US interest rates are likely to be higher for longer – the latest inflation and jobs reports only underscored that likelihood. And that presents a tricky situation for certain corners of the market.

Real estate is one of those: with mortgage rates still near 20-year highs, sales activity has been sluggish. Private equity’s been no picnic, either – the co-president of industry giant Apollo Global said just last week that “everything’s not going to be OK” in that industry.

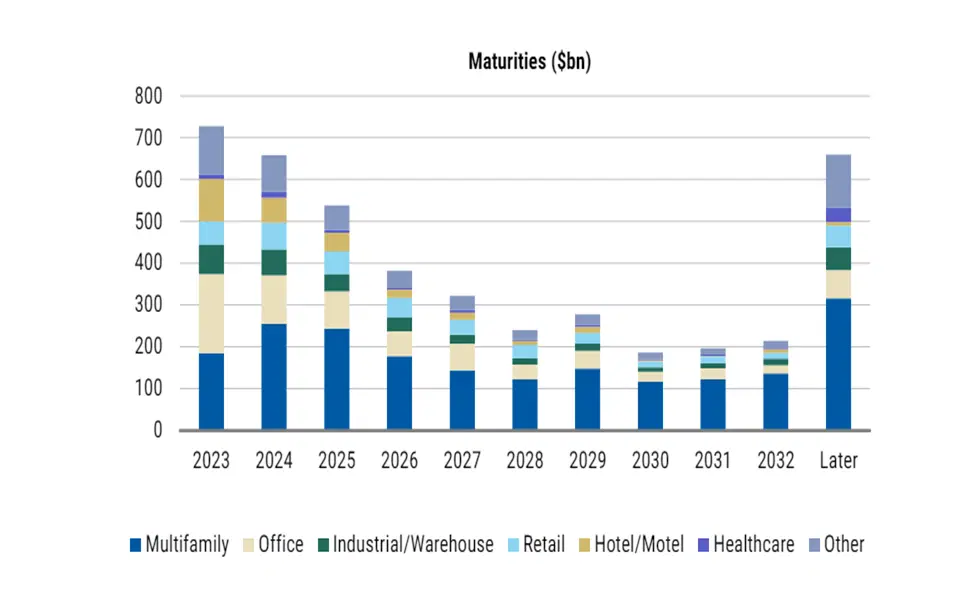

Some $660 billion in commercial real estate debt is set to mature in 2024. Sources: Mortgage Bankers Association, Morgan Stanley.

It’s been a rough time. Stock markets fell in 2022 as interest rates climbed from near-zero to above 5%, but private equity funds didn’t mark down many of their investments. But, eventually, they’ll have to refinance their debt at today’s much higher borrowing costs. And the numbers are big: a record $3.2 trillion was tied up in aging, closely held companies at the end of 2023, according to data firm Preqin. And now those private equity houses can’t sell these companies at the prices they need for them.

Howard Marks of Oaktree Capital Management wrote about this recently. He said, “When things have been going well for a while – asset prices have been rising, investment returns have been positive, and borrowing has helped increase returns – investors began to view leverage as harmless. And that’s what happened. For over a decade, interest rates were near zero and borrowing was cheap. What may have looked like sensible levels of borrowing when rates were zero to increase profits, do not look so clever now interest rates have moved sharply higher – as the risks of using borrowed money were overlooked.”

There have been reports lately that several private equity houses have taken out loans against their fund assets to support their existing portfolios – not an ideal situation, as that slaps another layer of debt on top what already exists.

And in real estate, Starwood Property REIT has been taking alarming new steps. Last week, it sharply reduced investors’ ability to withdraw their investments: a reminder of the problems that the real estate sector is facing.

With higher rates sticking around for longer, you might want to body swerve private equity and real estate assets – and instead veer toward big-cap quality businesses.