Government bonds are more defensive: they tend to perform well in an economic downturn as they benefit from falling interest rates. So buy them if you fear a hard landing.

High-yield bonds are a risk-on asset more akin to stocks, providing attractive returns in good times but experiencing losses in downturns because of their exposure to credit risk. Buy them if you’re seeking income but keep in mind they might struggle in tough economic waters.

Investment-grade bonds are a mix between the two and may be a good way to add income to your portfolio at a reasonable level of risk.

Bonds are back in the market’s good graces. And it’s no wonder: inflation and economic growth have both cooled, but yields are still at comfy levels. But if you’re thinking about picking up some bonds for the new year, there are two things you should know. One is that government bonds and corporate bonds are very different animals. And the other is that you can use that to your advantage. Here’s what you need to know…

So what are the key differences then?

Let’s start with government bonds: after all, they’re the biggest ones. And though they might not seem very exciting, judging by their typical yields and risk profile, they’re vital to global finance. Issued by national governments for public spending, the big ones are US Treasuries, UK gilts, German bunds, and Japanese government bonds. Essentially, these are paper loans to governments, and they offer periodic interest payouts and a principal repayment at maturity. They’re known to be low-risk because they’re backed by governments through their taxation or money-printing capabilities. They’re also highly liquid – US Treasuries are the world’s most traded asset – and that makes them attractive during economic uncertainties.

But there’s a perception that government bonds are completely risk-free and that’s misleading. Bonds carry interest rate risk, and their values fluctuate if sold before maturity. They also carry inflation risk, which can diminish the “real” value of their cash flows. Plus, while they’re generally considered low in credit risk, that doesn’t mean it’s nonexistent. Some countries (not to point fingers, but: Argentina), face significant credit risk, and even stable countries like the US aren’t immune to it (in fact, that risk may be rising). But overall, interest rates drive most of their returns.

Corporate bonds are, let’s just say, a bit more flavorful. They’re issued by companies, usually to fund expansion plans or new ventures. Like government bonds, they face interest rate and inflation risks. But unlike those assets, corporate bonds come with significant credit risk, because their repayment depends on the company’s financial health. This risk varies, depending on the company and its creditworthiness, and because of that, corporate bonds fall into two big categories:

Investment-grade bonds: Issued by financially sound companies, these bonds carry lower default risk and offer steady income, but yield less.

High-yield bonds: Often called “junk” bonds, these are issued by companies with lower credit ratings. They carry a higher default risk but offer higher yields. They’re common in newer, competitive sectors or among companies with weaker financials.

But they’re all bonds, so can’t you just treat them the same?

I wouldn’t. While corporate and government bonds both carry interest rate and inflation risk, their exposure to credit risk makes them behave very differently – especially when the economy hits a rough patch. Even among corporate bonds, riskier, high-yielding ones tend to perform a lot differently than safer, investment-grade ones. Here’s why it’s so important to treat them differently:

Government bonds are typically more defensive. They usually outperform corporate bonds during economic downturns for two reasons. Firstly, their low credit risk and high liquidity make them sought-after safe-haven assets during challenging times. Secondly, the fact that they’re more influenced by changes in interest rates – rather than by default risks – means they tend to benefit when central banks cut interest rates – which tends to happen when the economy has collapsed. That makes them a better counterweight to stocks.

High-yield bonds are more of a “risk-on” asset, like stocks. They do gain from falling interest rates, but their heavier credit risk means that investors tend to shun them when this risk escalates. So during economic slowdowns, when default risks heat up, high-yield corporate bond prices can fall pretty hard – to a level low enough that allows for higher expected returns. In other words, high-yield bonds tend to outperform safer government and investment-grade bonds in stable economic conditions, but they tend to underperform – often badly – during recessions (though not as badly as stocks).

