Nike may be down, but as any sports fan knows, that doesn’t mean it’s out. The company’s stock has slumped 22% this year, which just might bring long-term investors back into the arena. Sure, the firm’s had some challenges – slowing global demand and a sales strategy revamp that badly missed the mark, to name just two. But the swoosh-emblazoned sportswear brand is still the undisputed champ of this league, with a 40% market share. And with Nike veteran Elliott Hill coming out of retirement to serve as its new CEO and a big 40th-anniversary celebration in the works for the iconic Jordan line, this firm could be ready to rally. I ran the numbers on Nike and found that, based on conservative estimates, Nike has an upside potential of at least 35% over the next 12 to 18 months, making it a compelling opportunity for those who love a good comeback story.

A group of leading wealth advisors recently shared their top investing ideas with Bloomberg, and one of them really got me thinking: gold. Specifically, I found myself wondering why this one metal remains a top pick among so many big-name investors – even after its almost 40% price gain over the past year. And I’ve been tying myself into mental knots wondering why it’s done so well, despite the absence of its usual drivers, like low interest rates, high inflation, or slow economic growth. I actually can’t stop thinking about gold.

Thesis

Nike holds a robust 40% market share in the sportswear industry, with powerful branding and economies of scale that few competitors can match.

The company has struggled in recent years because of slowing consumer demand and strategic blunders. Still, Nike has rebounded before.

Nike is currently trading at a discount, thanks to its year-to-date decline. But it’s got plenty of upside potential. A conservative estimate puts its growth at 35% over the next 12 to 18 months – making for a compelling investment opportunity.

Last month, Nike pulled Elliott Hill off the bench and out of retirement, installing him as the firm’s CEO – with the promise of delivering a fresh strategic direction. Hill, who started at the firm in 1988 as an intern, is expected to reinvigorate the company. So investors are at the edge of their seats, waiting for details about his plans.

Nike’s iconic Jordans will celebrate their 40th anniversary next year, with some buzz-generating limited-edition sneaker releases and events likely to give some air to the brand and its revenue.

Bill Ackman’s hedge fund, Pershing Square, scooped up three million Nike shares this year, in a high-profile show of confidence.

Risks

If global economic conditions worsen, consumer spending could take a big hit, affecting Nike’s sales, particularly in North America.

Despite the prevailing optimism about the change of CEO, new strategies can sometimes take longer than expected to implement and don’t always result in a quick, upward turnaround. Hill may also choose to lower expectations for the upcoming year, sending the stock down in the short term. Adidas CEO Bjørn Gulden did exactly that when he took the German sportswear’s helm, calling 2023 a “reset year” and adjusting forecasts lower.

Nike’s performance could get worse before it improves, as often happens during transition phases.

Competition from fast-growing brands like On, Hoka, and New Balance could chip away at Nike’s standing. These companies are gaining market share – particularly in the running category – and could chip away at Nike’s dominance.

While Nike is again embracing retail partnerships after its direct-to-consumer (DTC) flop, the shift back to wholesalers could take time, and there might be further costs associated with excess inventory and logistics.

PART 1: WHAT’S GONE WRONG AT NIKE?

Listen, I’m all about scoring a good deal, and when that deal comes with a big-name swoosh, that can be even sweeter. But it’s not just legendary kicks like Jordans that are catching my eye these days – it’s the sneaker titan itself. And that’s why I’m doing my homework.

