Dan Suzuki of Richard Bernstein Advisors believes that small-cap stocks are undervalued, after more than a decade spent lagging behind their more sizable siblings. By the end of the year, small-cap earnings growth is expected to outpace that of large caps, potentially marking the beginning of a new market leadership cycle.

Tallbacken Capital Advisors’ Michael Purves is very bullish on gold and silver miners, betting that the two metals have further room to run. That’s because he expects the growing US budget deficit to increase demand for gold as a safe haven. At the same time, many central banks are building up serious stores of gold.

He’s also bullish on uranium, believing that despite a recent price pullback, the metal has a long-term growth narrative driven by increasing global electricity needs – fueled by growing trends like AI and EVs – and a shift towards nuclear power as a stable, clean energy source.

It’s a truly splendid problem to have: you come into a little financial windfall – say, an overdue bonus at work or a tidy inheritance from a long-lost relative – and you just don’t know what to do with it. You can get decent yields on a money market or savings account these days, sure, but interest rates have started to come down. So to bring in higher returns, you’re probably better off investing it. Four leading wealth advisors recently shared their top ideas with Bloomberg, and I’ve taken my top two a bit further to help you put them into action.

Idea 1: US small-cap stocks

Investors have been stuffing huge sums of cash into mega-cap US stocks, like Big Tech. Dan Suzuki, deputy chief investment officer at Richard Bernstein Advisors, believes that has created attractive investment opportunities elsewhere. One of the most compelling is US small-cap stocks. After lagging behind their more sizable siblings for over a decade, small caps are undervalued and overlooked, according to Suzuki.

He believes that the little guys tend to go through extended periods of both outperformance and underperformance. And during these down cycles, investor sentiment often becomes overly pessimistic, which then paves the way for a potential rebound. After all, despite their recent struggles, small caps have historically outperformed their bigger rivals in the longer term, thanks to their stronger earnings growth. And while small-cap profits have lagged behind large caps recently, this trend appears to be shifting. By the end of the year, small-cap earnings growth is expected to outpace that of large caps, potentially marking the beginning of a new market leadership cycle.

Here are the ETFs that could offer a good starting point.

The iShares Russell 2000 Growth ETF (ticker: IWO; expense ratio: 0.24%) and the SPDR S&P 600 Small Cap Growth ETF (SLYG; 0.15%) offer exposure to small-cap stocks with high potential for growth. SLYG is slightly cheaper – and because its holdings are more concentrated, it may be able to offer greater returns than IWO.

And here’s my take.

I also believe that small caps seem to be poised for a comeback after years of lagging behind their bigger brethren. The Russell 2000, which includes about 2,000 of the smallest US stocks, has underperformed the S&P 500 – made up of the 500 biggest stocks – by 4.4% on an annualized basis since the start of 2014. That has left the Russell 2000’s price-to-earnings ratio, relative to the S&P 500, looking historically cheap.

Now, a lot of that performance gap was caused by the runaway rallies from mega-cap tech stocks – especially those seen as AI investing plays. But there was another factor at work too: small-cap companies have weaker balance sheets and less pricing power, comparatively speaking. That disadvantage has been particularly noticeable over the past few years, which have been marked by high inflation and a steep rise in borrowing costs. Those higher rates have, among other things, made debt more expensive to pay off – and that’s been a harsher headache for smaller firms: roughly 40% of the debt on Russell 2000 balance sheets is the short-term or floating rate kind, compared with only about 9% for bigger S&P 500 companies.

But there are signs that things are looking up for the little guys. Unless there’s a recession, lower interest rates are expected to buoy up small-cap firms’ profits. In fact, analysts expect Russell 2000 companies to see their earnings increase by an average of 41% next year – significantly above the 14% forecasted for S&P 500 firms. That’s not only down to the cheaper cost of debt, either. Smaller stocks have always had a lot more growth potential compared to huge, established behemoths. So combine those promising outlooks, an improving economic climate, and the fact that small-cap stocks are trading for cheap relative to their bigger peers, and investors could be drawn back toward the underdogs. If they shift enough of their attention, that could help reverse a decade of underperformance.

It’s worth zooming into small-cap growth firms specifically, too. A lot of them are exposed to rising themes, which can disproportionately benefit their offerings and, in turn, potential takings. For example, the space has a lot of software-as-a-service companies. Those firms can leverage AI to enhance their products, dramatically boost their users’ productivity, and become more efficient.

