High market concentration tends to lead to lower long-term returns because even superstar firms can’t keep up extreme growth and margins indefinitely, and concentrated markets often carry higher risks that aren’t fully priced in.

But the biggest risks for the coming decade are high valuations that leave no room for error, and some of the major tailwinds that have helped boost earnings in the past might not be as easy to rely on in the future.

Diversifying to different sectors, regions, and asset classes is one way to reduce the risks of underperforming, and using a more active strategy like momentum is another.

If you’ve been pulling in comfortable 13% returns year after year, just by investing in a straight S&P 500 ETF, Goldman Sachs has a warning for you: that gravy train is about to get a lot slower. In a new report, the investment bank says it sees the big US stock index returning just 3% annually over the next decade. And I largely agree – in fact, I’ve been banging this drum for a while.

Goldman’s thinking aligns with mine on some key points – high stock valuations that leave no room for error and profit margins that the forces of economic gravity will soon pull down, for example. But Goldman is also raising a new red flag that I think is worth paying attention to: today’s record market concentration.

What’s the big deal about market concentration?

High market concentration doesn’t necessarily suggest there’s an immediate investment risk, but it has been linked historically with lower returns over extended periods. And there are two main reasons for that.

Exceptional today, average tomorrow.

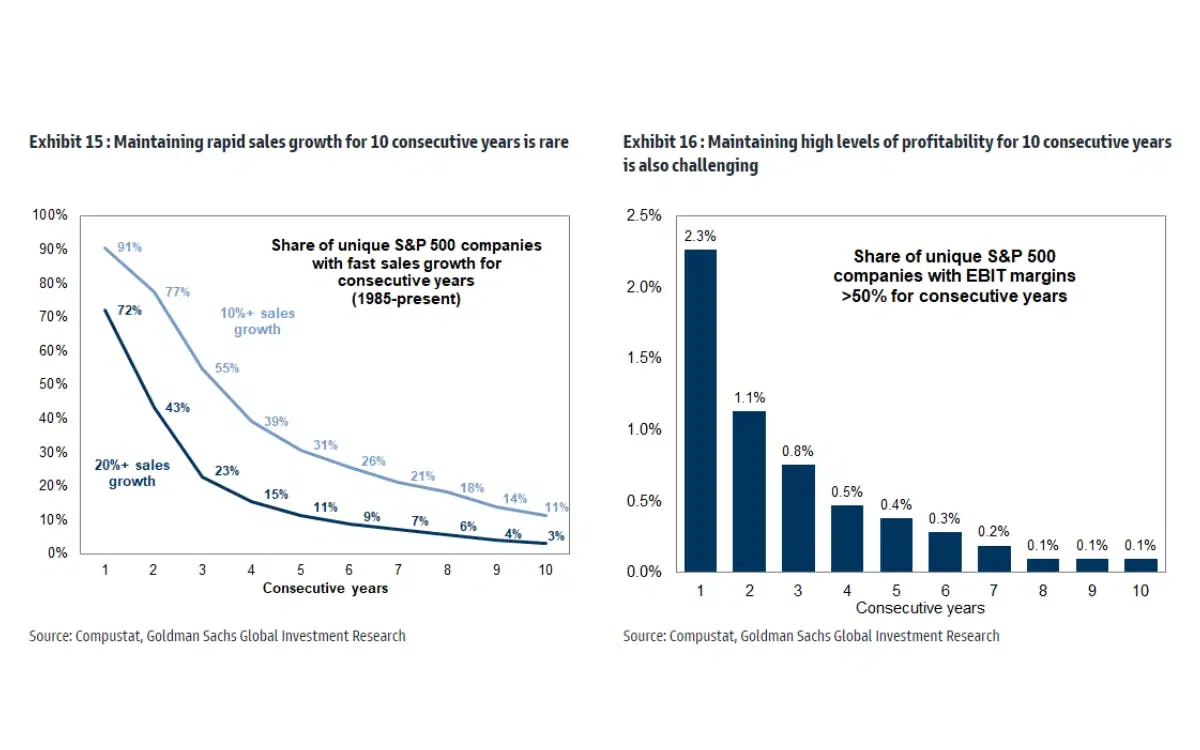

History tells us that it’s hard for any company, even a “superstar” firm, to sustain sky-high growth and super-fat profit margins over sustained periods of time. Even the most successful firms eventually experience a slowdown in growth and a slimming of profit margins as competition intensifies, market saturation occurs, disruptive innovations emerge, or governments impose consumer-protecting regulations. And in a market where just a few giants dominate – like today’s mega-cap tech companies – every slowdown hits a bit harder. In other words, when the behemoths cool off, the broader market can feel the chill.

Sustaining high profit margins and growth over long periods is difficult – and rare. Source: Goldman Sachs.

Higher risk, lower reward.