Investment-grade bonds are kind of a mix between the two. Like their high-yield siblings, investment-grade bonds are exposed to credit risk, which can punish their prices during economic downturns. But the steady income they churn out is often enough to help cushion those blows. So, these bonds might not bring in the big bucks during boom times, but they do come with an income stream, making them a favorite among more cautious investors who prefer a reliable income over chasing higher returns.

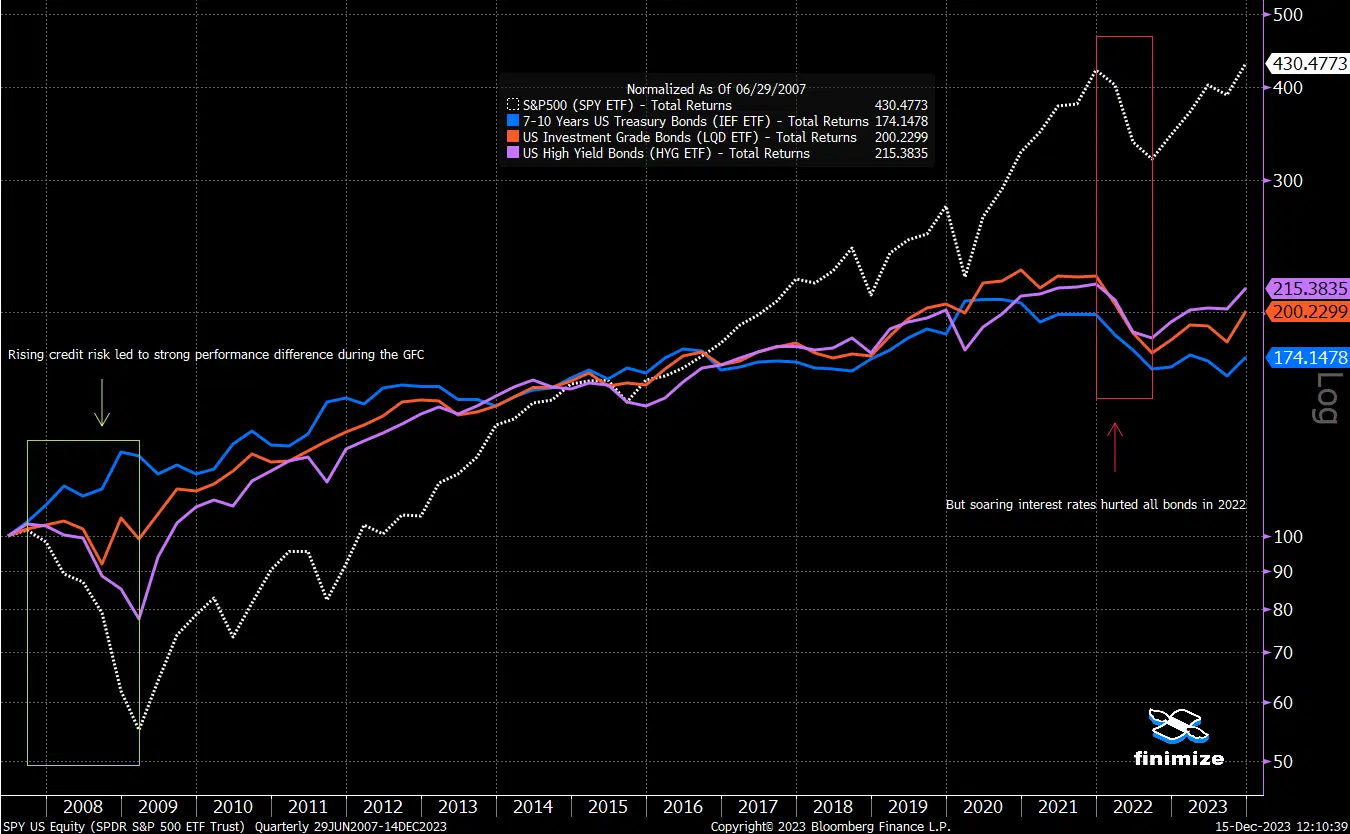

Their historical performance illustrates just how different they are:

Government, high-yield corporate bonds, and investment-grade ones are different animals. Sources: Bloomberg, Finimize.

