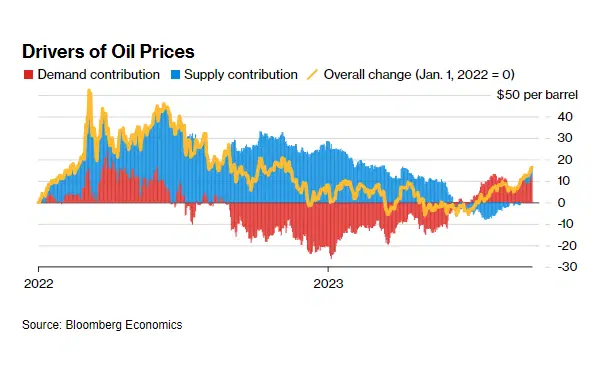

On the demand side, the economic bounce-back has been beefier than we thought, especially in energy-guzzling countries like the US. Just to paint a picture: the global thirst for oil hit a fresh peak of 102 million barrels a day this year.

On the supply side, the OPEC+ group of major oil-exporting countries like Saudi Arabia and Russia have recently slashed output. And since supplies were already tight, that sent prices for imminent oil deliveries way out ahead of those set to arrive later. This phenomenon – it’s called "backwardation" – is a big heads-up that there’s a mismatch between supply and demand.

But there’s also a speculative aspect to what’s going on with oil prices. After a cold spell for oil earlier this year, hedge funds and other big money managers have been diving back into crude. And this gush of new money has only amplified the price rally, which, in turn, has attracted more buyers to the scene.

Rising demand (red) and tighter supply (blue) have both contributed to the gains in oil prices since the start of 2022. Source: Bloomberg.

How long is this squeeze likely to last?

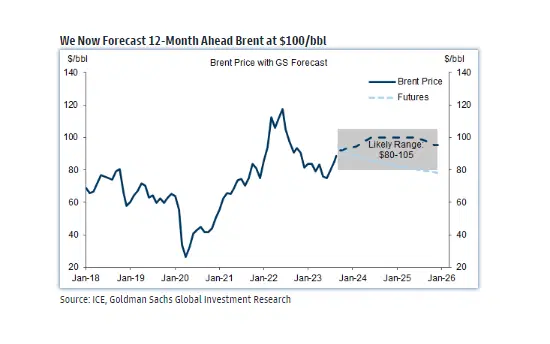

In the short haul, these prices are likely to continue to climb. After all, demand vibes still look solid from Asia (including China), Europe, and Canada, despite some economic hiccups. Plus, Saudi Arabia and its OPEC+ pals aren't just known to talk the talk about maintaining elevated prices: these countries walk the walk. It’s no wonder big finance houses are boosting their price predictions for a barrel of the global benchmark Brent crude, with Goldman Sachs setting its sights on a cool $100, up from $93 before.

But prices can’t soar forever, and a lot of people expect oil prices to top out around $105. They see the potential for rising production from non-OPEC countries like Guyana and Brazil keeping prices in check. And they know that if US shale bigshots crank up their game or if demand goes "meh" – two not-so-unlikely scenarios – prices could take a step back. That’s why Goldman predicts oil to trade between $80 and $105 over the next 12 months.

Goldman Sachs estimates that the price of the benchmark Brent crude oil will trade between $80 and $105 over the next 12 months. Source: Goldman Sachs.

What does it mean for your portfolio?

Surging energy prices and the US economy aren’t BFFs: oil prices have been a spoiler before, squeezing consumers' wallets and helping to drive the US economy into a recession – not just during the disco days of the 1970s, but also in the neon-lit 1980s and grunge-era 1990s. Fast-forward to now, and the backdrop is dicier. With folks feeling the pinch from climbing interest rates and inflation, and pandemic savings starting to deplete, the longer oil prices remain lofty, the more trouble they could spell for the economy.

Rising energy prices also risk setting off a brand-new inflationary wave: Bloomberg suggests that if oil chills at $100 a barrel this quarter, it could send US inflation higher by a cheeky 0.9 percentage points. And that’s because the higher production and shipping costs go, the more they nudge up the prices of everything else. Unfortunately, inflation shocks also tend to be long-lasting: the International Monetary Fund analysed over 100 inflation shocks from the 1970s onward and found that inflation took over five years to settle down in about 60% of instances. That’d be a nightmare for the Federal Reserve (the Fed), which has been raising interest rates for over a year already, trying to cool the current inflation blast.

Now, it’s not all doom and gloom. The progress that’s been made in tamping down inflation isn’t going to evaporate overnight. And while the current oil price fiesta is lively, it's also likely running out of, um, gas. Plus, the Fed's gaze typically skips over the more volatile, energy-led inflation measures. Still, it's worth keeping your hawk-eye on this scenario. It may also be worth considering adding some commodities to your portfolio to offset some of that inflation risk. The abrdn Bloomberg All Commodity Strategy K-1 Free ETF (ticker: BCI; expense ratio: 0.25%) is a pretty good way to do that.

-

Capital at risk. Our analyst insights are for information purposes only.