The longer your investment time horizon, the bigger the impact of compounding, with the real benefits typically kicking in after 20 to 30 years.

As your compound annual growth rate (CAGR) improves, your long-term wealth could increase exponentially.

The more money you invest consistently, the better off you’ll be, as regular contributions accelerate compounding.

With all the market noise right now, it’s a good time to step back and focus on your end game. As Albert Einstein (supposedly) said: “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it.” And there are three important parts to that equation: time, returns, and the amount you invest.I’ve run the numbers for each of these with some hypothetical examples, so you can zoom out and plan ahead.

1. Time.

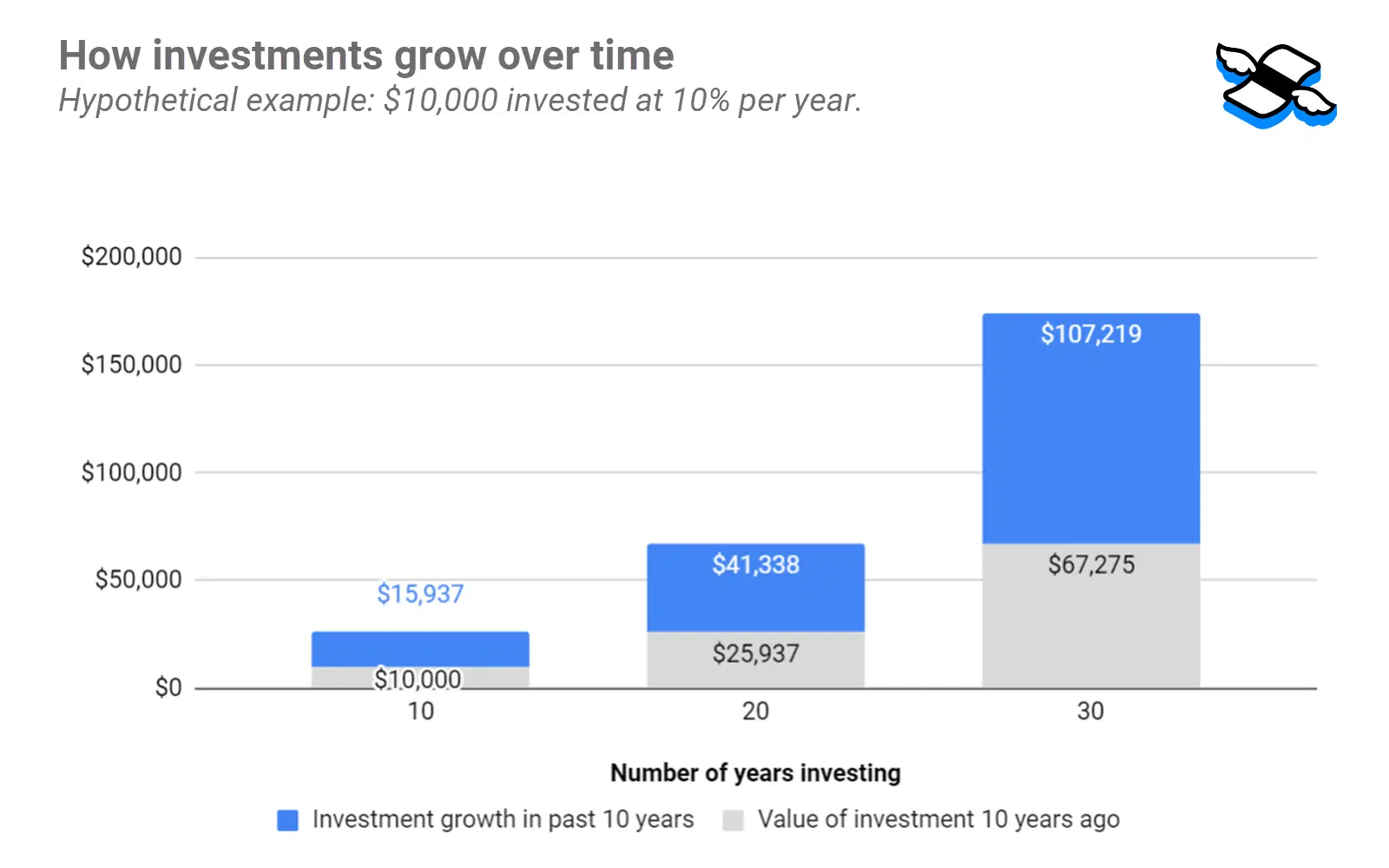

Warren Buffett accumulated most of his investment fortune after his 50th birthday. And he has famously said that “the biggest thing about making money is time”. So I’ve put his wisdom to the test with an example. Suppose you invest $10,000 for ten, 20, and 30-year periods. And for simplicity's sake, assume your original investment grows by 10% per year on average (i.e., your compound annual growth rate, or CAGR, is 10%).Here’s how the math works out. After ten years, you’d have $25,937 to your name – more than double your initial $10,000 investment. But after 20 years, that number goes up dramatically, to $67,275 – nearly seven times your starting amount. And after 30 years, the power of compounding really kicks in: your pot would have grown to $174,494 – nearly 18 times what you put in. And $107,219 (or 61.4%) of that total would’ve manifested in those last ten years (blue, right bar).The real benefits of compounding typically kick in after 20 to 30 years.

Source: Finimize.So, yeah, not surprisingly, Buffett has hit the nail on the head here. Time is of the essence when investing – meaning, the sooner you start, the better off you’ll be (all else being equal).