With only a few companies steering the whole ship, you’d expect a valuation discount to make up for that higher risk. After all, these concentrated markets are more exposed to sector-specific shocks, like tech regulations or supply chain issues, and even to firm-specific risks, making returns overall more volatile and less predictable. But here’s the thing: investors often underestimate this added risk and forego the usual discount. Instead, momentum and bullish narratives just keep pushing valuations higher than the longer-term risks would justify. Eventually, when the market finally adjusts, long-term returns could fall short of expectations.

So what does the current concentration mean for future returns?

Goldman’s gloomy return forecast for the next decade is influenced – in no small part – by today’s ultra-high market concentration. In fact, the firm estimates that if this particular factor somehow disappeared, its baseline return forecast would jump from 3% to 7%. And that’s huge: spread over the next ten years, that makes for a lot of potential lost wealth for investors.

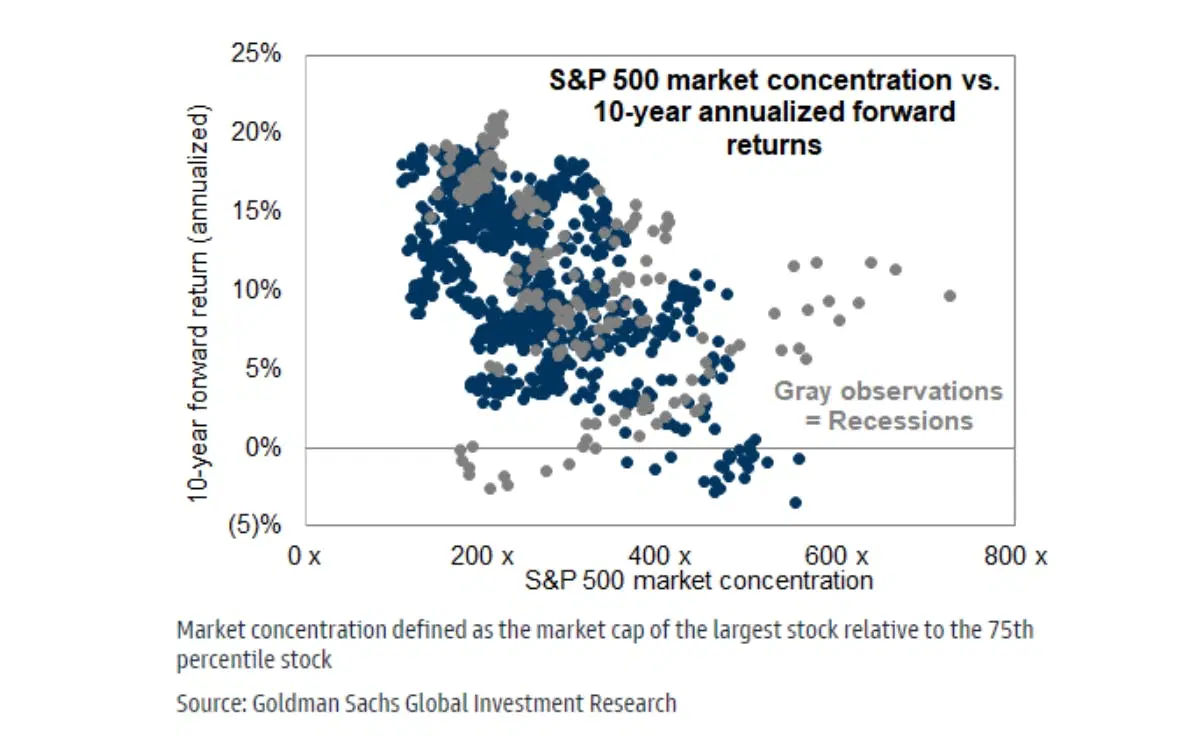

And, of course, Goldman has data to back it up. When a few giants dominate the market, its research shows, volatility goes up and returns tend to shrink, especially outside of recessions. So, while it doesn’t spell immediate trouble, this concentrated setup suggests higher risk and lower returns over the long haul.

High concentration has historically led to lower returns, outside of recessions. Source: Goldman Sachs.

So, what should you be aware of?

First, consider taking Goldman’s warning to heart: returns over the next decade could fall short of what you’ve seen in recent years. Concentrated markets come with extra risk, and today’s sky-high valuations on leading firms leave little room for error. And with tech and innovation moving faster than ever, the risk of disruption is high and the top players could be facing an even shorter window if they hope to stay on top. If these giants start reverting to more typical growth and profit levels, it could weigh heavily on overall market returns over, yep, the coming decade.

That said, concentration risk might not be the biggest threat to future returns. If other sectors catch up (for example, thanks to a productivity boost from AI), that market clustering could drop naturally. And, to be honest, that factor alone doesn’t necessarily foretell lower returns: when starting valuations were cheap (way back when), high concentration didn’t lead to lower index returns.

So, sure, I’m aligned with Goldman’s outlook about lower returns, but in my view, the risk is less about concentration and more about two other factors we both see as crucial.

