US small-cap stocks have tested the patience of long-term investors for a while now, with the Russell 2000 Index underperforming its tech-heavy rivals in the big-cap S&P 500.

Meanwhile, European small-cap stocks have lagged behind Europe’s big GRANOLA stocks, weighed down by interest rate hikes and slower growth.

But that tide could be shifting: with interest rates likely to fall in the US and eurozone, these stocks could soon see a profitable comeback.

If you think a rising tide lifts all boats, you should try telling that to stocks. Sure, the Magnificent Seven tech stocks and Europe’s GRANOLA shares have been buoyant this past year, floating on expectations for an AI revolution and an overall increasingly sunny mood among investors, but their smaller peers have all but run aground. Still, a tide can always turn, so it’s worth taking a look at the big stocks and their smaller peers from both sides of the pond, to see which are seaworthy.

What’s gone wrong for US small caps?

Stocks from small-cap companies – that is, the ones whose total market value is between $250 million and $2 billion – have always been cheap compared to their biggest peers (those with values of $10 billion or more). The problem is that the difference between their valuations has just grown wider and wider in recent years.

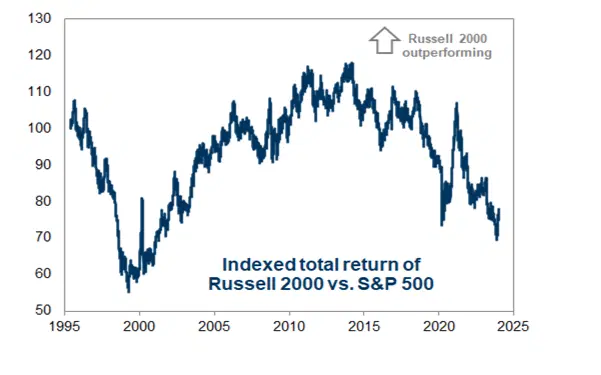

What’s more, the Russell 2000 Index (which includes about 2,000 of the smallest US stocks) has lagged the S&P 500 Index (which includes 500 of the biggest) for most of the past decade.

The total return of the Russell 2000 compared to the S&P 500, “indexed” or from a starting point at 100 in 1995. A move lower indicates that the S&P 500 is outperforming, and a move higher indicates that the Russell 2000 is outperforming. Source: Goldman Sachs.

Now, that may be mainly because of the way the indexes have changed over time. The S&P 500 has become more and more dominated by tech stocks through the years, (and less exposed to energy and financial sectors), while the Russell 2000 has become more cyclical and less tech-heavy. Higher earnings growth warrants a higher price-to-earnings (P/E) multiple, and because technology stocks enjoy higher profit growth, the tech-heavier S&P 500 trades at a higher multiple.

But T. Rowe Price thinks there’s another factor driving that disparity, and that’s the fact that there’s a higher proportion of lower-quality companies listed on the exchanges – with private equity houses having bought up a lot of the higher-quality ones.

Goldman Sachs estimates that about a third of the Russell 2000 constituents are unprofitable – which doesn’t sound like a great investment, if you ask me. Goldman’s hedge fund clients seem to agree: the investment bank wrote earlier this month that it sees them holding multi-year low exposure to the Russell 2000 constituents.

Is it the same story for Europe’s smaller stocks?

It’s similar: Europe’s small-cap stocks have underperformed their bigger cousins – they’re down 16% since January 2022, while the big-cap firms are back at their highs. Just like in the States, small-cap stocks in Europe are more vulnerable to economic lulls and interest rate rises, compared to the big-cap stocks like the buzzy GRANOLA companies (that’s GSK, Roche, ASML, Nestlé, Novartis, Novo Nordisk, L'Oréal, LVMH, AstraZeneca, SAP, and Sanofi).

These small-caps have less banking, energy, healthcare, and technology exposure overall, and higher exposure to real estate and manufacturing. So these stocks aren’t getting the boost that bank stocks are seeing because of higher interest rates, but they are getting the blowback on the real estate side. And they’re feeling the fallout from the economic slowdown in China as well, especially across their manufacturing firms.

