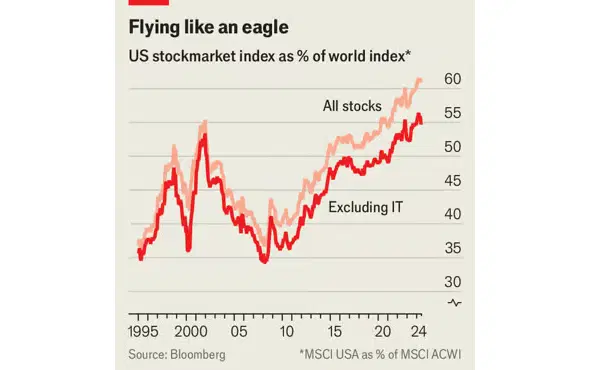

US companies have done more than outperform their global peers in recent years: they’ve actually expanded their presence on the world index. Back in March 2008, US stocks made up less than 40% of the world's total stock market capitalization. Fast forward to today, and they’re over 60% – even though the country itself accounts for only about a quarter of the global economy.

The MSCI USA index as a percentage of the MSCI All Country World Index (ACWI) over time, measured across all stocks, and excluding information tech stocks. Sources: The Economist, Bloomberg.

That got some folks wondering whether the US’s dominance in international stock markets is even sustainable. There’s good reason for skepticism – just ask Japan.

In the 1980s, Japan’s markets were on fire, but then some asset bubbles burst, leading to a spectacular fizzle. By the end of 1989, Japanese stocks accounted for 40% of the global total: now, they're closer to 5%.

And look, that’s not to say that US stocks are doomed to suffer the same fate. Sure, America’s stock valuations are high, but they’re not as inflated as Japan's were. In 1989, Japan’s price-to-earnings (P/E) ratio hit a whopping 60x – the S&P 500's is sitting at just 27x.

And let's give credit where credit is due: US stocks have earned their dominance. Since March 2008, earnings per share for the MSCI US index have jumped by 162%. Meanwhile, global markets (excluding the US) have seen a 2% drop on that front. Put simply: American companies have been killing it in growth, profitability, and returning cash to investors.

But this US dominance can be a tricky thing if you’re looking to diversify through index-tracking vehicles like ETFs. It can leave your portfolio more thickly concentrated in one country than you might realize. And diversification – the idea of not putting all your eggs in one basket – is key for reducing risk and boosting returns over time.

So, what’s an investor to do?

Know why you diversify. The US’s stellar performance over the past decade might tempt you to keep everything stateside, but remember, diversification is about reducing risk and boosting returns. It’s like avoiding a strikeout while still aiming for a base hit.

Be smart about how you diversify. With US companies hogging a bigger slice of the global market, a worldwide index fund like the MSCI ACWI will still put a bunch of your eggs in the American stock basket. So if you want to spread your bets, you might need to look at specific regional funds. Emerging markets, for example, tend to move to their own drum but with a bit more volatility, offering a different kind of mix.

Consider quality. If you’re feeling adventurous and prefer to buy individual stocks, consider Europe's superstar giants – the GRANOLAS: GlaxoSmithKline, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L'Oréal, LVMH, AstraZeneca, SAP, and Sanofi.

And, finally, don’t sweat it. It may not be all that bad to have a majority exposure to the S&P 500. Remember, the US stock market is global. Plenty of overseas companies are listed in New York, and many stateside companies have international exposure – so maybe investing in the big S&P 500 alone is more diversified than you think.