Intel delivered a positive set of results, with its revenue last quarter and its outlook for the current one both coming in above analyst expectations. Excluding one-time impairment charges, its EPS last quarter also beat forecasts. So did its EPS outlook for the current quarter.

There's no change to the investment thesis. But the firm's update on Gaudi 3 is slightly disappointing, and it’s worth monitoring how orders progress next year. That’s because the GPU is one of Intel’s few hopes of making a dent in the AI data center market.

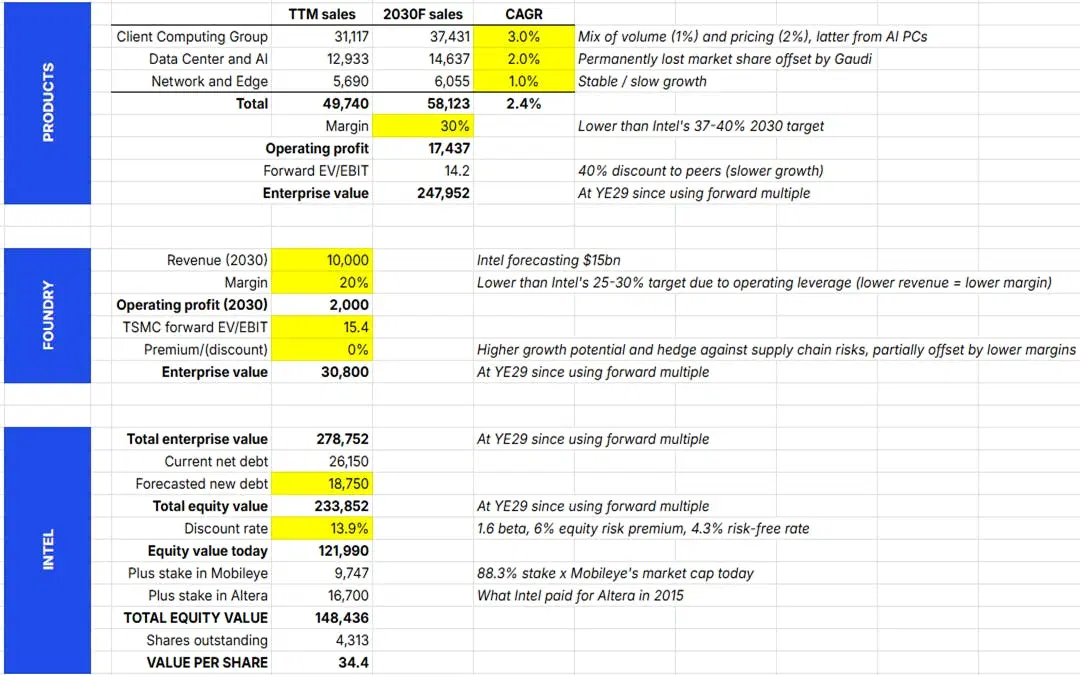

My updated “sum-of-the-parts” valuation puts Intel's fair value at $34.4 per share – still around 60% higher than Intel’s stock price as of Thursday’s close. In other words, Intel’s shares are still undervalued.

Last month, I conducted an in-depth analysis on Intel, explaining why the struggling chipmaker’s shares could be an attractive investment. With that in mind, and with the company recently out with its latest quarterly update, it’s time to re-examine its shares. Now, the earnings results, released on Thursday, were generally positive and investors seemed to think so too: Intel’s stock jumped 7% higher after markets closed.So, let’s take a look at the key takeaways and see whether they change my investment thesis.

First, a look at the books.

Note that all figures here (other than the firm’s outlook for this quarter) reflect third-quarter 2024 results, while growth rates represent year-over-year changes from the third quarter of 2023.

Total revenue fell 6% to $13.3 billion (analyst forecasts: $13 billion)

Client computing group (CCG) revenue fell 7% to $7.3 billion (analyst forecasts: $7.4 billion)

Data center and AI (DCAI) revenue rose 9% to $3.3 billion (analyst forecasts: $3.1 billion)

Network and edge (NEX) revenue rose 4% to $1.5 billion (analyst forecasts: $1.4 billion)

Foundry revenue (from external customers) fell 82% to $55 million

Adjusted earnings-per-share (EPS) of -46 cents (analyst forecasts: -2 cents)

Excluding $3.1 billion of impairment charges, adjusted EPS would’ve been 17 cents

Adjusted gross profit margin (excluding the impairment charges) of 38.4% (versus 45.8% in Q3 2023)

$2.8 billion in restructuring charges, tied to its reorganization and cost-cutting program (designed to save $10 billion a year)

Sees Q4 2024 revenue of $13.3 billion to $14.3 billion (analyst forecasts: $13.6 billion)

Sees Q4 2024 EPS of 12 cents (analyst forecasts: 6 cents)

Sees Q4 2024 adjusted gross profit margin of 39.5% (analyst forecasts: 38.7%)

Sees gross capital spending of $20 billion to $23 billion in 2025

Sees net capital spending of $12 billion to $14 billion in 2025, after accounting for expected proceeds from government incentives and financial partner contributions to its foundry

Next, my (quick) take on that.

