This week, we dove into Mexican stocks, Nvidia’s latest rise, and the acquisitions trendin the US shale patch. Plus, we had a look at the health of the US consumerand China’s overcapacity conundrum. Check out this week’s Quick Takes for the full rundown.

This Could Be A Good Moment For Mexico’s Stocks

The market’s having a tough year – and there could be an opportunity in that.

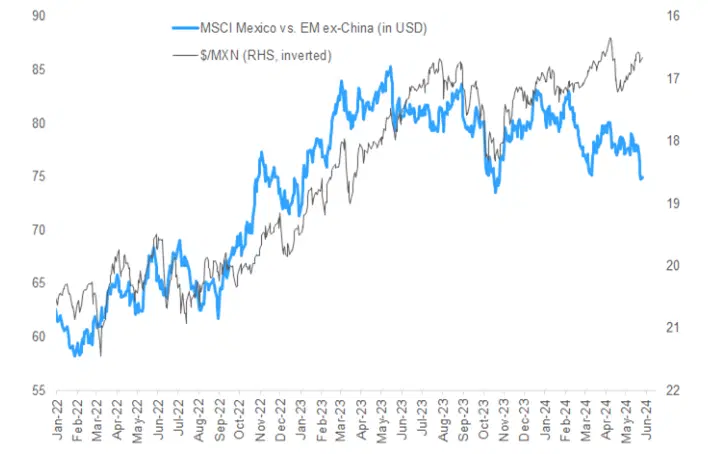

The MSCI Mexico stocks index vs the broader emerging market index (excluding China), with stocks priced in US dollars (blue line). The Mexico peso vs the US dollar (black line, right-hand axis), inverted so that a rising line indicates gains for the peso. Source: Goldman Sachs.

The strength in the Mexican peso against the US dollar and Mexico’s stockmarket outperformance over the past few years have been notable, buoyed by its close links to the US economy and the pick-up in onshoring activity. However, that relationship has broken down this year, with the Mexican stock index underperforming other emerging markets in US dollar terms despite the relatively strong Mexican peso. With valuations looking cheap and double-digit profitgrowth expected this year, the current weakness may be an opportunity.

US Consumers Are Starting To Show Weaknesses

And that’s already changing the big economic picture.

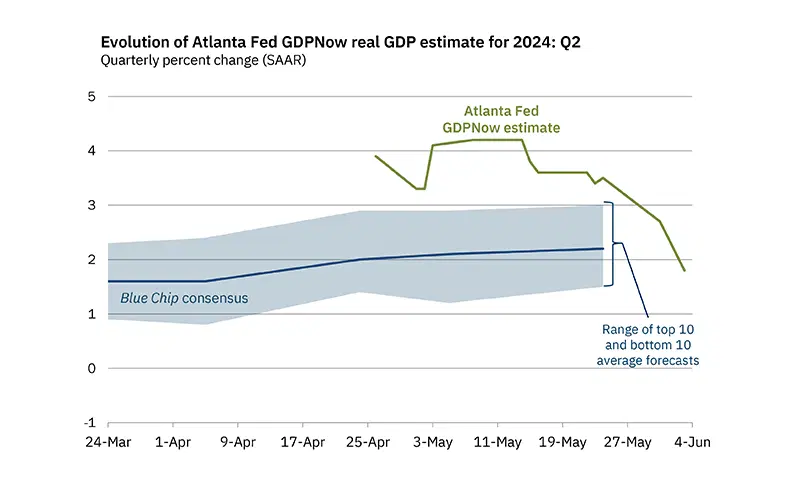

Atlanta Fed GDPNow’s real GDP estimate for the current quarter recently fell from 4% to 1.8%. Source: Atlanta Fed.

The Atlanta Fed's GDPNow tool, a go-to for real-time economic snapshots, just dialed back its US growth forecast from a cheery 4% annual pace to a mere 1.8%. This sharp revision was driven by lackluster data across retail, housing, and manufacturing sectors, coupled with decreasing personal income and spending, pointing to a decline in US consumerhealth. While it's not all doom and gloom – a resilient yet slowing economy might lead the Fed to slash rates, potentially lifting markets – a sharper slowdown could stoke recessionfears, catching investors off guard and potentially triggering a market sell-off. With inflationdominating the conversation for months, the focus might finally shift back to economic growth.

Nvidia’s Latest Rise Has A GameStop Feel To It

A refresher on how a “gamma squeeze” works and what that might mean for the AI chipmaker

Nvidia’s market cap has surged by almost 23% since it reported its first-quarter results two weeks ago, adding more than $500 billion to its market value. Source: Bloomberg.