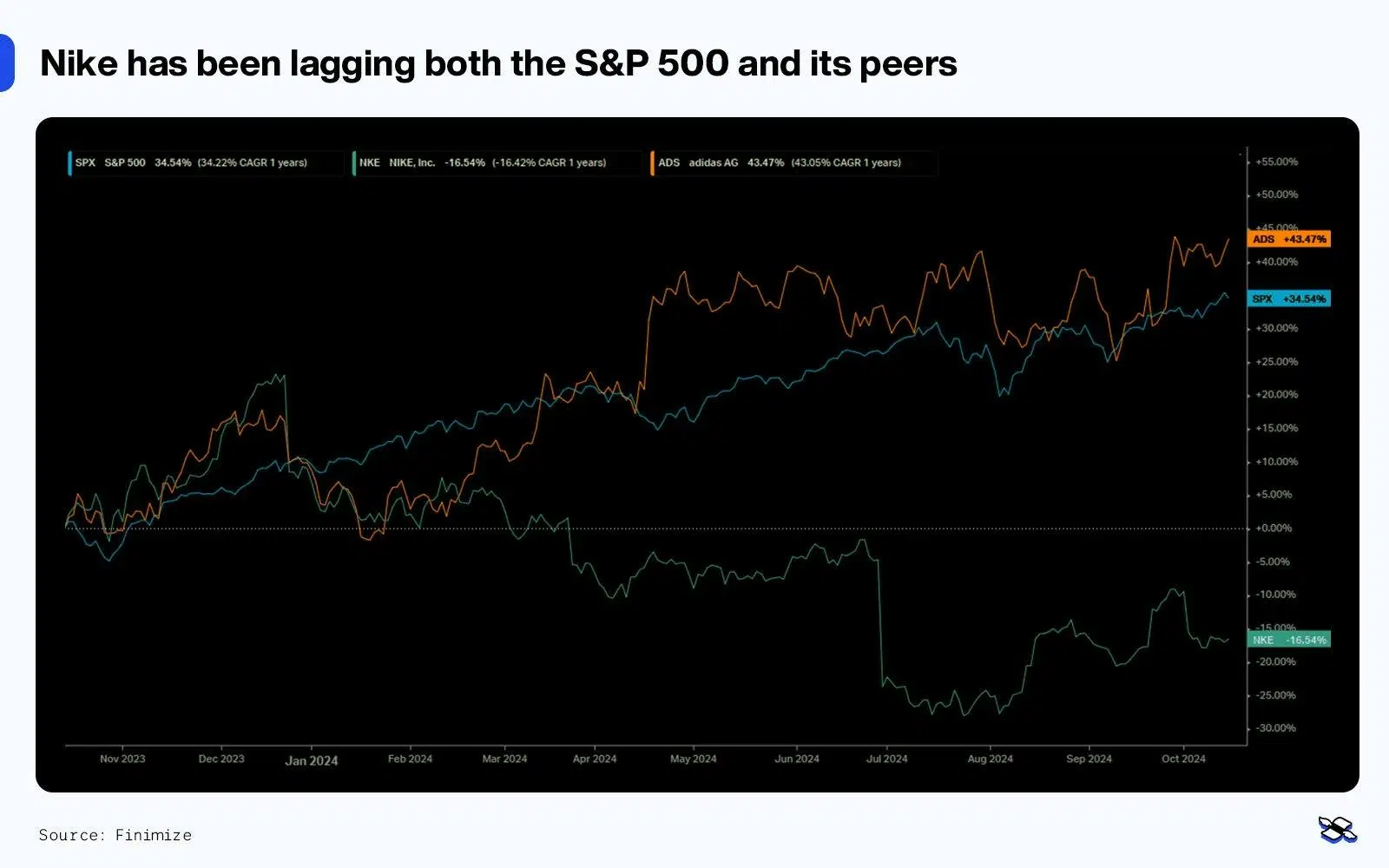

Nike’s shares have been stumbling on the track this year: they’re down 22% since January, while shares of rival Adidas have been sprinting ahead, up 22%. That’s a pretty damaging lag: it means Nike’s stock is trailing behind Adidas by a staggering 44%. And it’s not doing a lot better against the broader market: the S&P 500 has gained 23% so far this year, leaving Nike behind by 45%.

Over the past five years, in fact, Nike hasn’t exactly been the industry’s MVP. The stock has slipped 15%, falling a jaw-dropping 110% behind the S&P 500’s 95% gains. Talk about missing the finish line.

And with two profit warnings already this year and a new CEO lacing up to take charge, I’ve got questions. I want to know what the firm is worth now and whether a turnaround is just too much to hope for.

How Nike (green), Adidas (orange), and the S&P 500 (blue) have performed over the past 12 months. Source: Finimize.

Before diving into Nike’s valuation, let’s unpack what’s been driving its underperformance.

