The rise of generative AI is significantly increasing demand for data centers, leading to a boom in the energy sector, especially for those supplying the power to keep these tech hubs running.

Sure, there have been impressive advancements in renewable energy, but the enormous energy needs of AI and data centers might keep fossil fuels, particularly natural gas, in the mix much longer than expected.

Investors who want to capitalize on the AI revolution should consider diversifying into electricity-exposed stocks, including utilities, fuel-cell manufacturers, and companies involved in power infrastructure.

It’s well known that AI gulps a lot of energy. But exactly how much juice this game-changing tech will need as it’s unleashed to everyday folks and businesses, that’s an open question. It’s also an interesting question. See, that’s a line of thinking that just might lead you beyond the usual Nvidia and Microsoft stock plays to some of the more under-the-radar winners from this big AI boom.

OK, where are you going with this?

The buzz around generative AI and its mind-blowing digital abilities comes with a catch: all the data-crunching that’s required to produce almost human-like speech, text, images, and videos needs physical hardware to make it happen, at least for now. That means data centers – those massive warehouses packed with computing gear – are in high demand and gaining lots of investment love. Microsoft alone is launching a new data center somewhere in the world every three days.

At this pace, the industry is set for some serious growth. By next year, the energy appetite of generative AI could munch through a third of the total energy data centers used worldwide throughout 2022.

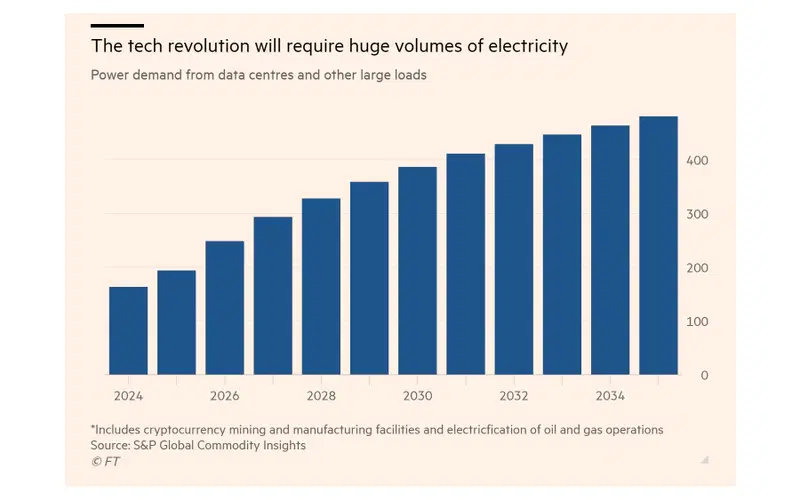

Projections of power demand from data centers and other heavy loads over time. Sources: FT, S&P Global Commodity Insights.

But these data centers come with a catch: they suck up a ton of electricity. According to S&P Global Commodity Insights, these energy-guzzling giants in the US are on track to devour over 480 terawatt hours of electricity a year by 2035 – that’s nearly a tenth of what the entire country uses, and more than double what they’ll consume this year.

And on a global scale, the International Energy Agency has crunched the numbers, projecting that global power demand for data centers could hit over 1,000 terawatt hours by 2026. That’s double what they used in 2022, and equivalent to the entire power consumption of Germany. Echoing this, Morgan Stanley is forecasting a 70% annual increase in power needs for generative AI, for most of this decade.

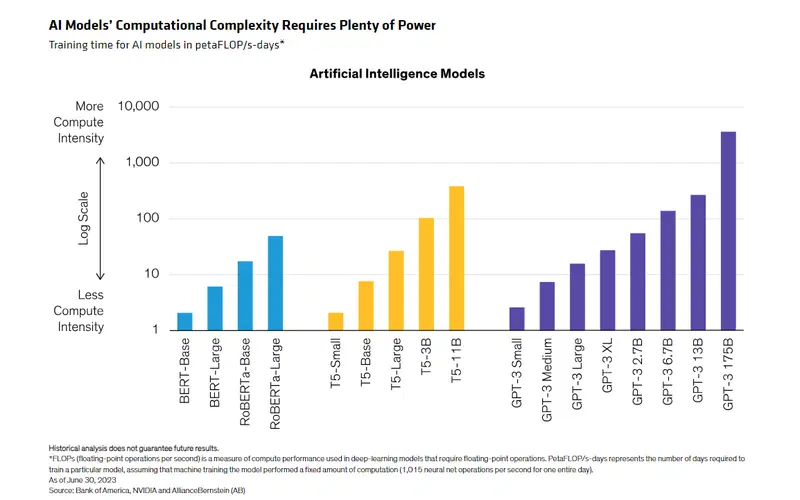

And this thirst for energy will only grow more intense as AI models get more complex and powerful.