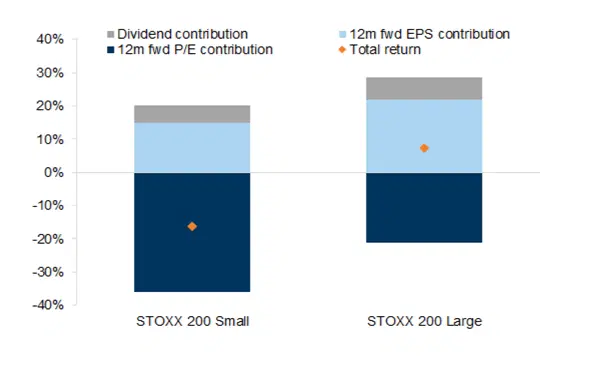

And what’s making things worse is that roughly 50% of European small-cap companies have floating-rate loans, so they’ve been hit hard by all those interest rate hikes. And that’s led to a steep “derating”, or fall, in the small-cap forward P/E ratio. It’s plunged 36% since January 2022.

Small caps have seen their price-to-earnings valuation ratios fall more than 30% since the Federal Reserve began hiking interest rates in January 2022. Sources: Datastream, STOXX, Goldman Sachs.

So what’s the opportunity here?

Goldman’s strategists see the Russell 2000 turning a corner this year, gaining 9% in the first six months and 15% by the end of the year, helped by its cheap valuations and a better economic environment. After all, those experts say, with roughly 30% of small-cap company debt carrying a floating rate (compared to 10% for big-cap firms) they’re more sensitive to lending rate changes and, hence, positioned to benefit big when the Fed cuts interest rates. Smaller firms are more sensitive to economic growth too, so any positive surprises on that front could also boost their performance.

To bet on the rise of those firms, consider buying the iShares Russell 2000 ETF (ticker: IWM; expense ratio: 0.19%), which tracks the whole Russell 2000. But if you want to body-swerve the index’s loss-making companies, consider investing instead in the S&P 600. It’s outperformed the Russell 2000 by an average of 1.4 percentage points per year over the past 20 years, according to T.Rowe’s math. If that sounds like a better fit for your view, the Vanguard S&P Small-Cap 600 ETF (VIOO; 0.1%) could be a nice place to be.

Now, generally I’d agree that passive investing wins the day, but when it comes to small caps, a good active fund manager can easily add enough value to justify their higher fees.

Over the past five years, the Royce Quant Small-Cap Quality Value ETF (SQLV; 0.6%) has returned 62%, while the Vanguard S&P Small-Cap 600 ETF has returned 53%, and the Russell 2000 ETF 43%. So even after you factor in the higher expense ratio, Royce – a small-cap specialist asset manager – has returned more to shareholders than the cheaper, passive ETFs.

Royce Small Cap Quality, Russell 2000, and S&P 600 small cap ETFs 5-year total return. Source: Bloomberg.

And, sure, there are tons of active managers out there, but there are ways to find the right one. Our guide is full of pointers.

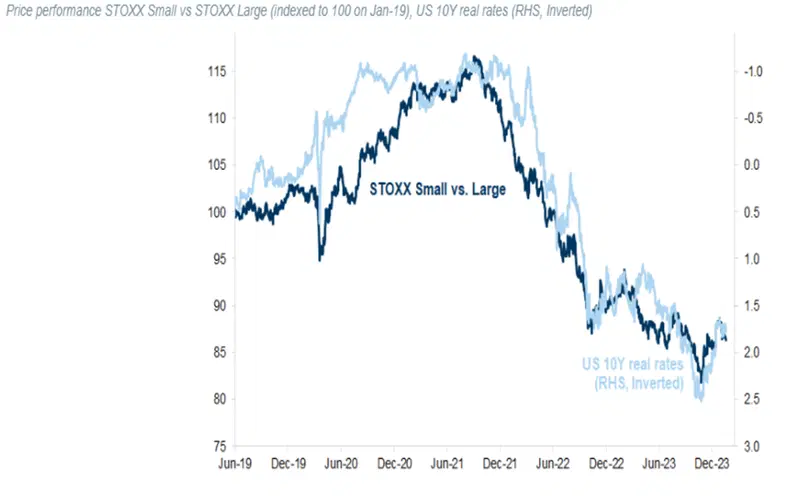

Okay, let’s not forget Europe. After all, where there’s distress, there’s often opportunity. The sharp derating in European small caps relative to big caps looks a lot like the move in US 10-year real rates (that’s the interest rate minus the inflation rate).

The price of Europe’s STOXX Small vs its STOXX Large, starting from 100 in January of 2019. And the US 10-year real rates – the rate of interest minus the rate of inflation – inverted and measured on the righthand axis. Sources: Datastream, Goldman Sachs.

With interest rates expected to remain flat or even decline, the hope is that growth can drive European small-cap stocks higher. But the worry is that a recession may linger. If you’re in the hopeful camp, the iShares MSCI Europe Small-Cap ETF (IEUS; 0.42%) could be worth a look.

-

Capital at risk. Our analyst insights are for information purposes only.