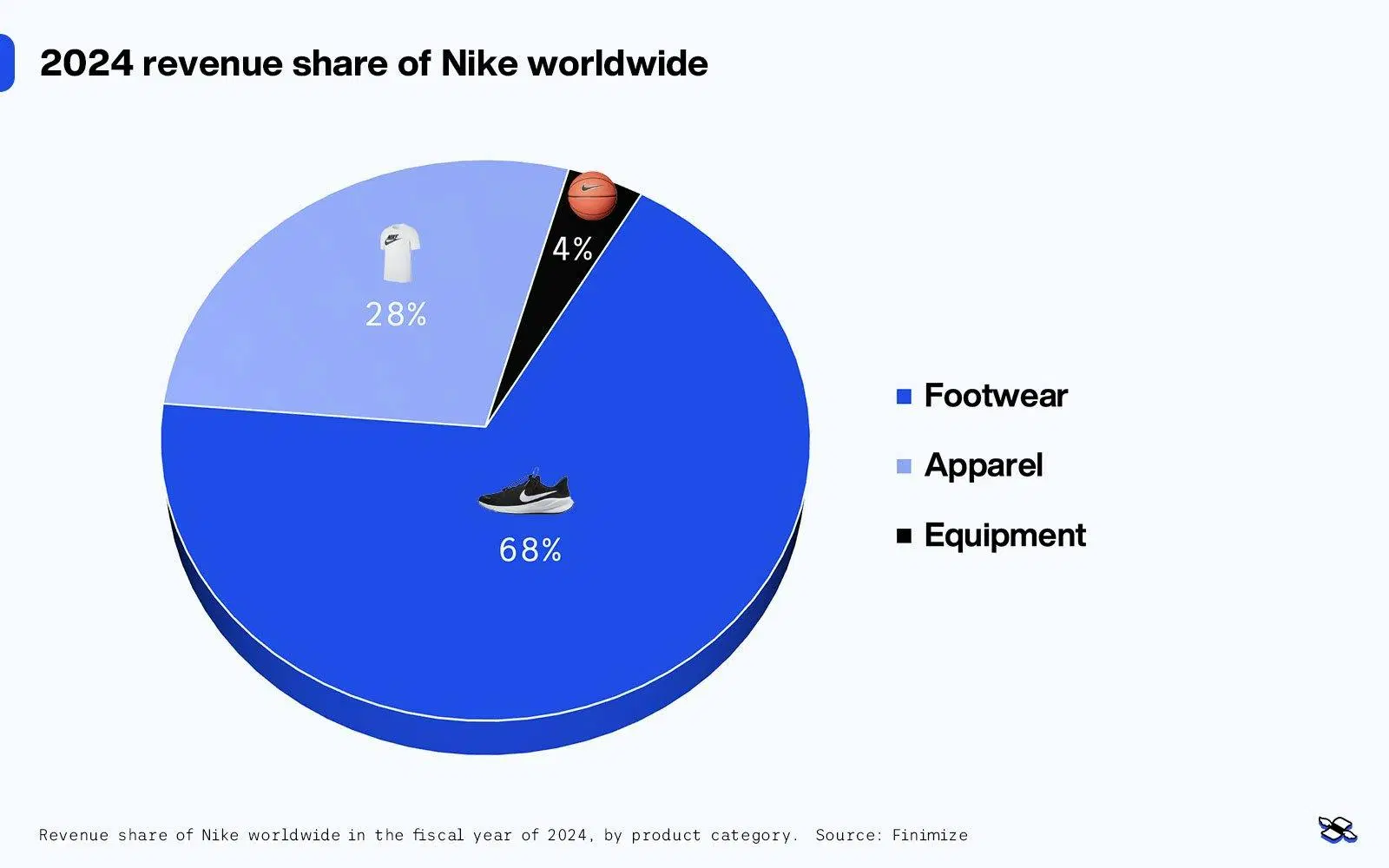

The breakdown of Nike’s global revenue for 2024. Source: Finimize.

1. Sluggish consumer spending.

Nike's sales momentum has taken a tumble, particularly in North America, its biggest market. The company reported a 10% revenue drop in its most recent quarter – its sharpest slide since the starting gun of the pandemic. This dip was exacerbated by a 6% drop in North American footwear sales and reduced demand globally for its core products, including popular lines like Air Force 1, Air Jordan, and Dunk. For the fiscal year ending in May 2024, Nike’s revenue grew by just 1% – its slowest in over a decade, aside from the Covid crisis. The company has also cooled its heels on its revenue outlook for fiscal 2025, now forecasting a mid-single-digit decline in sales.

My take: Slower consumer spending nearly everywhere is a challenge for Nike, but it's important to view it through a wider lens. This isn’t a Nike problem – it's industry-wide. And footwear tends to be more recession-resistant than other sectors. While the latest dip may be affecting short-term sales and market sentiment, I don’t see this as a long-term red flag for Nike. To me, this looks more like a potential investing opportunity: a strategic entry point ahead of the eventual rebound in consumer spending.

2. The DTC flop.

Nike aggressively chased a DTC model, pulling out of partnerships with major retailers like Foot Locker, DSW, and Macy’s – and focusing on selling through its own stores and digital platforms. But the strategy backfired spectacularly as ecommerce growth sputtered when pandemic-era shopping restrictions lifted. Nike just wasn’t able to fill the void left by all those jilted retailers. What’s more, the rapid shift toward DTC also led to higher storage and shipping costs – expenses that had previously been handled by wholesalers – and that squeezed Nike’s profit margins. The firm has since acknowledged this misstep and has reconciled with some of its old retail partners to try to offload some of its excess inventory.

My take: Nike’s DTC pivot initially seemed like a savvy move – cutting out the middleman to boost margins. But it didn’t pan out. Ecommerce growth nosedived, and Nike wasn’t fully prepared to manage logistics, storage, and shipping costs. Fortunately, Nike is backtracking and making nice again with retailers like Foot Locker. And that should ease inventory pressures and boost its retail presence again. Ultimately, Nike's strong relationships with its wholesale partners mean this blip will probably be just a short-term operational hiccup, rather than a fundamental flaw in its business model.