Training time for AI models by computational complexity. Sources: Bank of America, Nvidia, AllianceBernstein.

So, where’s all this power going to come from?

The boom in data centers is tightly hitched to the expansion of the power grid, which right now is feeling the squeeze.

In the US particularly, limited capacity of power lines, slow-moving planning and permitting processes for new transmission projects, and kinks in the supply chain are all big hurdles. And that means, power companies are facing a tall order in creating enough new generation and transmission capacity to keep up with the skyrocketing demand. Making matters worse, the journey from blueprint to flipping the switch at shiny new data centers is dragging out even longer, because of grid operators’ hefty backlogs.

So, if you’re betting on a future where AI is everywhere, you’ve also got to bank on the energy infrastructure rising up to power it all.

How’s that going to happen?

Well, that’s a matter of debate: experts are weighing up whether renewable energy alone can fully meet the growing power demands. With Uncle Sam rolling out $1 trillion in incentives to green up the electricity grid, and with tech giants like Google and Microsoft aiming to power their empires on nothing but eco-friendly volts, the stakes are high.

But even with renewable energy sources sprouting up faster than ever, it can’t keep pace with AI’s relentlessly growing energy hunger. The technologies are gobbling up power so fast that the tech titans are sweating over more than just their green credentials; they’re starting to wonder if there’ll be enough power to go around – period. Already, several data centers have delayed their debut from two years to six years, all thanks to power supply woes.

Personally, I think natural gas will stick around longer than most people anticipate. If tech companies are faced with a choice between halting their AI progress or proceeding with gas, many will quickly abandon their green intentions. And it certainly helps that natural gas, alongside nuclear, is one of the few energy sources that can deliver reliable, round-the-clock power.

Despite years of talk about reducing fossil fuel consumption, history has shown that humans consistently miss the mark. And with AI’s never-ending appetite for energy thrown into the mix, that’s not likely to change anytime soon.

Where are the opportunities then?

Regardless of where you land in the debate, one thing is clear: the surge in electricity demand will usher in a golden era for natural gas and renewable energy sources. And that’s likely to release a cascade of mini-booms, like these:

Regulated utilities.

These companies can bring the big guns in terms of the power infrastructure needed for humongous data centers. They might see a nice bump in earnings from the AI craze, but getting there could mean shelling out $5 billion to $10 billion in capital investments, bumping up their budgets by 10% to 20% each year.

To bet on that boost, you could consider buying shares in those companies, which include: Duke Energy, Southern Company, NextEra Energy, Vistra, and Dominion Energy. Alternatively, you can also consider buying a utilities ETF such as the Utilities Select Sector SPDR Fund (ticker: XLU; expense ratio: 0.09%) or the iShares US Utilities ETF (IDU; 0.4%)

Fuel-cell manufacturers.

These little guys are about to become very popular. Their tech is perfect for data centers looking for steady power that can complement less predictable renewable sources. These companies include Plug Power, FuelCell Energy, Bloom Energy, and Ballard Power Systems.

Nuclear power companies.

These firms are in a prime position, thanks to the clean, uninterrupted power supplies they create. With built-in access to cooling water and sprawling sites, they offer an attractive proposition for companies that want to set up data centers right next to the power source, bypassing the expensive step of hooking up to the grid. To bet on the success of nuclear power companies, you could consider buying stocks in companies like NextEra Energy, Constellation Energy, Exelon, Entergy, Dominion Energy, and Duke Energy. Or you could go for a nuclear energy ETF, like the VanEck Uranium+Nuclear Energy ETF (NLR; 0.6%) or the Global X Uranium ETF (URA; 0.69%). To invest in uranium, which fuels nuclear, consider the Sprott Physical Uranium Trust.

Natural gas companies.

The firms that supply the much-needed fuel to power utility companies should stand to benefit as energy demands surge. And that includes companies such as EQT, Southwestern Energy, Chesapeake Energy, and EQT.

Power purchase agreement providers.

These power purchase agreement (PPA) providers, especially the ones dealing with wind and solar, are in a prime position to lock in profitable long-term deals with big energy users. They include NextEra Energy, First Solar, Brookfield Renewable Partners, and Pattern Energy.

Interconnection firms.

And don’t forget the folks making the interconnections – those medium-voltage and high-voltage cables are key to keeping the energy balance across regions, and they’re poised for a surge in demand. Nexan, Prysmian Group, and Hubbell Incorporated are some of the big names in this group.

-

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.