Aston Martin in discussions with bankers over debt strategy

Aston Martin, is in deep discussions with bankers to manage a huge debt of $1.4 billion, focusing on a bond worth $1.1 billion due next year. Executive Chairman Lawrence Stroll, who saved the company in 2020, is looking for the best ways to handle the debt, keeping shareholders in mind. Despite financial challenges, the company's stock went up slightly as investors reacted positively to the debt management talks. Aston Martin is also exploring refinancing options during uncertain times in the debt market. The company, known for its appearance in James Bond movies, has welcomed new shareholders, including Saudi Arabia’s Public Investment Fund and China’s Geely, aiming for a turnaround with a shift towards electric vehicles. Amidst this, the company faces the challenge of making a profit for the first time in six years while dealing with its complex financial situation.

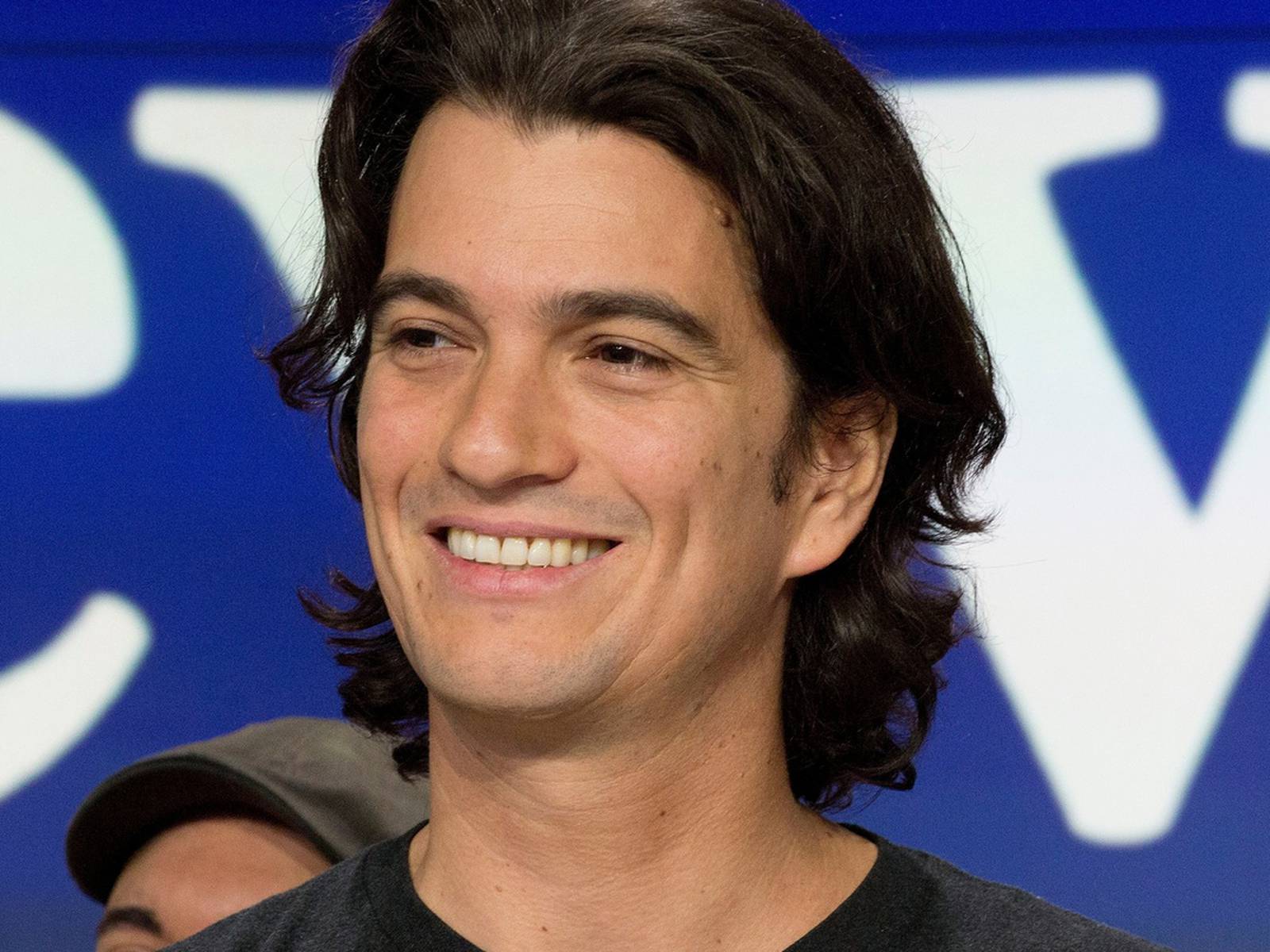

Macquarie's high-earner Nick O’Kane bids farewell

Nick O’Kane, the star commodities head at Macquarie Group who earned a whopping A$58 million last year, is leaving his post later this month. His departure, announced for February 27, comes as a surprise to many, especially since he was making more money than big bank CEOs like Jamie Dimon of JPMorgan and Jane Fraser of Citigroup. Simon Wright is set to take over O’Kane's role, bringing his 35-year experience at Macquarie to the table. This news arrives alongside Macquarie's announcement of a significant profit dip for the last nine months. O’Kane's exit and the financial downturn led to a temporary 4.3% drop in Macquarie's shares, reflecting his high regard in the market. His incredible earnings, which surpassed those of leading US bank executives, underscored Macquarie's competitive edge in the global talent race.

Travel giant TUI smashes earnings expectations as investors decide on London exit

TUI, the travel giant from Germany, has surprised everyone by making a profit of 6 million euros this quarter, beating the expectations of a big loss. Their success is thanks to more people wanting to travel and being willing to pay higher prices. The company made a whopping 4.3 billion euros in revenue, a 15% increase from last year. TUI's shares went up by 6% at the start of trading, showing strong investor confidence. CEO Sebastian Ebel is excited about the future, aiming for more growth and transformation. The company is also thinking about focusing its stock market presence solely in Germany, moving away from the London Stock Exchange.