First, today’s high valuations could limit stocks’ upside gains. Prices reflect extremely optimistic expectations around profitability, future earnings growth, and low interest rates. That may well happen, sure, but it means there’s zero room for slip-ups, and it sets a pretty high bar for valuations to stay elevated – or climb even higher.

Second, some of the major tailwinds that have helped boost earnings in the past might not be as easy to rely on in the future. Without these supports – from globalization and huge fiscal stimulus programs to share buybacks and time-limited tax cuts – achieving the kind of earnings growth we’ve seen over the past decade could be much tougher.

That said, while the balance of probabilities suggests lower overall returns, I’d keep an open mind about an upside surprise. If industries see substantial productivity gains thanks to AI, that could push valuations and margins even higher, setting the stage for high single-digit returns over the next decade. In today’s fast-changing environment, I think it’s important to stay humble and consider more extreme scenarios in both directions – whether that’s a prolonged earnings drag or a surprising boost from innovation and efficiency strides.

What’s the savvy course of action, then?

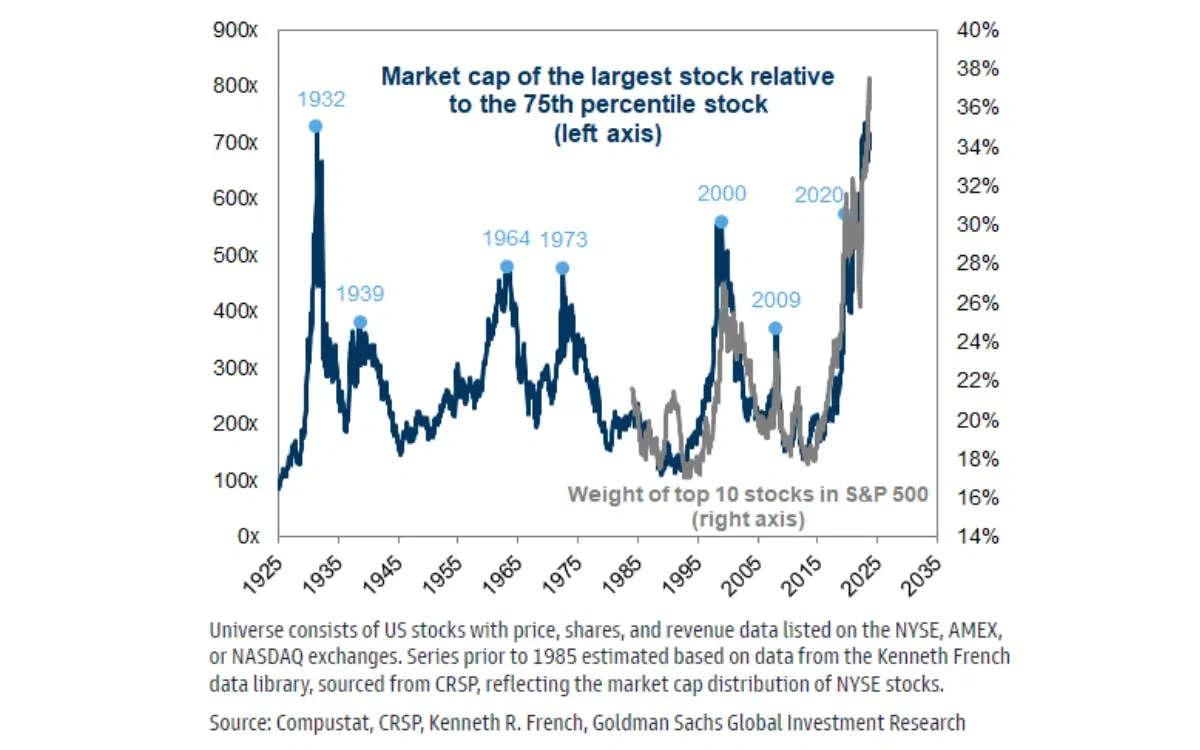

Being ready for anything is key. If you look at past periods of extreme concentration – the post-Depression early 1930s, for example, or 1973, 2000, or 2009 – each one signaled a major turning point.

The S&P 500 has never been so concentrated. Source: Goldman Sachs.

And though many people would view the current high level of concentration as a potential crash indicator or warning, I interpret it differently. I see these transition periods as moments when industries consolidate and new leaders take the stage. This can be bearish, or bullish.

In any case, turning points matter: they demonstrate the importance of preparing for the unexpected. And that brings me to another key point: diversification.

Diversification is also key. Spreading your investments across small- and mid-cap stocks – and across different regions – can help reduce your risk when things don’t turn out the way you expect. That’s why our Easy Rider portfolio goes beyond just mega-cap tech, bringing together stocks of all sizes from the US and other developed markets, plus emerging markets, and offsets that concentration risk with investments from other asset classes like commodities, bonds, and crypto.

And, finally, managing your investments more actively is key. You could, for example, let our Sector Momentum Edge strategy signal when it’s time to rotate out of last season’s winners. That way, you could ride the tech wave while it’s leading, then smoothly pivot to other sectors when the tide shifts.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.