3. Stiffer competition.

Nike’s market dominance has been under threat lately, with zippy competitors such as On, Hoka, and New Balance following fast on its heels, particularly in the running category – a core area for Nike. Hoka, owned by Deckers Outdoor, saw its annual sales rise to $1.4 billion in 2023, up from just $352 million three years earlier. And On Holding, the Swiss sportswear company, reached $1.3 billion in sales in 2023, a 69% increase over the year before. That’s kicked Nike’s market share in the shins, particularly among runners and younger consumers who want fresh, innovative designs.

My take: Rising competition is probably the biggest long-term concern for Nike. But even if On, Hoka, and New Balance are gaining ground fast, they’re still relatively small players. Nike has seen challengers come and go before (remember Allbirds?) and has mostly held its turf. And its technological prowess, massive marketing machine, and global scale give it a distinct advantage that smaller brands struggle to match.

4. Strategic fumbles.

Under its previous CEO, Nike was focused on boosting digital sales and pumping out limited-edition sneakers – but that led to overproduction of its most iconic models, diluting their exclusivity and value in the resale market. Meanwhile, the company's restructuring efforts, including layoffs and an over-reliance on past hits, have damaged employee morale and pushed Nike further from its innovative roots. This decline in corporate culture has contributed to strategic misfires and a loss of the brand’s bleedingly sharp edge.

My take: Nike’s recent strategic goofs, particularly the overproduction of limited-edition sneakers, are concerning, but not insurmountable. After all, with a new CEO at the helm – one with decades of experience at Nike – there’s a real opportunity for a turnaround. The key will be whether Nike can demonstrate a return to its innovative roots and upbeat employee morale. Given Nike’s history of resilience and its ability to pivot when necessary, I see this as a bump in the road for the company – not a path-altering blow.

PART 2: WHAT IS NIKE WORTH?