The small-cap growth space also boasts a lot of cybersecurity firms, which are experiencing booming demand these days. Remember, Covid created a permanent shift in the number of people who work from home. Employees now handle their workload (and sensitive corporate data) via the internet, while businesses worldwide have been forced to take their operations online – both of which have significantly bumped up the threat of cyberattacks.

The ongoing Russia-Ukraine conflict, meanwhile, has resulted in a spike in cyberattacks, and plenty of experts are worried that battlefield hacks might accidentally spill over to personal computers. At the same time, other malicious groups are also trying to get their hands on vast amounts of encrypted information now to decrypt later, when quantum computers can easily hack even the most secure data.

Idea 2: Gold, silver, and uranium miners

Michael Purves, founder of Tallbacken Capital Advisors, is very bullish on gold and silver miners, which are leveraged plays on the prices of the respective metals. Despite gold’s strong performance this year (it’s up around 25%), Purves believes investors will keep their appetites for the metal. There are two key reasons behind that assumption. First, the growing US budget deficit, combined with a lack of fiscal restraint from any likely election outcome, should support demand for gold as a safe haven. Second, countries like China are building up serious stores of gold to diversify their reserves, hedge against dollar-related risks, reduce reliance on US monetary policy, and gradually challenge the US dollar’s dominance as the global reserve currency.

Purves’ bullishness on gold naturally extends to silver, since the prices of the two metals generally move together (more on that later). As for his third commodity pick, Purves sees good value in uranium. He believes that despite a recent price pullback, uranium has a long-term growth narrative driven by increasing global electricity needs – fueled by growing trends like AI and EVs – and a shift towards nuclear power as a stable, clean energy source.

Here are the ETFs that could offer a good starting point.

The VanEck Gold Miners ETF (GDX; 0.51%) tracks a basket of the world’s biggest gold mining stocks. That’s a cheaper option right now than the Global X Silver Miners ETF (SIL; 0.65%), which invests in silver miners all over the globe. Finally, the Global X Uranium ETF (URA; 0.69%) provides investors access to a broad range of companies involved in uranium mining and the production of nuclear components. Or, for direct exposure to the commodity itself, you can consider the Sprott Physical Uranium Trust Fund (UU; 0.71%).

And here’s my take.

In my opinion, investors should always own a small amount of gold as part of their strategic asset allocations. That’s because gold increases a portfolio’s diversification, provides a hedge against inflation, protects investors during times of economic and/or geopolitical turbulence, and offers an additional source of return that’s largely uncorrelated with other major asset classes.

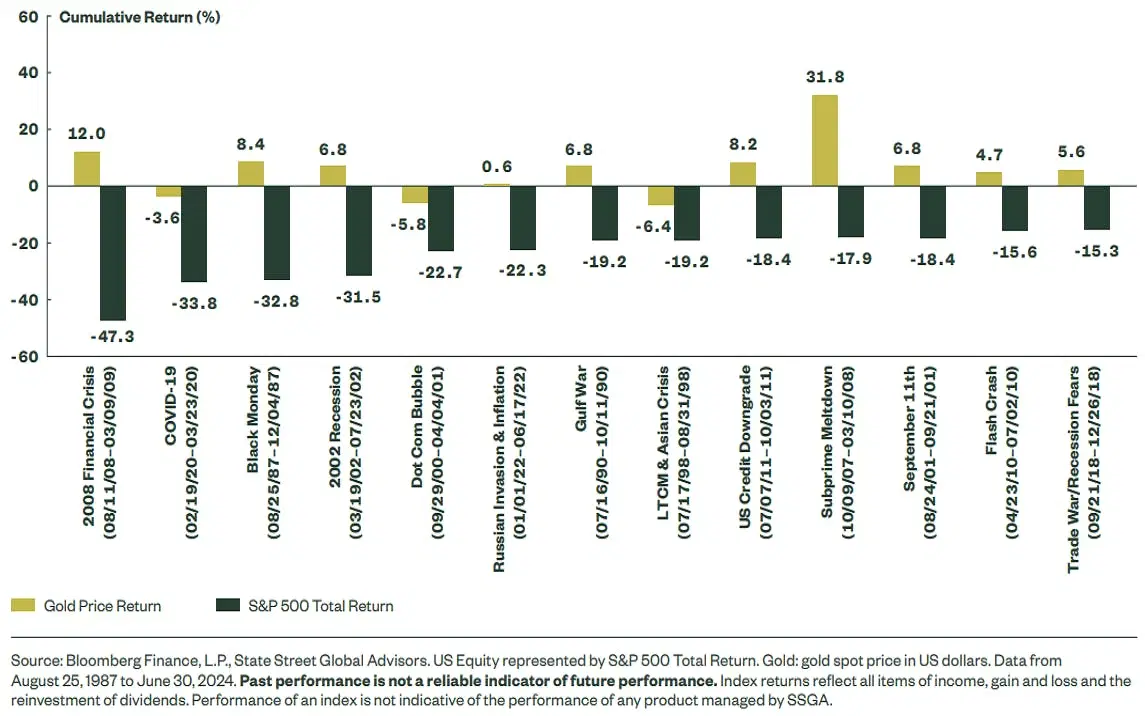

Gold has outperformed US stocks during drawdowns greater than 15%. Source: State Street Global Advisors.

