Goldman increased its weighting to stocks on a 12-month view, with a preference for US and Japanese ones.

Sentiment and positioning indicators look stretched, but the continued inflows into money market funds could be a source of new buying if stocks fall.

Global manufacturing sentiment is recovering and historically has acted as an accurate indicator of a stock market rally.

The world’s factories are starting to clang, bang, and rev once again, with a manufacturing recovery finally punching its timecard and getting to work. That’s good news, and not just for fans of black metal lunchboxes. It means there’s likely to be a new boom in stocks, especially US and Japanese ones, says Goldman Sachs. Let’s take a look at what’s happening and how you could take advantage.

What’s the latest, then?

Being optimistic about US and Japanese stocks seems to be all the rage right now – with the S&P 500, Dow Jones Industrial Average, Nasdaq, and the Nikkei 225 all rising to new record levels.

Goldman says it’ll be leaning more heavily into stocks over the next 12 months – especially shares from the S&P 500 and the Topix, with the US and Japanese economies both looking especially bright. And, sure, valuations are already pretty high for both indexes, but the investment bank says it’s not shaken – it says that as the economy improves, it’ll be earnings that drive those stock returns.

Goldman recently increased its US growth estimates for this year to 2.8% (from 2.3%, which was already well above the 1.6% consensus view of 1.6%). And the latest US purchasing managers index (PMI) suggests its optimism is probably well-founded.

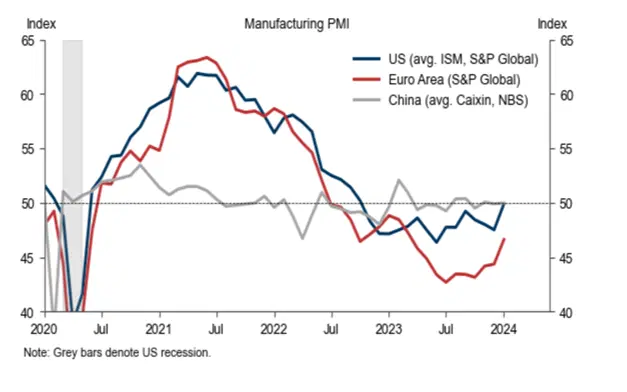

Manufacturing purchasing managers indexes (PMIs) for the US, China, and Europe. Sources: S&P Global, Haven, Goldman.

A reading above 50 means that most manufacturers say business is getting better (suggesting expansion), and a reading below 50 means that most say it’s getting worse (suggesting a contraction). The US PMI reached 49.9 in January – not quite to the all-important “50” level – but for stocks, the change in direction is a big deal. See, more than 90% of the time, when the US PMI has slumped and then moved higher again, the S&P 500 has averaged a 23% return in the following months.

Goldman’s global manufacturing PMI, meanwhile, reached 50 in January, a high not seen since 2022.

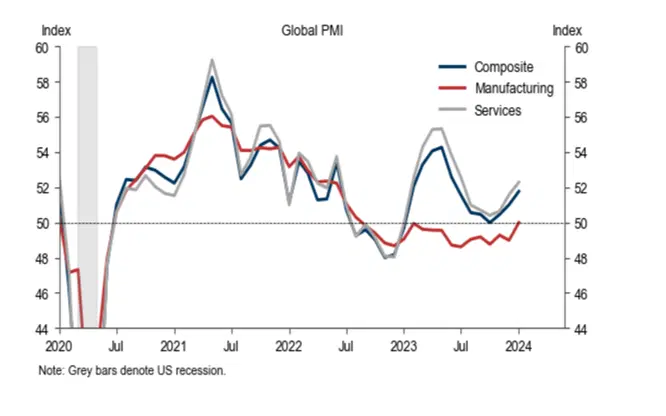

Global purchasing manager indexes (PMIs). The manufacturing component rose to 50 in January. Source: S&P Global, Haver, Goldman Sachs.

That’s good for the global economy, but it’s also good for Japan, whose major industries rely heavily on exports. Stocks in Japan already looking upward, thanks to a strong earnings recovery, reasonable valuations, and corporate governance changes that have made them more attractive to foreign investors.

Aren’t stocks already rallying?

They are. And those strong gains already have investor sentiment and positioning looking pretty stretched.