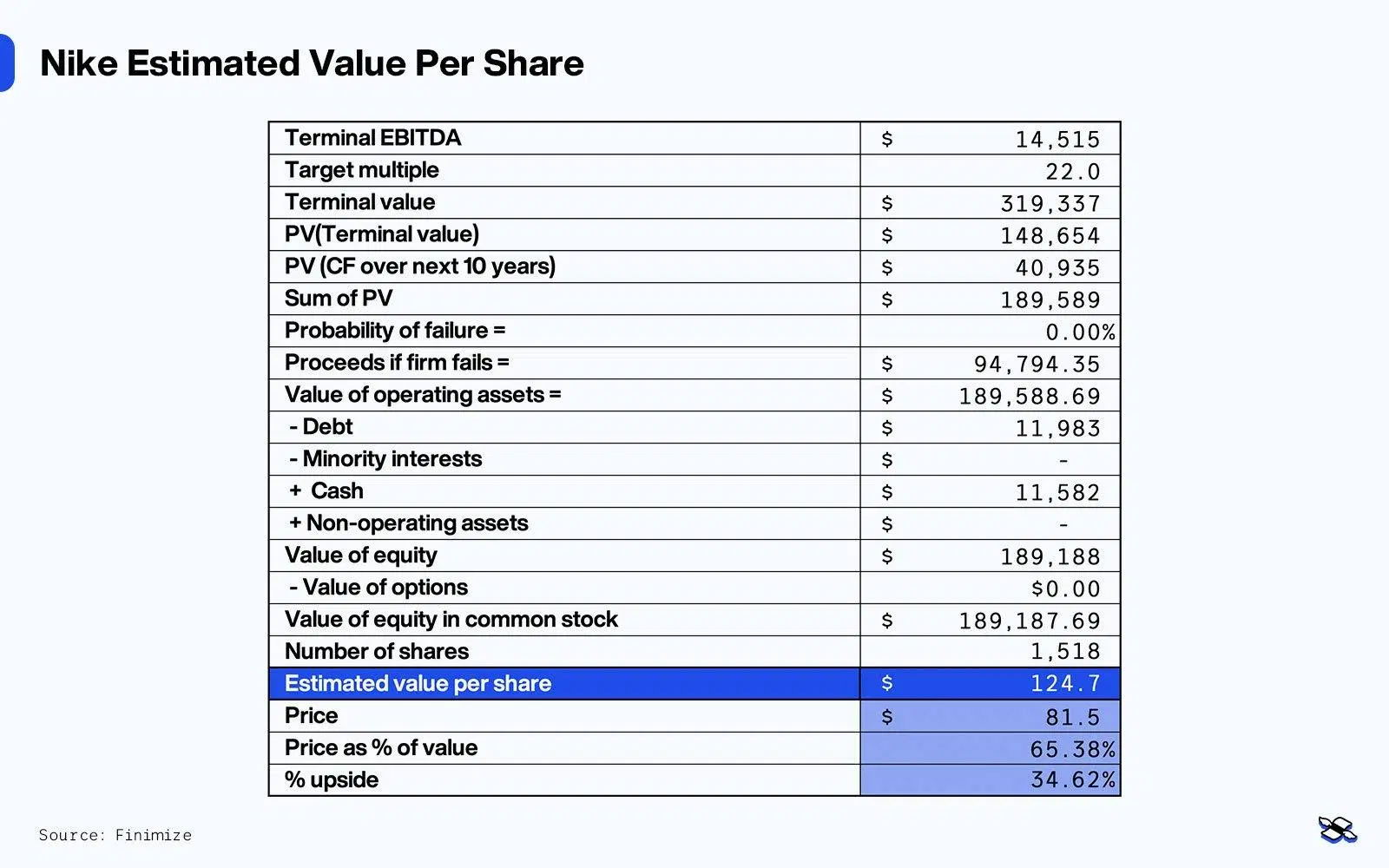

Based on my assessment, Nike’s value shows an upside of at least 35% over the next 12 to 18 months, with a target price of $125 per share. That said, I’ve been rather conservative in my estimates, so the upside potential could be higher.

My valuation approach.

