Risk is more than volatility: it’s the chance of not hitting your investment goals.

Your risk will increase if an asset’s performance varies wildly from its “expected” return, as well as if you’re exposed to potentially catastrophic losses or relying heavily on forecasts for returns.

A few steps can help you reduce your risk: focus on diversification, plan for potential downside scenarios, invest with a margin of safety, and be cautious of consensus ideas while ensuring your portfolio is prepared for a variety of market conditions.

Returns are concrete and simple – a number that shows how much your investment has earned. Risk, meanwhile, is far more elusive and often overlooked. It’s hard to identify and even harder to quantify. And it isn’t a one-size-fits-all concept: what feels risky to one investor may seem secure to another, and the same investment can carry vastly different risks depending on the time and environment. So let’s take a look at a subjective but specific definition, three factors that can aggravate your risk, and some strategies to temper them.

What actually is risk?

Volatility tracks how much an asset’s price typically moves, and it’s often seen as a quick way to measure risk. However, it’s far from a perfect measure. Volatility doesn’t tell you if price moves are good or bad, it only looks at past data, and it provides little insight into the real risk of a major loss. The measure also overlooks critical factors like whether an asset could be sold quickly if needed, or whether it aligns with an investor’s time horizon.

So it’s true, volatility has driven breakthroughs in modern finance and given investors real insights into managing portfolios and risk. But for most investors, it’s usually not what keeps investors up at night: they’re more worried about actual losses than price swings.

I prefer to think about risk as the chance of not hitting your investment goals. Naturally, that’s subjective. For a retiree, it's the fear of seeing their portfolio fall so much that they can’t sustain their lifestyle. For a young professional, it may be the worry of not growing their wealth enough to send kids to college or retire early.Thinking in that sense, three key factors could increase your risk.

1. Owning assets that swing a lot around their “expected” returns.

If you buy a one-year Treasury bond, you know almost exactly what you’ll earn after a year. On the other hand, if you buy bitcoin, your returns are unpredictable, to put it lightly. That’s because it’s hard to know what factors will drive its price in the future, making it hard to tell whether you’re

more likely to strike it rich or end up with nothing. The same goes for betting on a young startup or company working in new tech like AI.

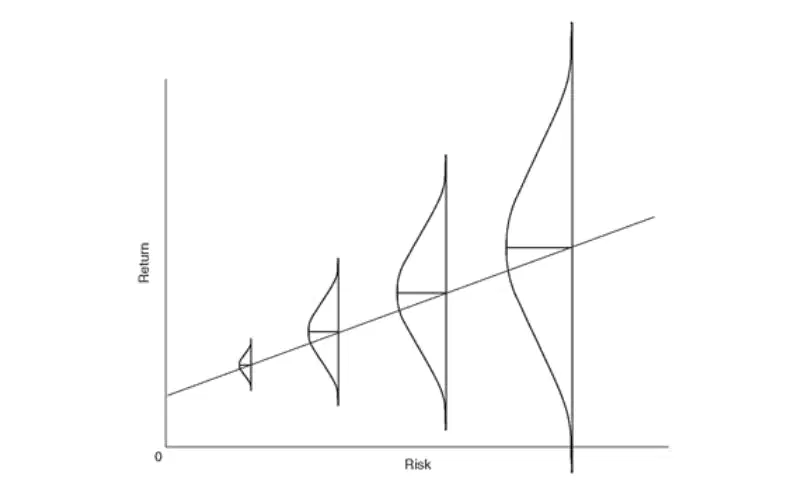

Even more “established” assets, like the S&P 500, can be unpredictable in the short term. For example, while stocks are expected to give a long-term return of around 8% per year, they can swing between as much as a 50% loss to a 50% gain in any given year. And even over a decade, their returns can vary wildly. The more an asset strays from its expected return, the higher the chance you’ll miss your target – in our definition, increasing your portfolio’s risk. So in that same sense, traditional volatility isn’t such a bad measure: it does track how much an asset typically deviates from its average, after all.

