The Year of the Dragon is believed to be auspicious – and Chinese stocks would surely welcome a little good fortune. They underperformed global markets in 2023 for a third straight year and got off to a rocky start in 2024. But now there are reasons to be positive about the outlook for Chinese assets.

So what’s the outlook then?

As the world’s second-most populous country celebrated the Lunar New Year on February 10th, its investors had something else to celebrate too: the government has shown that it’s ready to stimulate the economy through monetary easing measures. Most recently, the country’s central bank, the PBOC, announced a deep cut to banks’ reserve ratio requirement (RRR), a move that would inject billions into the financial system and send a strong signal of support for the floundering economy and its beaten-up stock market.

China is also considering a market rescue package worth about 2 trillion yuan ($2.8 billion), intended to restore investor confidence in the market and tackle the ongoing property crisis, which saw indebted property giant Evergrande liquidated. Despite more news of further US sanctions on Chinese technology companies, the stability in US-China trade relations seems the desired outcome for both parties – which should allay some concerns among investors.

As the Chinese economy continues to mature and become more open, government policy changes and resultant volatility should come as no surprise. In fact, the short-term selloffs we’re likely to see could create buying opportunities for long-term investors.

China’s economy grew at 5.2% in 2023, and the government has set a target for 2024 of 4.5% to 5%, which is generally above the expected range for the world’s advanced economies. With further targeted government stimulus in the offing, the Chinese consumer is also expected to bounce back. This should also benefit other economies, with millions of Chinese tourists traveling abroad each year. Furthermore, China plays an integral part in global innovation and supply chains of critical markets, such as electric vehicle production and clean energy supply, which bolsters its position on the global stage.

The long-term case for investing in the Chinese growth story remains intact. The expansion of the middle class and the refocusing of China’s economy toward domestic consumption are expected to be key drivers of economic growth and the stock market in the coming years.

While there are short-term challenges including property sector troubles and geopolitical risk – the threat of conflict with Taiwan is a particular concern right now – improving fundamentals, a stronger consumer, and technological advancements will be key factors in determining market direction.

And as China is increasingly recognized as being a major driver of global growth, investors should consider having exposure to China when building a balanced portfolio. China currently represents nearly 18% of world economic growth but less than 3% of world market capitalization, having previously comprised over 5% in late 2020.

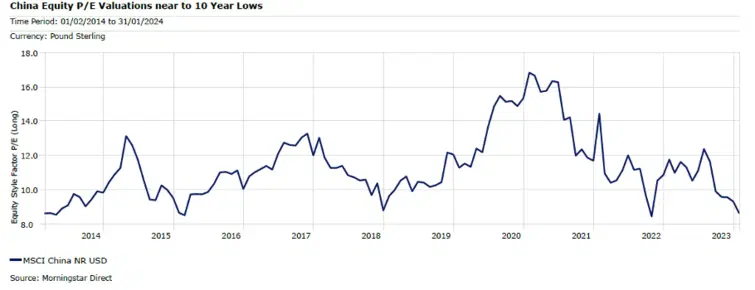

Investors have been broadly derating Chinese companies – in other words, revising downward their views – over the past two years. And so their valuations now look attractive, both when compared to historic averages and when compared to other world indexes. Valuations are supported by strong MSCI China consensus earnings estimates of more than 14%.

For these reasons, the recovery in Chinese stocks is likely to continue. And with depressed/compelling valuations versus history and other markets, plus the fact that institutional holdings are at their lowest in five years, the risk-reward ratio for Chinese equities looks favorable.

What’s the opportunity here?

China’s share of global stock markets is much smaller than its share of economic output, and it’s expected that over time this gap will close, and Chinese markets will likely take up a significantly bigger share of major equity benchmarks.

That’s why I believe investors should be thinking seriously about China today to take advantage of that expected future demand.

There are lots of ways to gain exposure to China, but funds and investment trusts are the most straightforward approach.

The Fidelity China Special Ord provides broad, diversified exposure to Chinese equities, including “H” shares listed in Hong Kong and mainland-listed “A” shares. Since 2014, it’s been managed by Dale Nicholls, who focuses on faster-growing, consumer-oriented companies with robust cash flows and capable management teams. Due to the trust’s single-country exposure, its bias to small and mid-sized companies, and its ability to use gearing, its return profile is likely to be more volatile, making it a higher risk and best suited as a satellite (read: adventurous) holding in a well-diversified portfolio.

The KraneShares CSI China Internet ETF provides exposure to Chinese internet companies listed in both the US and Hong Kong. The ones that provide services Google, Facebook, Twitter, eBay, Amazon, and the like are benefiting from increasing domestic consumption by China’s growing middle class. The ongoing charge is 0.75%.

-

Capital at risk. Our analyst insights are for information purposes only.