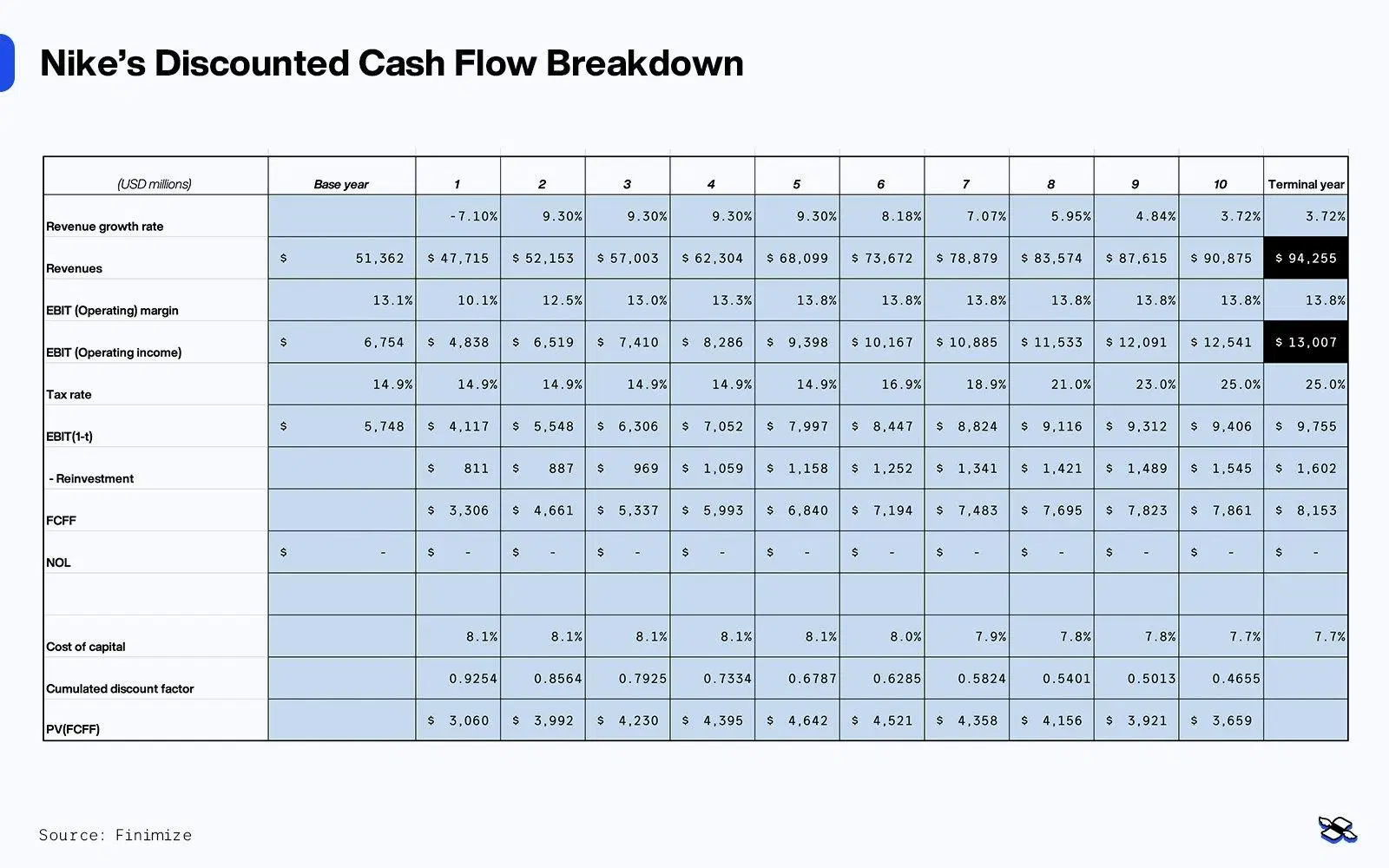

Instead of relying solely on traditional valuation multiples like price-to-earnings (P/E) or enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) – both of which can fluctuate wildly with market sentiment and trends – I opted for a more balanced method. My approach combines a discounted cash flow (DCF) model with an exit multiple strategy. This method merges the precision of intrinsic valuation with the practicality of market-based multiples, keeping the valuation grounded in both company fundamentals and current market behavior. By doing so, I avoid the typical pitfalls of relying too heavily on future earnings predictions or overestimating the terminal value through speculative growth assumptions.

Traditional DCF models can be hypersensitive to small changes in terminal growth rate assumptions, and that can lead to highly variable outcomes. In fast-moving industries like athleisure, you’re best to maintain flexibility. Using the exit multiple approach – based on tangible market data like Nike’s historical EV/EBITDA – keeps the terminal value more realistic and in line with market trends. I’ve used a multiple of 22x, reflecting Nike’s average multiple since 2020, which includes some of its toughest years.

The breakdown of Nike’s price per share, based on a discounted cash flow (DCF) model and an terminal exit multiple strategy. Source: Finimize.

My assumptions.

On growth. Nike’s own guidance says it’s headed for a mid-single-digit decline in organic growth for next year, and my model assumes a conservative 7% decline (in line with consensus expectations). Beyond 2025, I project an average annual growth rate of 6% over five years – lower than Nike’s historical average of 7.2%. Longer term, this growth is expected to taper to a steady 3% to 4%. These estimates also consider the expansion of the global athleisure market, which is expected to grow at a 9.5% compound annual growth rate (CAGR) over the next decade.

On margins. Nike’s operational leverage means shifts in growth can have a magnified impact on margins. While 2025 is expected to be a weak year in terms of profitability, I’ve assumed Nike will recover to target margins of 13.8% (its average since 2020) by year five.

On the discount rate. I’ve applied a cost of capital of 8.1%, which factors in Nike’s financial leverage, the risk-free rate, and the equity risk premium.

On the terminal multiple. To calculate Nike’s terminal value, I’ve used a multiple of 22x EBITDA, consistent with Nike’s average multiple since 2020. Remember: this multiple reflects some of Nike’s more challenging years, so it’s a bit on the conservative side, with room for upside if market conditions improve.

Nike’s DCF breakdown. Source: Finimize.

PART 3: WHAT’S KEEPING ITS RIVALS AT BAY?

