We’re in the midst of the second-most aggressive cycle of interest rate hikes in the history of the Federal Reserve and hoping to see a soft landing. But almost every one of the Fed’s past hiking cycles led to a hard landing – that is, a recession.

The combination of dwindling savings, the resumption of student loan payments, and increasing interest and gas costs is poised to dent consumer spending, which is the biggest driver of the US economy.

With markets appearing to be underestimating the risk of a hard landing, you may want to exercise caution with your portfolio by reducing risk, avoiding leverage, holding cash, investing in gold and long-term government bonds, and tilting your stock exposure toward defensive sectors.

A summer of easing inflation, abundant job opportunities, and strong consumer spending has boosted investors’ hopes that the US economy might achieve something truly rare: the so-called soft landing. But history and the current state of things suggest that investors have probably become overly complacent – just as they’ve done before every US recession in the past 40 years. Here’s why a hard landing is still the most likely scenario, and how you might brace your portfolio for the impact…

What’s the difference between a hard, soft, and no landing?

When the economy runs too hot, it can lead to a potentially damaging increase in inflation. To combat that, the Federal Reserve (the Fed) typically raises interest rates, a move that tends to chill economic activity and stabilize prices. The Fed’s goal is a soft landing: that dream scenario where the economy weakens enough to tamp down inflation, but remains strong enough to avoid a recession. But, with every interest rate hiking cycle, there’s also the risk of a hard landing, where the impact of those rate hikes actually tip the economy into recession. And there’s also the risk of a no-landing scenario, where inflation remains high and the economy isn’t impacted by the hikes. That’s probably not in the cards today: we’re already seeing evidence of a slowdown in growth and inflation.

How hard is it to get a soft landing?