On top of that, gold’s outlook is positive in the short term. With interest rates starting to fall in the US, the “opportunity cost” of owning gold (instead of cash or bonds) goes down. The precious metal doesn’t generate any income, after all. What’s more, lower rates stateside make the dollar less attractive to overseas savers and investors. And those cheaper Benjamins are good for gold since it’s priced in US dollars. See, when the greenback weakens, gold goes on sale across much of the world – and that can increase demand and push up its price.

And Purves highlighted valid reasons to stay confident. For example, China’s central bank was the world's biggest single buyer of gold in 2023. And while it’s been on pause in recent months, it’s widely expected to start shopping again at some point, despite high prices. That’s due to political, rather than economic, motivations – for example, diversifying its reserves away from the US dollar.

Silver tends to move in line with gold, since both are seen as safe-haven assets, inflation hedges, and are influenced by similar economic and market factors. The main difference between the two is that silver has more weight in the industrial industry: 46% of silver’s yearly consumption comes from the sector versus just 6% for gold. See, because of its unique characteristics, silver plays a pivotal role in many fast-growing electronics segments – think solar panels, LED lighting, flexible displays, touch screens, RFID tags, cellular technology, and water purification. With so many uses, demand for silver is rising a lot faster than supply – and it’s the solar industry driving the biggest uptick. In fact, one study forecasts the solar sector alone could exhaust between 85% and 98% of global silver reserves by 2050.

As an added bonus, silver currently looks like better value than gold. This is based on the gold-to-silver ratio, which indicates how many ounces of silver you need to purchase one ounce of gold. Over the past 30 years, the ratio has averaged around 67. Today, it’s closer to 83, signaling that silver seems undervalued compared to gold.

The gold-to-silver ratio is currently about 83, compared to its 30-year average of approximately 67. Source: Bloomberg.

Just a quick word of caution: because the silver market’s much smaller than the gold one, the combination of heady trades and lower liquidity in the space make silver’s price way more volatile than gold’s. What’s more, if you invest in gold or silver miners (as Purves suggests), then just know that their stocks are leveraged plays on the prices of the respective metals, and are therefore more volatile. In other words, they typically rise more when the metals' prices go up, but also drop more sharply when prices fall. So if you wanted to invest in the commodities directly instead, you can consider the abrdn Physical Gold Shares ETF (SGOL; 0.17%) and the abrdn Physical Silver Shares ETF (SIVR; 0.3%)

Finally, Purves’s third commodity pick is uranium, and – you guessed it – I’m a fan as well. Uranium has been on a hot streak since 2020 and the reason comes down to supply and demand: there’s less of it around, but consumption is growing. See, governments are building new nuclear plants to reduce their reliance on fossil fuels and secure their energy independence – particularly after Russia’s invasion of Ukraine. Plus, nuclear power is considered a clean energy source, which is a big deal right now.

What’s more, electricity demand is set to, ahem, surge over the coming years – thanks to economic growth, EVs, increasing needs from emerging countries, and, of course, AI and AI-linked data centers. A ChatGPT search, for example, requires ten times as much power as a traditional Google search. Not only that, but data centers are “switched on” 24/7, so they need a steady source of stable electricity. And that’s how nuclear reactors work, generating uninterrupted power, all the time, unlike wind and solar sources whose power depends on weather conditions.

Thing is, the supply of uranium is tight. Mining of the metal tapered off over a decade ago because people got spooked after the Fukushima nuclear accident in Japan in 2011. That’s resulted in fewer new mining projects, which means there’s less of the stuff being pulled from the ground. There isn’t a quick fix here: uranium projects take a long time to start, so the market will probably be tight for some time.

As a result of all these factors, uranium has been one of the top-performing commodities over the past few years – and it just might continue that hot streak. Plus, it’s an investment that increases a portfolio’s diversification since it tends to move somewhat independently from stocks and bonds, and that’s a nice bonus.