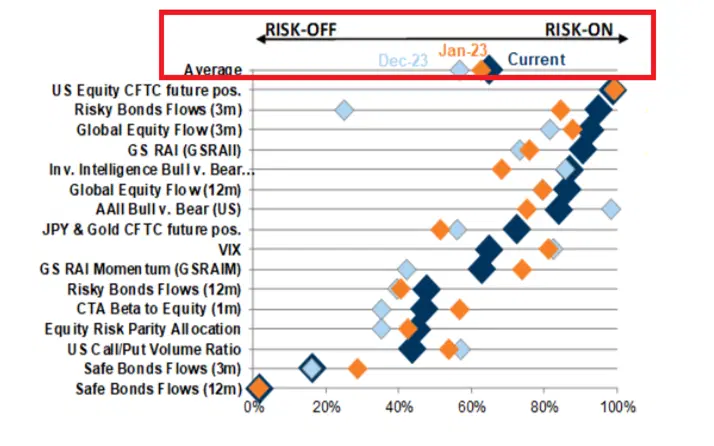

This chart shows how investors have moved from the market’s safer assets, like government bonds, toward its riskier ones, like stock futures. Some of the data here is Goldman’s alone, but some – like the American Association of Individual Investors (AAII)’s Investor Sentiment Survey – is freely available. The diamonds show what level the readings were in December (light blue), January (orange), and two days ago (dark blue). About half of the diamonds are sitting above the 80th percentile (i.e. are in bullish territory) – and that could be a worry.

Sentiment indicators and positioning data look elevated. Sources: Datastream, Haver Analytics, EPFR, Goldman Sachs.To quote Warren Buffett’s famous words: “be fearful when others are greedy, and greedy when others are fearful”. So it makes sense, then, that Berkshire Hathaway is currently sitting on $147 billion in cash.Still, it’s not like everyone else has gone all-in on stocks either. Money has continued to flow into money market funds and there are still plenty of folks invested in the bond market – both among the retail investing crowd and the pros. And that suggests that stocks could move higher yet, if those investors look to get on board. And when that money does eventually arrive in the stock market, Goldman says it will probably be directed toward companies and sectors that have lagged behind the market leaders.

What’s the opportunity here?

With the global economy and stocks both on an upswing, Goldman recommends dipping into quality growth stocks like those from the Magnificent Seven – Nvidia, Microsoft, Meta, Alphabet, Amazon, Apple, and Tesla.

Of those tech giants, Microsoft is still the biggest of the big. And AI-powered stock picker Danelfin recently highlighted Microsoft as its trade idea of the week: by its calculations, it’s the most likely of the batch to continue to outperform the S&P 500 over the next three months. The firm’s AI software screened all the stocks in the universe, and it noted Microsoft’s return on assets on a trailing 12-month basis – a view that strips out some of the statistical noise – stands at 19.77%, the highest among US stocks. That’s pretty impressive.

Of course, you don’t have to buy each one of the Magnificent Seven: you can pick and choose. Or you could go for the Invesco QQQ ETF (ticker: QQQ; expense ratio: 0.2%), which provides exposure to them all, along with several other leading technology and AI stocks – and at a pretty cheap fee.

But there are also plenty of quality stocks outside the Magnificent Seven: the iShares MSCI USA Quality Factor ETF (QUAL; 0.15%) provides broader exposure to them. For small and mid-cap stocks, meanwhile, the low-cost Vanguard S&P Small-Cap 600 ETF (VIOO; 0.1%) could be a decent place to put some funds. And for exposure to the market’s more cyclical stocks, you could consider the iShares Global Energy ETF (IXC; 0.44%), which holds cheap energy companies.

In Japan, big-cap firms and semiconductor-related stocks have been leading the market higher and the iShares MSCI Japan ETF (EWJ; 0.5%) provides broad exposure to many of those well-known names. If you specifically want exposure to Japanese semiconductor companies, the Global X Japan Semiconductor ETF (2644; 0.65%) could be an interesting addition. It tracks the FactSet Japan Semiconductor Index, which includes global leaders in the semiconductor supply chain – Screen Holding, Tokyo Electron, and Advantest, for example. And with the Nikkei launch of the Nikkei Semiconductor Stock Index on March 25th, there could be added interest and inflows into those stocks.

If you’d rather look further afield for quality stocks, European markets appear pretty tempting. I couldn’t find a “GRANOLAS” ETF, but the iShares Edge MSCI Europe Quality Factor UCITS ETF (IEFQ; 0.25%) has more than a 30% weighting in the shares from that club – GSK, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L'Oréal, LVMH, AstraZeneca, SAP, and Sanofi) – as well as some other quality European companies.

-

Capital at risk. Our analyst insights are for information purposes only.