Overall, this was a positive set of results from Intel. The firm’s revenue last quarter and its outlook for the current one both came in above analyst expectations.

And while its EPS last quarter came in far short, that was mainly due to $3.1 billion of one-time impairment charges. Intel had some excessive optimism during the pandemic about the level of future demand for its chips, and that led it to buy more manufacturing equipment than it needed. Excluding those dings, Intel’s EPS last quarter would’ve been 17 cents – much better than the 2 cent loss analysts were anticipating. In other words, Intel’s underlying operations are performing better than expected. That helps explain why its EPS outlook for the current quarter also topped estimates.

Now, let’s revisit the investment thesis.

We’ll start with a quick recap: Intel’s shares are lingering near a ten-year low, and the firm is trading below its book value for the first time since at least 1990. So that made me suspect that its stock is cheap – something I confirmed with a sum-of-the-parts valuation (SOTP) valuation during my earlier research piece.

Having said that, Intel’s ambitious transformation plan to restore profitability and significantly expand its foundry network makes this a "show me" story fraught with execution risks. That’s why I think it’s smart to begin with a small investment position in Intel and gradually add to it as the firm hits certain milestones in the coming years, including:

Stabilizing or reversing revenue declines in the CCG and DCAI segments

Reporting strong sales performance for its Gaudi 3 GPU

Improving profit margins

Securing more high-profile clients for its foundry

Completing its major manufacturing projects on time and on budget

Demonstrating the potential of high NA EUV technology on a commercial scale

Managing cash flows and the balance sheet prudently to avoid being forced to issue equity at a depressed valuation

And this is how Intel fared on each of those, as per its latest results.

1) Stabilizing or reversing revenue declines in the CCG and DCAI segments

Slightly positive. CCG revenue fell 7%, but sales at DCAI increased by 9%. But CCG is expected to see positive growth next year, helped by chips for AI PCs. Intel reiterated during its update that it’s on track to ship more than 100 million AI PCs by the end of 2025.

2) Reporting strong sales performance for its Gaudi 3 GPU

Negative. Management said during the earnings call that orders for Gaudi 3 have been weaker than projected and that revenues from the chip won’t hit the company’s $500 million target this year.

3) Improving profit margins

Positive. Intel’s adjusted gross profit margin (excluding impairment charges) was 38.4% last quarter, and the company forecasts that this will rise to 39.5% this quarter, which is better than the 38.7% analysts had forecast.

4) Securing more high-profile clients for its foundry

Negative. Other than Amazon’s cloud business (which I’ve already factored into my earlier analysis), Intel didn’t secure any new clients for its foundry during the quarter.

The firm said that for the next two years, the majority of work done by Intel’s factories will still come from orders from its own chip design unit. The financial benefit of outside business is expected to start showing up in 2026.

5) Completing its major manufacturing projects on time and on budget

Positive. Intel’s latest manufacturing process, “18A”, is progressing well, with high-volume production that uses this process expected to begin in the second half of 2025. Two new products designed to be built using this process have met key early milestones.

6) Demonstrating the potential of high NA EUV technology on a commercial scale

Neutral. It’s too early to tell if Intel can successfully implement high NA EUV technology, which promises big breakthroughs in fabricating the most advanced chips, on a commercial scale.

7) Managing cash flows and the balance sheet prudently to avoid being forced to issue equity at a depressed valuation

Neutral. The firm’s adjusted free cash flow during the quarter was negative $2.8 billion. However, with nearly $30 billion in cash on hand, Intel is not at a point where it has to consider issuing new equity.

Overall I’d say the company is still on track. DCAI is rebounding and CCG is expected to return to growth next year. Margins are improving, which is also good. However, the update on Gaudi 3 is slightly disappointing, and it’s worth monitoring how orders progress next year.

That’s because the GPU is one of Intel’s few hopes of making a dent in the AI data center market.Intel is still investing heavily to expand its manufacturing capacity. And while the foundry didn’t secure any more high-profile clients in the latest quarter, it’s unrealistic to expect it to land big wins every three months. Still, I’d start to get worried if several quarters go by without any new customers, so this is something else worth monitoring.

Model update

Below is a snapshot of Intel’s SOTP valuation, updated with the latest data. The model points to a fair value of $34.4 – still around 60% higher than Intel’s share price as of Thursday’s close. In other words, the stock is still undervalued.

Updated sum-of-the-parts (SOTP) valuation of Intel. Source: Finimize.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.