BlackRock sees a big wave of AI investment boosting returns across sectors – easily overshadowing potential inflation from increased energy and commodity demands.

With half the world's population voting this year, the cost of living and other economic issues are front and center. High government debt can limit leaders' ability to address those troubles, and that could saddle countries with stubbornly higher interest rates – making shorter-term or inflation-linked bonds more tempting.

Infrastructure investments will be essential to tick the boxes on the low-carbon transition, with AI driving heavy demand for renewable energy. Meanwhile, aging populations in developed markets and in China will impact labor markets and inflation, making the healthcare sector seem like a hale and hearty investment.

It’s a split-screen kind of year with pivotal moments playing out in politics and tech. Half the world’s population will have voted in national elections by the end of 2024. And, alongside that, a wave of spending is happening in the race to build AI, rewire supply chains, and transition to a lower-carbon planet. It’s a lot to keep your eye on.

So it’s helpful that BlackRock – the $10 trillion asset manager – has come up with a short list of things you should pay attention to. And I’ve pulled together some investments that can help you do just that.

1. The AI buildout.

The AI boom is still mostly an American tale: it’s been the number one driver for the S&P 500 all year. BlackRock believes AI could be a major part of the next investment surge, boosting returns across various economic scenarios. And the firm is pretty upbeat too: it expects tech companies’ earnings to keep up with current valuations, just like Nvidia’s been doing.

As AI evolves, BlackRock sees investors looking beyond the firms that are closely linked to the technology and toward the ones who are successfully using it. Companies in sectors like healthcare, financials, and communication services could benefit, potentially in ways that will boost economic growth. But building AI and adapting to it are both likely to drive up resource demand before any improvements in work productivity kick in – and that could mean higher interest rates for longer just to keep inflation in check.

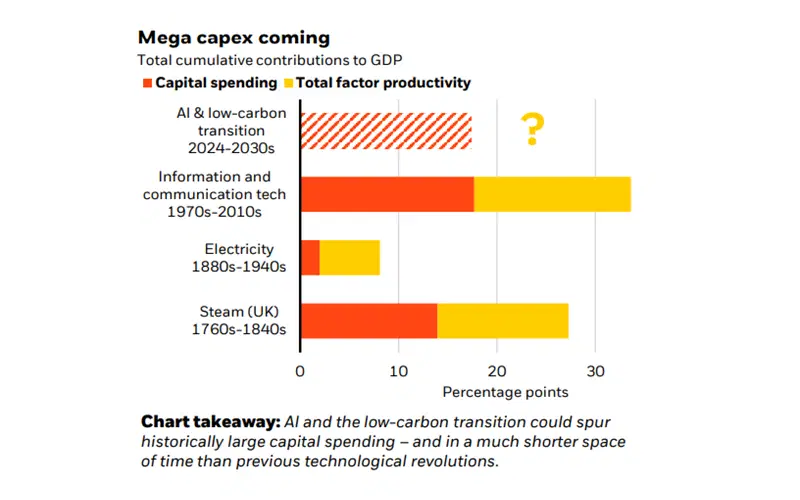

The cumulative contribution of previous US technologies (except steam) to economic growth (shown here as gross domestic product, or “GDP”, generally the broadest measure of the value of the goods and services produced by the economy).Source: BlackRock Investment Institute, June 2024, with data from Crafts,2021.

What does that mean for investors? The big thing here is AI’s growing stages might initially spark inflation, as demand for energy and commodities shoots higher. The first line to benefit could be major tech companies, chip manufacturers, and energy and utility firms. That’s before AI’s advantages spread to other sectors. You can consider investing in the iShares US Technology ETF (ticker: IYW; expense ratio: 0.4%), the Fidelity MSCI Information Technology Index ETF (FTEC; 0.08%), the Utilities Select Sector SPDR Fund (XLU; 0.09%), the iShares US Utilities ETF (IDU; 0.4%), or the Energy Select Sector SPDR Fund (XLE; 0.09%)

2. The election-driven pressures.

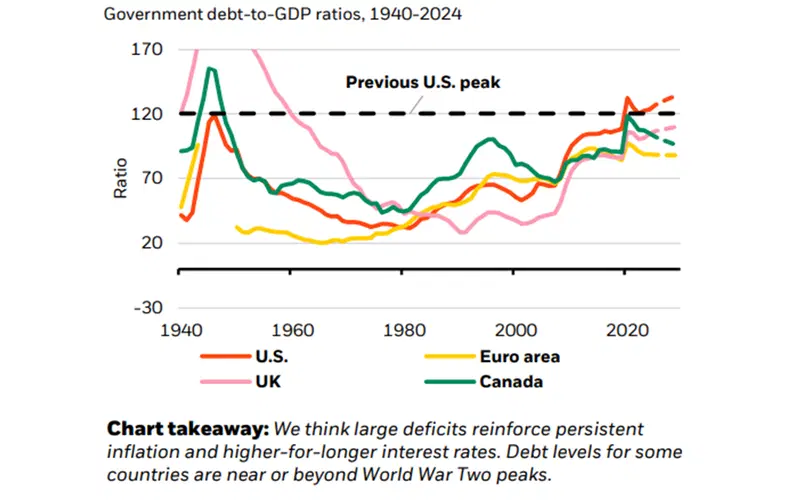

With half the world’s people casting ballots this year, economic issues like the cost of living are in ultra-crisp focus. But some sky-high government debt levels might mean leaders have very little wiggle room to tackle those problems. In the US presidential election, neither candidate appears to be losing sleep over debt or deficits: both are talking about big spending. But those gaping budget shortfalls could potentially keep the inflation fire blazing. And because of that, BlackRock’s betting the Federal Reserve will have to keep interest rates higher for longer. Otherwise, of course, it risks a potentially disastrous return of those rampant consumer price rises. The bottom line for investors is that they’ll likely want more bang for their buck on long-term US Treasuries (think: higher yields) since they’ll want better compensation for their risks, and they might favor shorter-term bonds instead.