Nvidia has gained more than $500 billion in market value – more than what Intel and AMD are worth combined – in just the past two weeks. And, sure, some of that is down to bumper quarterly results from the chipmaker at the center of the AI boom. But the recent rally also bears the hallmarks of a gamma squeeze, some say. That occurs when a stock's rise causes many “out-of-the-money” call options to suddenly become “in-the-money”, forcing market makers to buy the underlying stock to remain hedged. That, in turn, drives the share price even higher.

China’s Got An Overcapacity Issue: Here’s How It Could Affect Global Markets

Three potential things that could happen next.

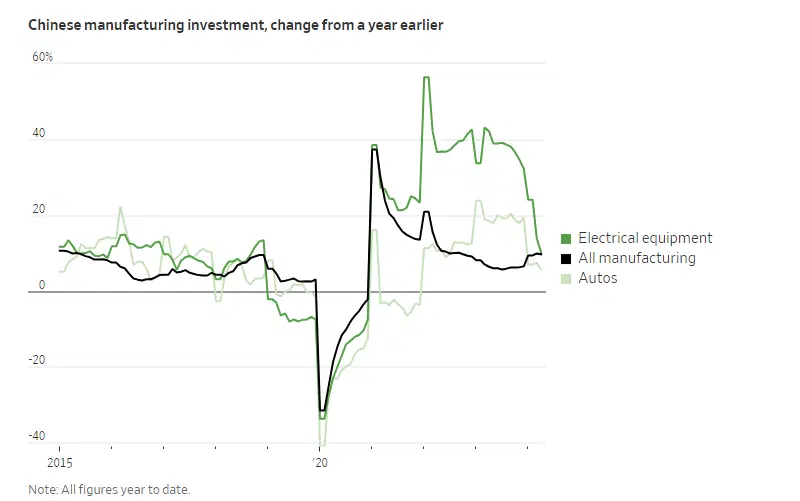

Year-to-year changes in Chinese manufacturing investment, measured in percentages. Source: CEIC.

Grappling with some sluggish economic growth, China’s policymakers have gone on a shopping spree – buying up high-tech goodies like batteries, electric vehicles, and other green gadgets. But in the process, they’ve cooked up a brand-new problem – overcapacity. Now, China’s cars, chemicals, and steel are flooding global markets and making it tougher for US and European companies to compete, especially in steel, solar panels, and autos. It’s why the US recently quadrupled tariffs on Chinese electric vehicles and why the European Union is set to follow suit. Those moves could do three things: spark trade wars, lead to a surge in consumerprices, and create new opportunities for other economies across the supply chain – such as India, Mexico, and Vietnam.

How Acquisitions Are Reshaping the US Energy Sector

And what it means for investors.

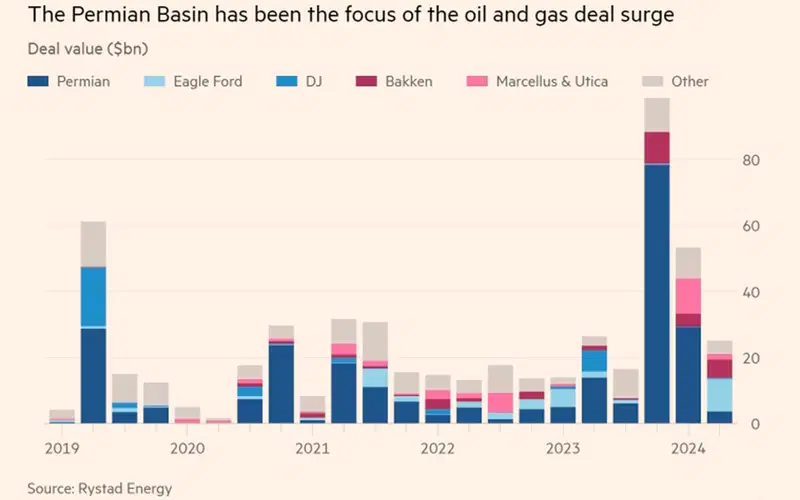

Global oil and gas mergers and acquisitions deal values over time, split by acreage, and measured in billions of dollars. Sources: Rystad Energy, FT.

In the past year, energy heavyweights including Exxon, Chevron, Occidental Petroleum, and ConocoPhillips have announced a whopping $194 billion worth of deals across the US shale patch. And this consolidation in US oil and gas has been good for investors. It’s meant that firms are likely to be more disciplined, focusing on shareholder returns and cash generation, and more resilient, staying profitable even in commodityslumps. What’s more, it’s likely to widen the gap between US big oil (like Exxon, ConocoPhillips, and Chevron) and European big oil (such as Shell, BP, and Total), with European companies focusing on divesting carbon assets and investing in renewables, while US companies are doubling down on oil assets – meaning their future profitability will be more closely tied to oil prices.