If you’re up to your eyeballs in US tech stocks well, nice one, but it might be time to start widening your vision. Europe looks interesting right now, and Goldman Sachs has some non-tech ideas that might suit.

Puma and Heineken are consumer-oriented ideas that look set for a decent 2024 with Puma continuing momentum and Heineken having more of a catch up

Then in the banking sector, Italy’s biggest bank Intesa has navigated the last few years with aplomb. Goldman thinks that’ll continue.

No question: I’m a diehard optimist about US stocks – especially from its unbeatable tech sector. But after a rocketing year like this one, even I know I should broaden my vision and diversify beyond America’s shores. And, I’ve got to admit, Europe – where the debt burdens and inflation problems are not exactly quaint, but certainly smaller – looks pretty great right now. And so do the stock valuations.

Now, I’m no expert on the European stock market, so I’ve turned to Goldman Sachs’s conviction-buy list (which is updated every month) for inspiration and pulled out three of its best non-tech plays.

1. Puma

First up is fashion retailer Puma. And the big reason here is that I wore Puma Kings when I played soccer, and they are still, ahem, the king of all footwear if you ask me.

But, even without my sports nostalgia, this Puma idea from Goldman is pretty interesting. It’s also easy to understand, and who doesn’t like that? The stock popped onto Goldman’s must-buy list back in October, with its analysts saying they see this cat pouncing higher by about 50%. Their thesis has four parts. First is the idea that European shoppers will have more cash in their pockets this year and next, because inflation has beefed up their paychecks and now their household costs – think: energy and groceries – are about to decline. That sets the stage for a little more discretionary spending (nice-to-haves, rather than need-to-haves) and should benefit Puma – among other brands, of course.

Second, Puma’s got some wind in its sails right now, having stolen some market share from rival Adidas, especially in Germany and China. There’s no guarantee that this shine will continue, of course, but brand popularity usually lasts for longer than a few months.

Third, Puma’s inventory levels are looking healthier than they have in a while. That’s super important for a retailer – especially at this time of year – because too much stock usually leads to heavy discounting, which can trash a retailer’s margins.

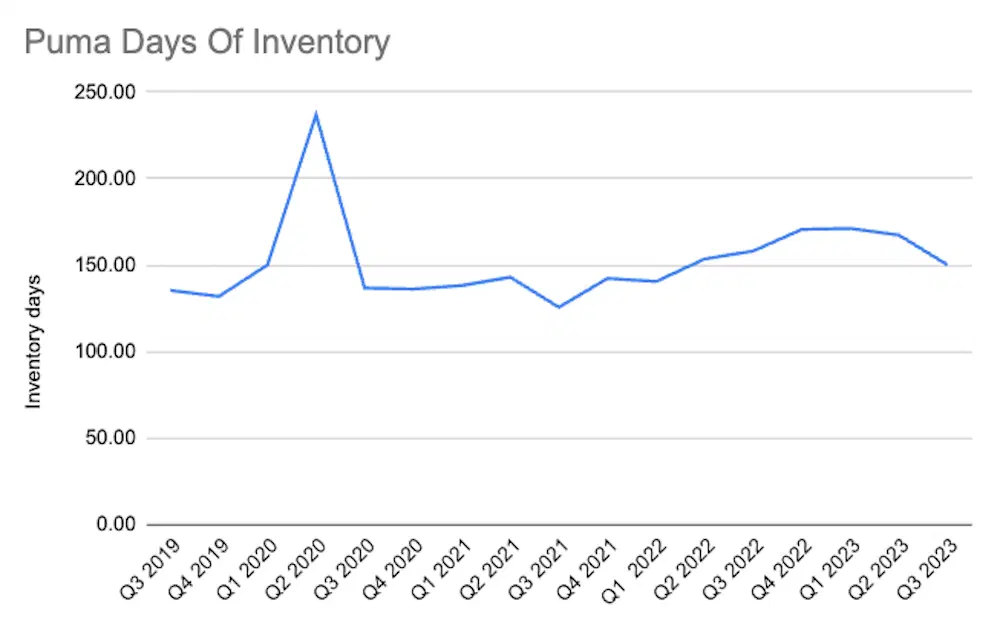

Number of days of inventory that Puma has had on hand, measured quarterly, since 2019. Source: Koyfin.

That spike in the chart, of course, happened in the early days of the pandemic when people weren’t able to go out to shop. Last year’s record-hot inflation sent the figure higher again for a while but more recently, the inventory metric has started to come back down, and it’s now not too far from Puma’s pre-pandemic days.

And, fourth, Puma’s expenses are finally set to ease. Things like freight and raw materials shot really high during the worst of the inflation surge, but those prices have been coming down. That should be good for Puma’s margins.

2. Heineken

This looks like a good time to order up some Heineken stock, and not just because it feels festive. Defensive stocks (like Heineken’s) have generally underperformed other areas of the market lately, and there’s a good chance that’ll reverse next year if global economies continue to slow.