The historic and estimated level of government debt as a share of GDP. Sources: BlackRock Investment Institute, International Monetary Fund, and Haver Analytics.

What does that mean for investors? BlackRock is feeling optimistic about Britain’s stocks these days, appreciating the country's perceived political stability since its election earlier this month and believing that the market’s attractive valuations might attract foreign investors. They also have a favorable view of its inflation-linked bonds for the long haul, partly because of the UK’s high debt levels. You could invest in the iShares MSCI United Kingdom ETF (EWU; 0.5%), or the Schwab US TIPS ETF (SCHP; 0.03%).

3. The infrastructure spending spree.

Infrastructure is smack dab in the middle of the mega forces driving the world’s transformation. AI is now a key player in the global economic competition, and the investment in data centers is nudging the low-carbon transition forward. Companies aiming for net-zero emissions while building out AI are driving up the demand for renewable energy. And AI’s hunger for energy could balloon the already massive anticipated investments. Infrastructure spending is crucial for a greener future: by the 2040s, BlackRock thinks up to 80% of energy spending will go toward low-carbon investments, up from 64% now. But there’s a big gap between the investment that’s needed and what governments can provide, given the high debt levels that many countries face.

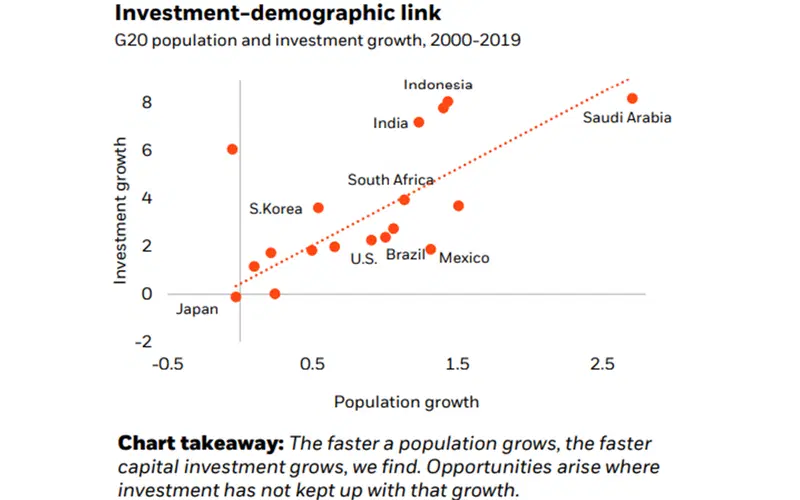

The relationship between average population growth and average real investment growth, as measured by the gross fixed capital formation component of GDP, between 2000 and 2019. Sources: BlackRock Investment Institute, World Bank Development Indicators, and the United Nations.

What does that mean for investors? BlackRock expects private markets to fill the gap between infrastructure investment needs and what governments can spend. Now, private assets aren’t readily available to retail investors, but you could consider buying an infrastructure ETF like the Global X US Infrastructure Development ETF (PAVE; 0.47%), the iShares US Infrastructure ETF (IFRA; 0.3%), or the First Trust Alerian US NextGen Infrastructure ETF (RBLD; 0.65%).

4. An aging population.

Demographic trends are often viewed as long-term issues that don’t affect current returns, but BlackRock begs to differ. (And so do I.) With rising life expectancy and falling birth rates, the working-age population – generally, folks aged 15 to 64 – is shrinking in most developed markets and in China. That means their economies won't produce or expand as quickly as they used to. And these changes are already impacting job markets and sector-level demand. Aging can also boost inflation: retirees stop making an economic contribution, but they don’t necessarily spend less, and governments are likely to have to ramp up healthcare spending. And that all adds up to the possibility that central banks might need to keep interest rates higher for longer. Now, this is a predictable demographic shift, but that doesn’t mean the market has already adjusted for it: big changes can take a long time to price in. And that’s why BlackRock favors the healthcare sector in the US, Japan, and Europe.

What does that mean for investors? Aging populations could create golden opportunities in sectors like healthcare, in the US, Japan, and Europe. On the other hand, BlackRock is eying countries like India and Saudi Arabia, which have young and growing populations, plus hefty infrastructure investments. To take advantage of the aging trend, you could invest in the Vanguard Health Care ETF (VHT; 0.1%), the Global X Japan Bio & Med Tech ETF (2636; 0.65%), or the SPDR MSCI Europe Health Care UCITS ETF (HLTH; 0.18%). To bet on the younger set, you could go for the iShares MSCI India ETF (INDA; 0.65%), or the iShares MSCI Saudi Arabia ETF (KSA; 0.74%).