2. Returns.

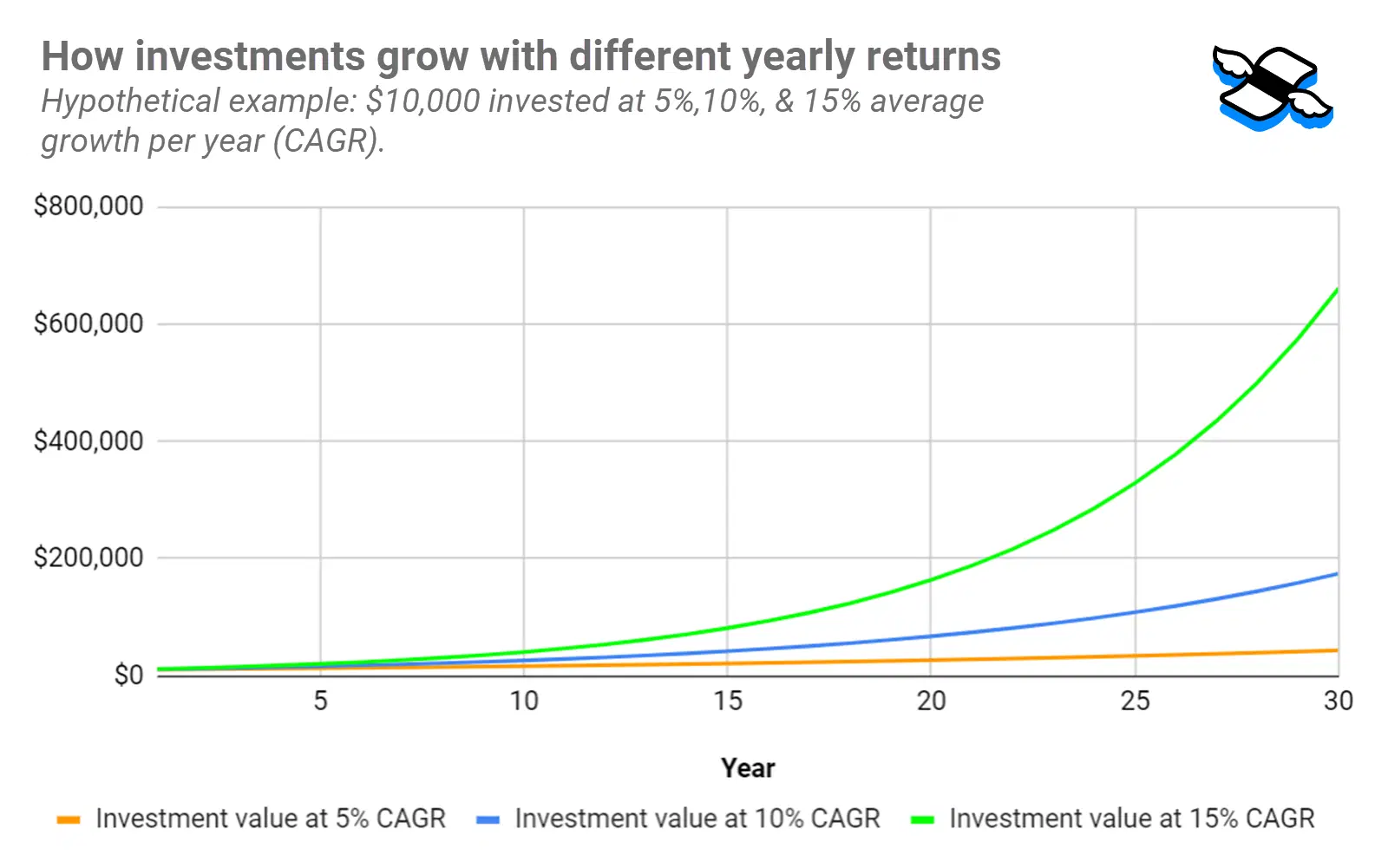

The next important piece of the compounding puzzle is your yearly returns. The higher your CAGR, the bigger your investment will become over time. So let’s run the same numbers from earlier, this time assuming yearly returns of 5%, 10%, and 15%.As the chart below shows, your initial investment would grow exponentially in each case – especially over the long run. After 30 years of compounding at 5% per year (orange), your $10,000 investment would be sitting at $43,219, which is about a quarter of $174,494 – or what it would’ve been growing at 10% (blue). And if you somehow managed to clock 15% per year on average for 30 years (not many people do), that $10,000 would’ve morphed into $662,118. Keep in mind that these numbers don’t account for inflation, and I’m using them simply to illustrate my point.

As your average yearly return (CAGR) grows, your long-term wealth could increase exponentially. Source: Finimize.