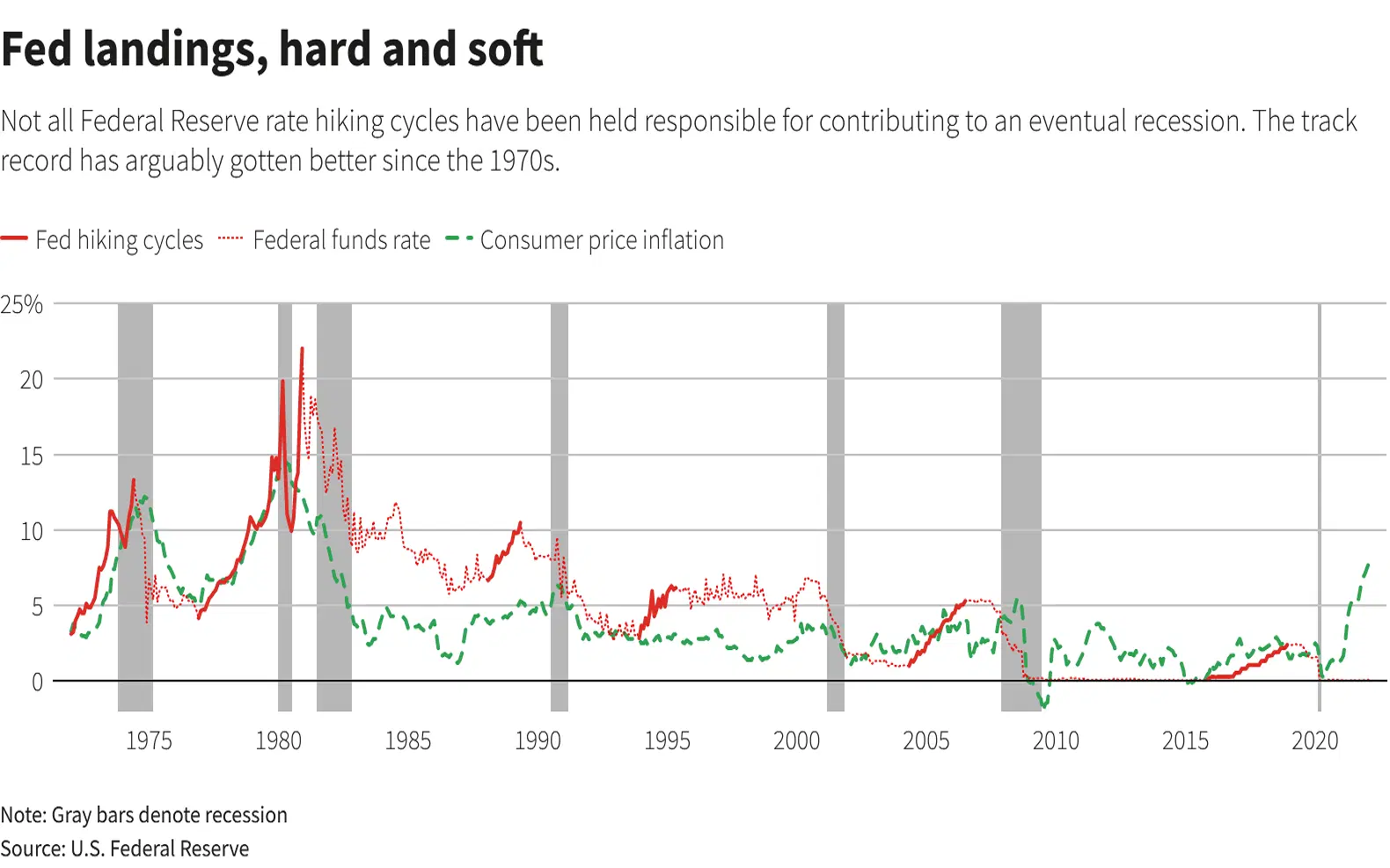

Well, it is the goal, but the Fed’s track record has been mixed, at best. This chart shows each of the Fed’s hiking cycles since the 1970s (solid red line), US inflation (dotted green line), and recessions (shaded gray bars). In most instances, aggressive interest rate increases were followed – sometimes in very short order – by a recession. The only clear example of a successful soft landing was in the mid-1990s when the central bank raised interest rates from 3% to 6% without crashing the economy.

Aggressive rate hikes, aimed at taming inflation, have often resulted in recessions. Source: Reuters.

Because the big debate today is whether the Fed's ongoing monetary tightening will shove the economy into a recession, you’ll want to keep in mind the intensity of the current rate-hiking cycle: it’s the second most aggressive run in the Fed’s 110-year history. So, in other words, apart from one rate-hiking cycle in the 1980s, every other round of interest rate hikes has been less severe than the current one, and most of them sparked a recession. So if history is any guide, the likelihood of the Fed landing this baby softly is low.

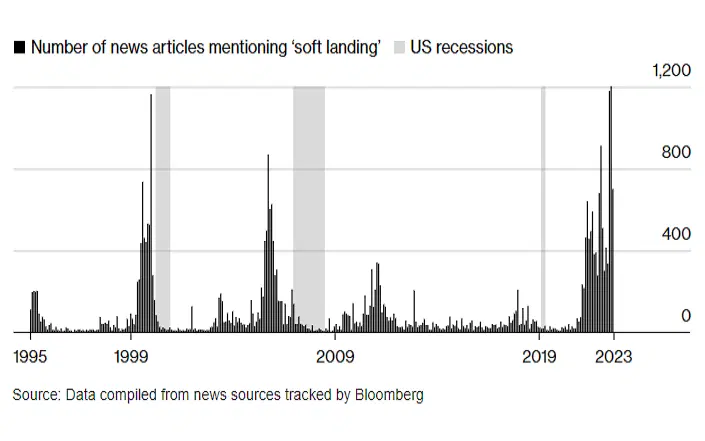

Still, that hasn’t stopped many investors and economists from being super optimistic about how things are going to go. Perhaps it’s because they typically assume that what happens next in the economy will be some kind of extension of what’s already happened. However, this method of linear forecasting doesn’t work for non-linear events like recessions. In October 2007, just two months before the Great Recession began, then-San Francisco Fed President Janet Yellen said “the most likely outcome is that the economy will move forward toward a soft landing”. And she was far from alone in her optimism. In fact, to see how wrong people often get it, consider this graph, which shows that soft-landing expectations usually peak before hard landings actually hit.