During the global financial crisis – which, of course, was all about credit risk – US government bonds flexed their defensive muscle as everyone hunted for safe havens. Treasury prices thrived and interest rates got pummelled. Corporate bonds, meanwhile, saw some initial losses but recovered quite quickly. But high-yield corporate bonds absolutely nosedived, as investors braced for mass defaults. We saw a similar pattern play out during the Covid crisis in 2020.

And if you look more recently, you’ll see that government bonds haven’t always been a good defensive move – and that’s because of their interest rate risk. When soaring inflation led the Fed to start aggressively hiking rates in 2022, all types of bonds (as well as stocks) suffered. Take a step back and you see a classic case of higher risk, higher reward: the assets that performed worst in 2008 are also the ones that generated the higher returns over the period. From another viewpoint, it’s a bit like buying insurance: there’s a cost (in the form of a lower return) for owning the assets that will perform best when you most need them to.

So which bonds should you turn to in 2024?

The answer depends on your outlook.

Consider government bonds if you fear a hard landing. Sure, government bonds have been on fire over the past few weeks, but they’re still mired in their worst-ever drawdown. And while the price point might not be as sweet as it was a few weeks ago, the risk/reward balance still seems pretty attractive, with the Fed more likely to cut rates than to hike them. More importantly, they’re the only bonds that could cushion a blow to your stocks if the economy falls off a cliff. And, sure, investors are already pretty optimistic about rate cuts and their expectations could limit your price gains, but the risk of a harsh recession could push interest rates – and cut expectations – even lower still.

Of course, if inflation does make a dreaded comeback, then their diversification benefits might be seriously diminished, because inflation hurts both stocks and bonds, as we saw in 2022. But with interest rates now much higher than they were back then, government bonds are in a much better spot this time, as the nice income you’d earn would help offset the negative price change. Case in point: the yield on 10-year US Treasuries is sitting around 4%, which means interest rates would need to jump above 4.5% for your total returns to turn negative, assuming you hold your bonds for a year. That gives you some margin of safety.

If you want to protect your portfolio from a hard -landing, The iShares 20 Plus Year Treasury Bond ETF (ticker: TLT; expense ratio: 0.15%) could give you the most bang for your buck as it’s more sensitive to interest rate changes and tends to move more than shorter maturity ETFs.

Consider corporate bonds if you’re cautiously optimistic that the economy might achieve a “soft landing”. Right now, corporate bonds are dishing up some attractive yields, especially when you stack them up against stocks and factor in their lower risk. If inflation falls to its target and the economy avoids a harsh recession, we’ll be looking at potentially high single-digit returns on those bonds in the next year. Plus, their cash flows are more yawn-inducingly predictable, meaning their performance will be a lot more stable than stocks if the path to get there is a bit bumpy.

But let’s get real: corporate bonds aren’t going to skyrocket like stocks in a boom time or be your financial bunker like government bonds in a bust time. And, personally, I’m not convinced they present the most attractive risk-reward right now: their credit spreads – the added returns you’d get for taking on higher risk – won’t exactly have you shouting from the rooftops right now (they’re at pre-pandemic levels of meh). So, if defaults start coming in hot – which is a risk I’ve been warning about – the safety net might be scarily threadbare.

Now, as for how to choose between investment-grade and high-yield bonds, well, it’s all about how much of a risk-taker you are, and what’s your macro outlook. If you’re the optimistic type, hunting for income but OK with a bit of risk, high-yielding bonds could spice things up. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG; 0.49%) might be right up your alley. If you’re more of a cautious player, you’d be better off leaning toward investment-grade bonds. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD, 0.14%) is a solid option. Those bonds are less of a thrill ride but offer a steadier path, and might still do OK even if the economy’s under a bit of pressure.

-

Capital at risk. Our analyst insights are for information purposes only and are not investment advice nor a recommendation.