3. Investment amount.

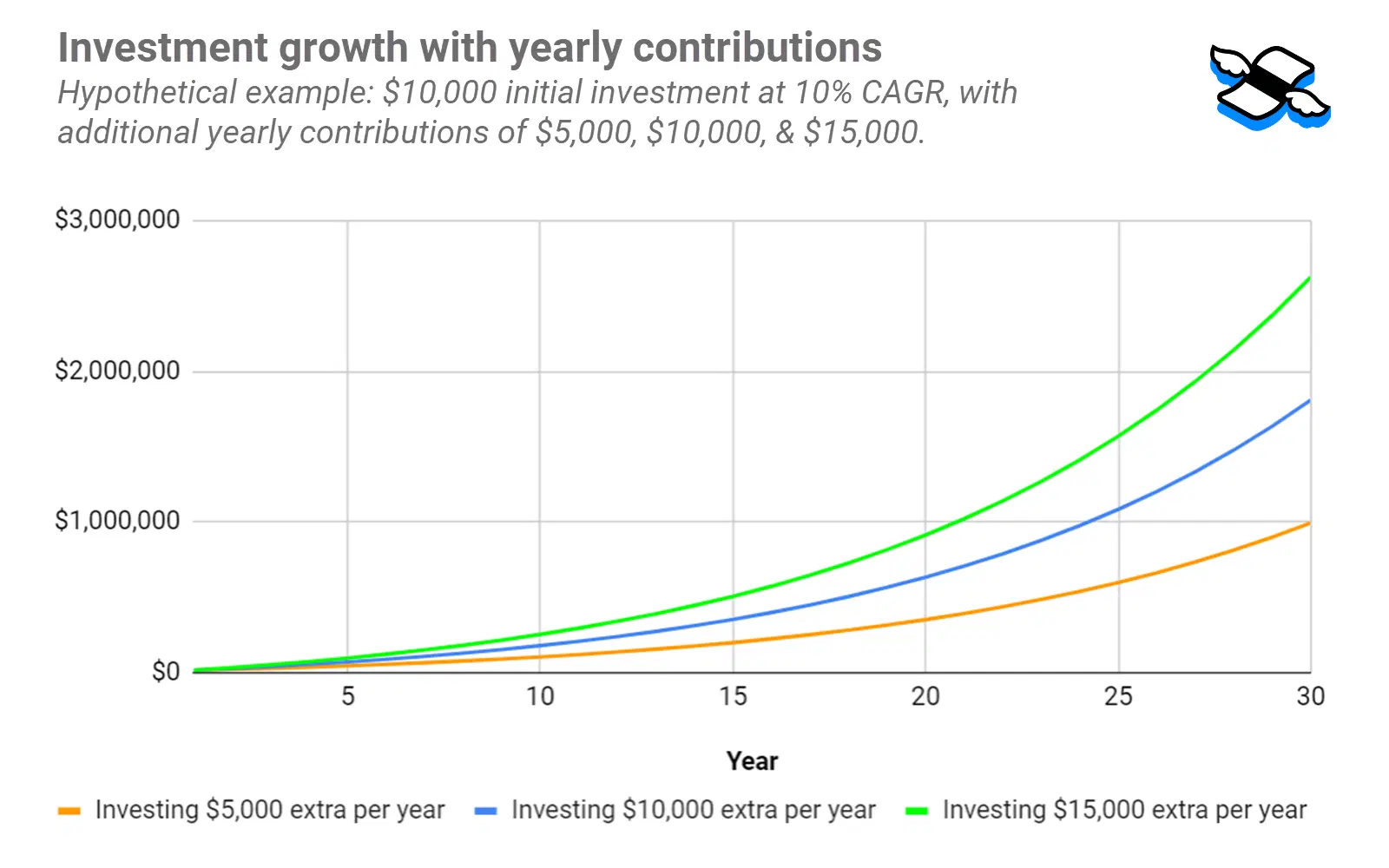

Here’s where the math really gets interesting, and why dollar-cost-averaging should be the bread and butter of any long-term wealth-building strategy. I’ll now run the same numbers from our original 10% per year base case scenario, assuming you invest an additional $5,000, $10,000, or $15,000 at the start of each year (after your initial $10,000 investment in the first year).It’s clear from the chart that the more money you put in, the more you get out over the long run. Investing an extra $5,000 per year (orange) would put you just short of millionaire status ($991,964) after 30 years. Adding $10,000 per year (blue) would grow your portfolio to $1,809,434. And with a $15,000 top-up each year, you’d be looking at $2,626,904 (green) when all is said and done.

Regular contributions to your investments accelerate compounding. Source: Finimize.

But there’s an important caveat to all this: these charts assume your investment would grow by exactly 10% each year – but in reality, you’ll have good years and bad as you work toward your eventual average (whatever that may be). And, therefore, your road to prosperity is likely to be a lot bumpier than these examples suggest.That’s why dollar-cost averaging is such a go-to strategy. If your returns are lower in the early years, you might benefit by accumulating more assets at lower prices with your regular contributions. When the market eventually recovers, those extra investments can seriously boost your portfolio. On the flip side, higher returns early on can grow your starting investment faster, giving you a bigger base that compounds over time.The bottom line: staying consistent and disciplined is key to harnessing the real power of compounding – so you can see out your golden years in style.