Soft-landing optimism tends to peak before a downturn hits. Source: Bloomberg.

Can the American consumer save the day?

Central to the soft-landing argument is the fact that consumer spending, which accounts for around two-thirds of the US economy, has been remarkably strong. All that out-of-hand inflation should have turned the country off spending, the argument goes, but that hasn’t happened (not yet, at least).

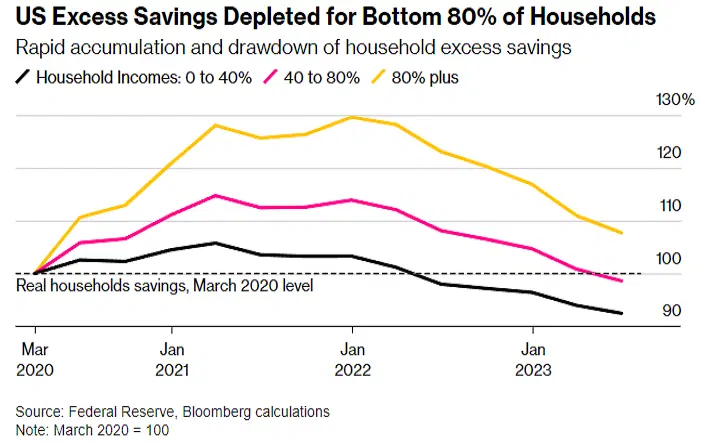

See, millions of Americans were able to save up during the pandemic, socking away stimulus checks and government benefits, while skipping luxuries like dinners out and vacations. Those savings created a financial cushion, which helped them handle rising prices, without cutting back too much. And that’s effectively been shielding the economy from a recession. But that money was bound to run out. According to the latest Fed study of household finances, all but the wealthiest 20% of Americans have spent those savings and now have less cash on hand than they did when the pandemic began.

Only the richest 20% of Americans still have excess pandemic savings. Source: Bloomberg.