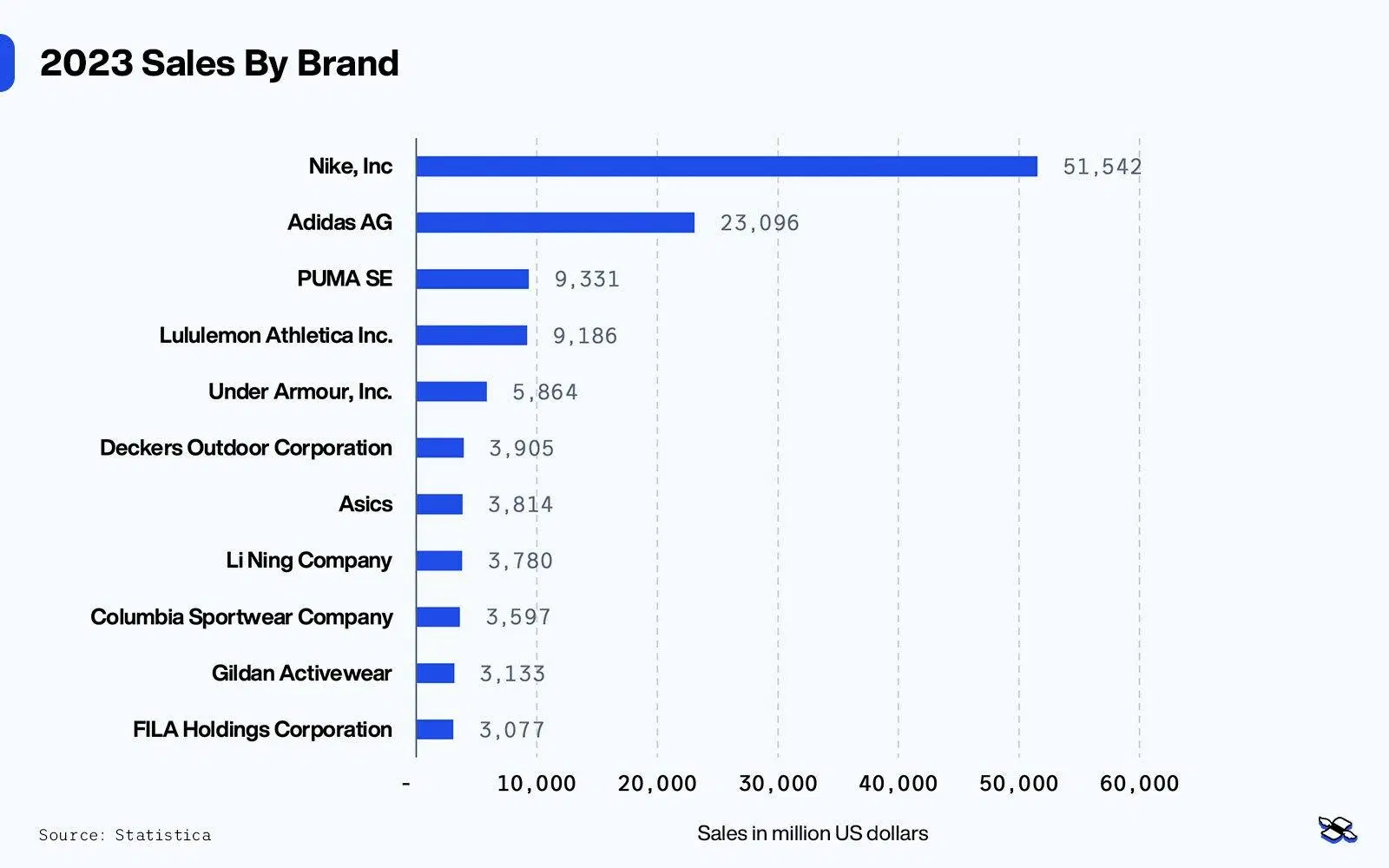

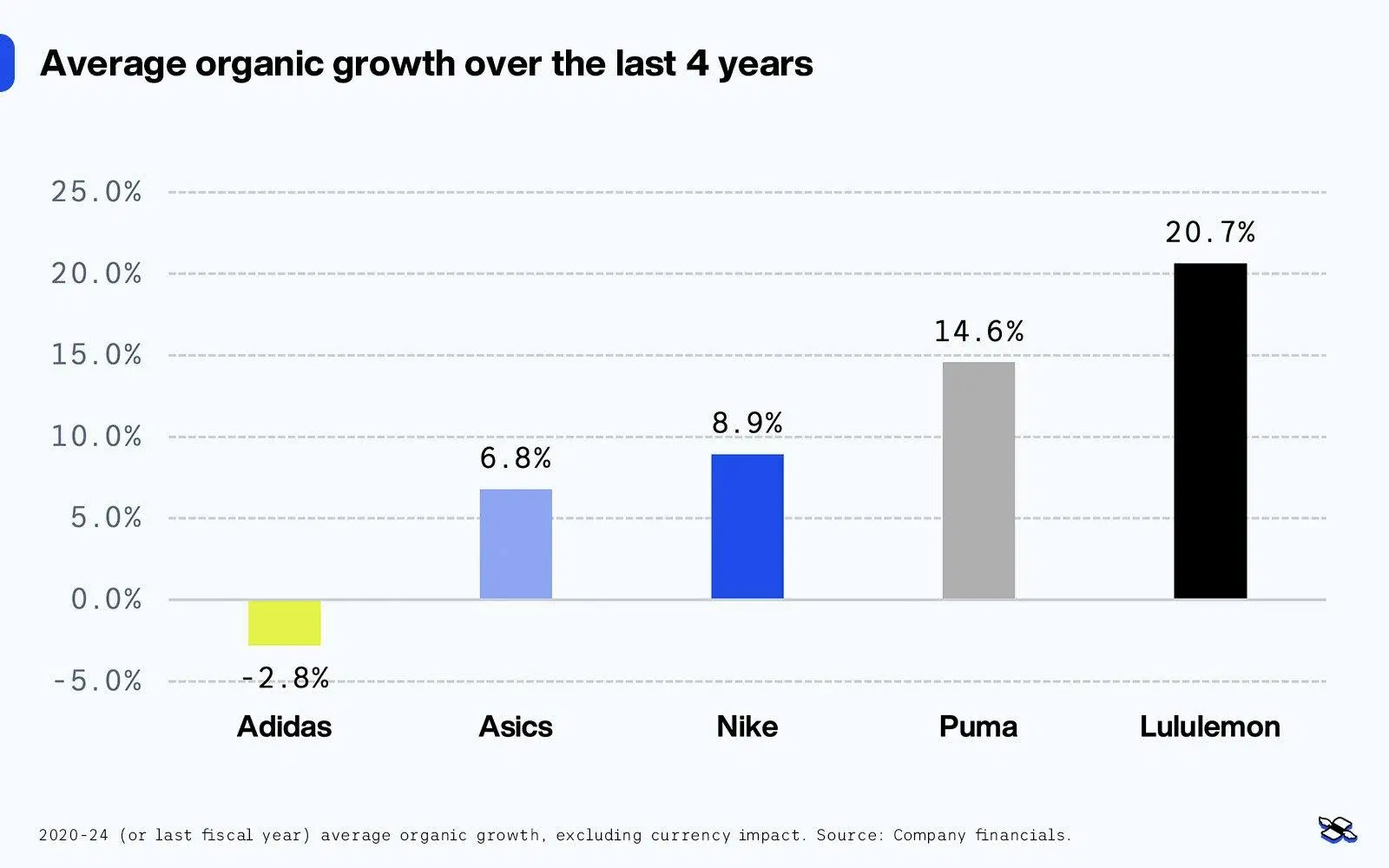

Nike’s competitive moats are deeply entrenched, allowing it to maintain its dominance in the sportswear industry. As the market leader with close to 40% market share, Nike holds an enviable position not seen in most apparel categories. For context, its next biggest competitor, Adidas, has a share that’s not even half as big. What’s more, Adidas has seen negative sales growth of almost 3% annually over the past four years, while Nike – even with its missteps – has seen positive growth of nearly 9% on average over the same period. And that significant lead in the industry is fueled by Nike’s powerful marketing machine and unmatched economies of scale.

Sportswear sales by brand in 2023. Source: Statistica.

The average annual organic growth over the past four fiscal years, excluding currency impact. Source: Company financials.

Nike’s scale is a key advantage (or “moat”) too, enabling it to invest heavily in high-profile sponsorship deals with global superstars like LeBron James and Serena Williams, and major sports leagues. Those partnerships bring the brand enormous visibility – resonating with consumers worldwide and solidifying its brand power. Nike’s ability to secure deals like its extended NFL contract and its win over Adidas to supply Germany’s soccer jerseys – ending a 70-year partnership – speaks volumes about its staying power and edge. Smaller competitors just don’t have the financial muscle to compete on this level, and Nike’s sponsorships translate into top-tier cash generation and returns.

Nike has consistently earned a higher operating margin (1.5% to 3% higher) than the rest of the industry, except in 2023. And since much of this industry consists of brand-name companies, that suggests that Nike is a premium name among them. If you’re generally a Nike-pessimist, though, the dropoff in the margin differential in the past five years is probably pretty troubling – even if most of that fall can be attributed to the company's blunders in 2023.

Nike’s technological prowess is another moat. Unlike many competitors who chase fashion trends, Nike prioritizes performance, which has allowed it to stick at the forefront of innovation, even as fads come and go.

The firm leverages its huge cash reserves so it can invest big in R&D, creating tough-to-replicate technologies like Nike Air, Flyknit, and ZoomX. Those advancements require significant expertise and investment in materials science and design, giving Nike a distinct edge that most competitors can’t match.