Bigger deviations from its average means an asset is more risky. Source: Howard Marks.

2. Being exposed to catastrophic losses.

Picture this: your portfolio’s down 50% and the forecasts look bleak. You might be tempted to panic and sell everything for cash. Or you might double down on riskier bets, hoping to claw back the losses. (Remember, a 50% drop needs a 100% gain just to break even).

Thing is, both choices increase the odds of permanent capital loss, putting your financial goals at risk. And even if you stay the course, you could be waiting years to recover your losses Case in point: the Nasdaq took 16 years to climb back to its previous peak after plunging 85% during the dot-com bust in 2000. Whatever happens, a loss like that could shake your confidence and stop you from taking necessary risks in the future, making it tougher for compounding to work in your favor over the long run. The bigger the potential loss, the more likely it is that you’ll fall short of your investment targets.

3. Relying heavily on your forecasts – and getting them wrong.

US stocks have delivered returns over 10% a year for decades, encouraging many investors to keep their portfolios all-American. Problem is, they’re betting their portfolio’s fate on the assumption that the future will look like the past. When it doesn’t, that’s a key reason why highly concentrated investors miss their targets.

And here’s the catch: we’re not just bad at predicting the future, our behavioral biases mean we’re also unaware of how bad we are at it. As Mark Twain allegedly said, "It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so." So the higher and more concentrated “bets” you’re making about the future, the higher the risk in your portfolio.

How can you reduce your risk?

The first step is recognizing and understanding risk. Always ask yourself, “What could go wrong?” and imagine how your investments would perform in different scenarios – past, predicted, and completely hypothetical. Question even the most basic assumptions, as risk is often hiding in plain sight. Just think back to 2007, when hardly anyone doubted that house prices would keep rising or that triple-A-rated mortgages were rock solid. The goal is to be aware of all potential risks, even the hidden ones.

Next, focus on the downside – not just the upside. When you salivate at the returns of a potential investment, remember to check for its risk: how likely it is to deviate from that expected returns, what the biggest loss could be, and how much you can truly rely on your forecast. The idea isn’t to avoid risk – you are forced to take risk to generate returns – but to make sure you can reduce it to a level that won’t derail you from meeting your goals.If the risk feels too high, there are ways to reduce it.

One option is investing with a margin of safety – buying assets below their intrinsic value gives you a buffer if things go wrong. Another is to create a clear plan to limit your losses: use a stop-loss, follow a trend indicator to go into cash, or buy options to protect against catastrophic losses. And don’t forget to size your positions correctly. Most importantly, have that plan in place before the proverbial hits the fan.

One of the easiest and most efficient ways to reduce portfolio risk is to diversify – but real diversification isn’t just holding different stocks. For me, true diversification means holding assets that thrive in different market conditions – think treasury bonds for recessions, commodities for inflation, gold and bitcoin for currency protection, and stocks for growth and stability. When one asset does well while another struggles, you smooth out your returns. This reduces the chance of a catastrophic loss, keeps your returns closer to their average, and makes you less dependent on trying to predict the future perfectly. Put more simply, that lowers your risk. Sure, you may always achieve less exciting returns than the investor who took a concentrated bet and got it right, but when the tide turns, you’ll never be caught swimming naked.Last but not least, think contrarian and avoid complacency.

As Howard Marks says, risk is “perverse”: it’s actually highest when everyone believes it’s gone and lowest when everyone is panicking. That means buying when it seems safe might actually be riskier than buying in a market meltdown. Similarly, the more “consensus” – or widely backed – an investment idea is, the more skeptical you should be. This doesn’t mean you should completely avoid them, though, just that you should tread carefully.

In fact, you should have a process in place to mitigate the impact of your behavioural biases, which will push you to take the worst decisions at the worst times.Elroy Dimson puts it nicely: “risk means more things can happen than will happen”. But if you’ve thought through the alternatives, made sure you’re comfortable with how your portfolio would perform in those scenarios, and have a plan in case things do go as planned, you’ll be one step closer to reaching your investment goals.