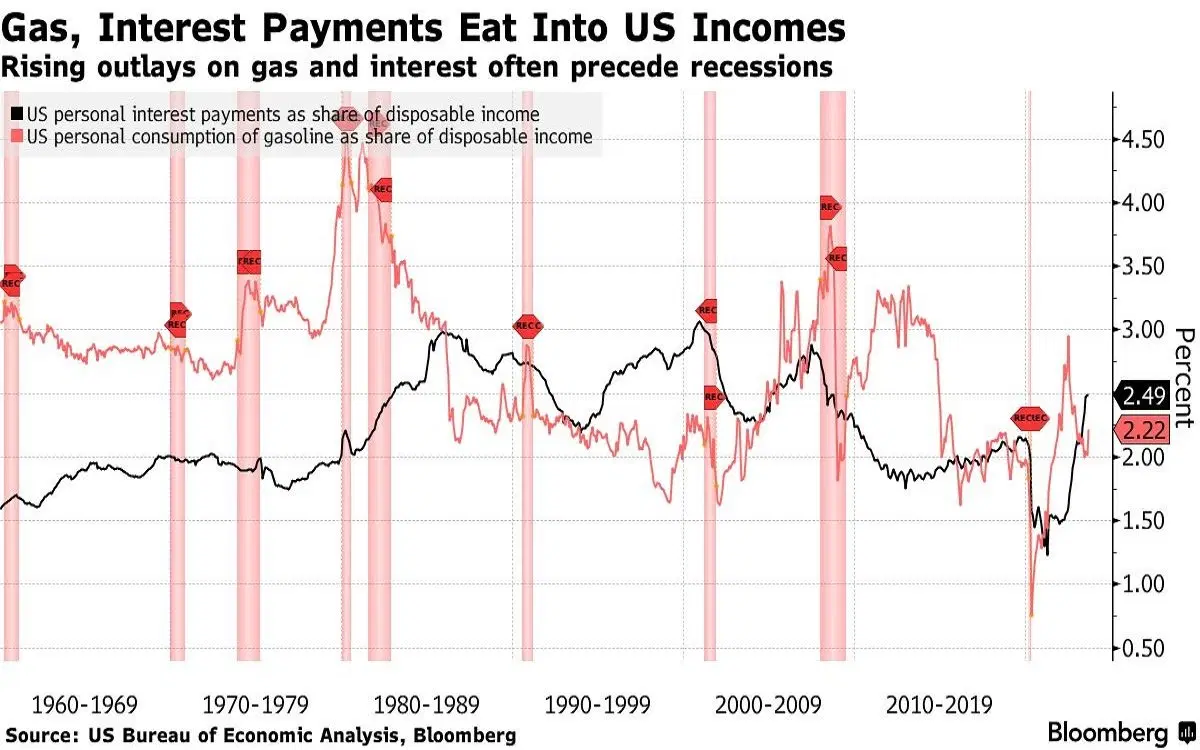

That means US households now face a dilemma: either spend less or borrow more to maintain their lifestyles. But with the Fed’s interest hikes making credit more expensive and harder to get, Americans will most likely have to cut back. To put that pricier credit into perspective, consider this: interest payments are now sucking up 2.5% of Americans’ disposable income – in other words, their “take-home pay” (the money left over to spend or save after taxes have been deducted). That’s the highest since September 2008.

Making matters worse are oil prices, which have been on the rise, forcing consumers to fork over a bigger share of their take-home pay on gasoline too. Together, spending on interest and gas accounted for 4.7% of US disposable income last month – the most since August 2014. Increases in the proportion of income going to either interest payments or gas expenses often precede recessions, and this recent surge in both poses a double threat to the economy. That’s because these higher costs dent Americans’ discretionary income – the money left over after paying taxes and essential expenses like housing, food, interest, gas, and utilities. Lower discretionary income, in turn, dents consumer spending.

Americans are spending a bigger share of their disposable income on interest and gas. Source: Bloomberg.

Adding insult to injury is that all of this is happening just as student debt payments are set to resume after a long hiatus. Those monthly repayments were suspended more than three years ago at the height of the Covid crisis, but that relief ends this month. So now millions of Americans will again be saddled with an average of $200 to $300 of monthly debt expenses.

What does this all mean for you?

The combination of dwindling savings, the return of student loan payments, and increasing interest and gas costs is going to dent consumer spending, which, let’s not forget, is the engine of the US economy. And we’re already seeing that happen: overall consumer spending rose just 0.1% in August after adjusting for inflation, marking the weakest reading since March.

And, yet, markets appear to be underestimating the risk of a hard landing. That means a downturn could catch a lot of people by surprise and trigger a whole lot of panicky adjustments. In light of that risk, it might be worth exercising caution with your investments. That is, reduce your risk exposure, and make sure your portfolio is well-diversified and doesn’t contain leverage. You might also want to lower your exposure to stocks, or perhaps tilt more toward quality companies in defensive sectors, like consumer staples and healthcare. When it comes to fixed income, it might be best to swap out riskier, high-yield corporate bonds for investment-grade ones or safe, long-term government bonds, which could do well in a recession. Consider holding some gold and cutting your exposure to other commodities, especially industrial metals, like copper and aluminum, and energy.

Finally, and this is maybe the most sensible thing you can do: consider holding some cash, potentially via money market funds, which are currently offering yields above 5%. I discuss the key roles cash can play in a portfolio – and dig into those funds – here.