What’s more, Nike’s focus on certain big sports – basketball, running, tennis, golf, and the NFL – anchors its growth. Meanwhile, growth in sports monetization paves the way for new Nike partnerships, like its recent Caitlin Clark deal in the WNBA. Long-term, locked-in agreements like those score points for Nike on stability and shrink the risk of sudden shifts in strategy. Together, those things build Nike’s formidable competitive moat, ensuring the company’s dominance and growth for the long term.

PART 4: WHAT MIGHT GIVE NIKE AIR?

Having a target valuation is great when you’re investing, but it’s no good without some clear catalysts to watch for. These are the big developments that will help the market recognize the true value of a company. And the good news for Nike is that it’s got several exciting catalysts coming up over the next 12 months.

First up is the impact of its new CEO. Elliott Hill, who took over the top job in September, is no stranger here. He has over 30 years of experience at Nike, and investors are eager to see what his leadership brings. The firm has even postponed its investor day so Hill could roll out his new strategy.

Then there’s the 40th anniversary of the iconic Jordan line next year. Jordan designs, which made up almost a fifth of Nike’s sales in the last fiscal year, are huge for the company, and anniversaries like these always come with hype-building sneaker drops, media events, and collaborations. The last big Jordan celebration boosted Nike’s visibility and financials, and while I’ve not baked that into my numbers, it certainly suggests there’s room for upside and consensus upgrades.

And finally, Bill Ackman’s Pershing Square recently picked up a nothing-to-sneeze-at three million Nike shares – and that’s a strong vote of confidence in the sneaker-maker. When a big-name investor like Ackman takes a hefty stake in a stock, it can generate a lot of interest and momentum. So I’ll be watching for that effect.

If you're looking for even more Nike content, you could check out Acquired, one of my favorite podcasts. It tells the story of Nike like no one else, but, a heads-up before you tune in: the Nike episode is four hours long. But, if you’re game, go ahead and lace up your Nikes, hit the track, and give it a listen.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.