But Goldman also has a snappy four-part pub speech prepared, arguing why this Dutch drinks giant and owner of the Moretti, Amstel, and Tiger brands might be in for some happy times. Part one is the fact that the firm faced some stiff revenue headwinds in 2023 in places like Vietnam and Nigeria (both big beer markets). And, the investment bank says those worries should either fade – in the case of Vietnam – or become less important – Nigeria – going into next year, making the sales growth picture look much better.

Part two is that, like Puma, Heineken is set to receive a big margin boost as its raw material costs decline next year. And its beer prices – have you seen the price of a pint these days? – are probably going to stay where they are.

Part three is that, in big beer markets like Brazil and South Africa, Heineken’s been making moves to take its big and growing market share and turn a profit to match. Heineken dominates the premium beer categories in these countries (which command higher margins) but the firm’s profit – until now – hasn’t matched that muscle. Some restructuring and strategic acquisitions could change all that, though, and brighten future for Heineken in these big markets.

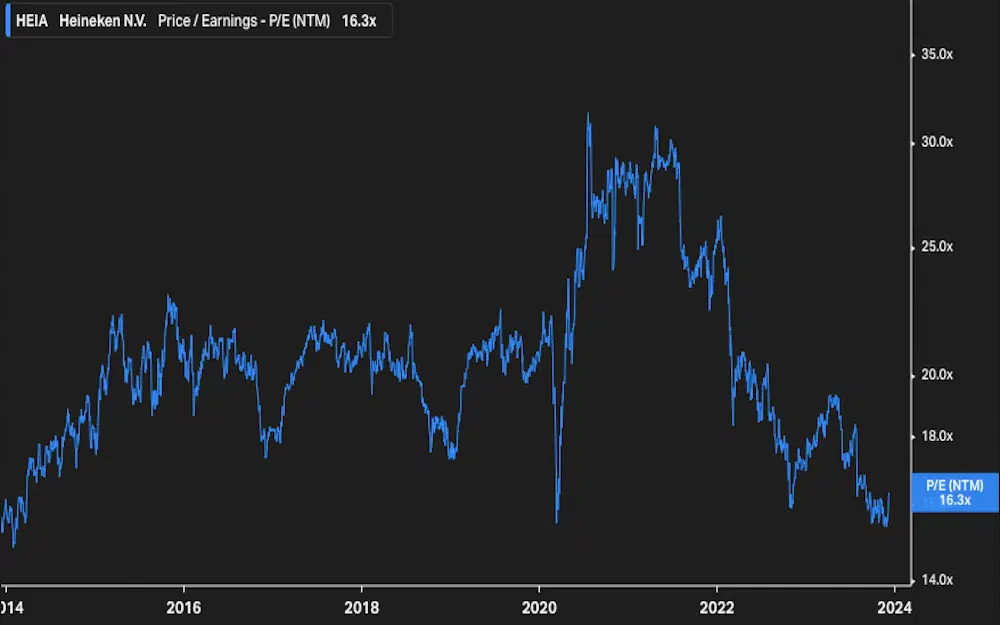

Finally, part four is that Goldman likes Heineken’s valuation. On just a 16x price-to-forward earnings (P/E) ratio, Heineken trades at a big discount to the consumer staples sector and is about as cheap as it has been over the past ten years. This next chart shows that beautifully, but any expansion here could lift Heineken toward Goldman’s €111 ($121) share price target, a 25% gain.

Heineken’s forward price-to-earnings (P/E) ratio over the past ten years. Source: Koyfin.

3. Intesa Sanpaolo

Less fun than the first two, this one is a bank. It’s Italy’s biggest bank. And, once again, I have two reasons to pick this one. First is that I used to work for Intesa (and we’ve already established that I’m the nostalgic type). The second is that I don’t normally invest in banks (few quality-oriented investors do), and it’s always a good idea to get a refreshed view into what’s going on in a sector that you don’t normally keep tabs on.Goldman makes three interesting points about Intesa.

The first is that it’s got a reputation for holding up well during tricky times. Its low-cost operating model and a higher proportion of revenues coming from fees (think: asset management and servicing high-net-worth individuals) make Intesa a relative port in a storm. And the numbers stack up here: the bank earned an average of 25 cents in earnings per share in the five years before the pandemic. It earned 21 cents last year, and Goldman predicts it’ll make 42 cents this year and 47 cents next. (Goldman could be wrong on this, of course).

The second is that Intesa is known for its generous shareholder payouts, and with continued profit resiliency, investors can expect more of the same. Its shares offer a juicy, 9% dividend yield, and the bank typically serves that up along with a healthy stock buyback (which is just another way for companies to return cash to shareholders).

And third is that Intesa has a snazzy new digital bank – Isybank – proving that it’s not just a bunch of old, oak-paneled bank branches that cater to rich Italians. Isybank aims to serve the needs of younger clients, while lowering the bank’s costs at the same time. All that should improve what is already an industry-leading cost-to-income ratio – a key gauge that investors use to compare banks. Goldman extrapolates all that into a €3.60 ($3.88) price target, about 35% above the current price.