A lot of people are talking about gold but the fact is, its big-picture outlook is mixed. A potential flurry of new tariffs and tax cuts from the US could send the dollar, bond yields, and inflation higher. The first two could drag down gold prices, while the third could provide a boost.

Taking a long-term view, the ballooning US budget deficit could bolster safe-haven demand for gold. What's more, countries like China have been building up serious stockpiles of the metal, driven by political – rather than financial – motivations.

Either way, investors should consider holding a small amount of gold at all times, as part of their strategic asset allocations, since the commodity increases a portfolio’s diversification, provides a hedge against inflation and other risks, and offers an additional source of return that’s mostly uncorrelated with major asset classes.

A group of leading wealth advisors recently shared their top investing ideas with Bloomberg, and one of them really got me thinking: gold. Specifically, I found myself wondering why this one metal remains a top pick among so many big-name investors – even after its almost 40% price gain over the past year. And I’ve been tying myself into mental knots wondering why it’s done so well, despite the absence of its usual drivers, like low interest rates, high inflation, or slow economic growth. I actually can’t stop thinking about gold.

Here’s where the gold recommendation came from.

The investing idea came from Russ Koesterich, a portfolio manager at BlackRock. He sees gold benefiting from economic and long-term trends.

From an economic standpoint, he notes that a weakening US dollar and declining “real yields” (i.e. inflation-adjusted interest rates) are likely to make this longtime “store of value” more attractive.

And on that long-term view, he expects the ballooning US budget deficit to bolster demand for gold as a safe haven. What’s more, countries like China are building up serious stockpiles of gold to diversify their central bank reserves, hedge against US dollar-related risks, and gradually challenge the greenback’s dominance as the global reserve currency.

Those combined forces, he says, could keep demand for the metal high for even longer.

And here’s my take.

Koesterich’s rationale for the long-term drivers of gold is sound. China’s central bank was the world's biggest single buyer of gold in 2023. And while it’s paused its shopping spree in recent months, it’s widely expected to start it up again at some point – despite today’s high gold prices. It’s got political – rather than financial – motivations in mind, like diversifying its reserves away from the US dollar and chipping away at the greenback’s dominance.

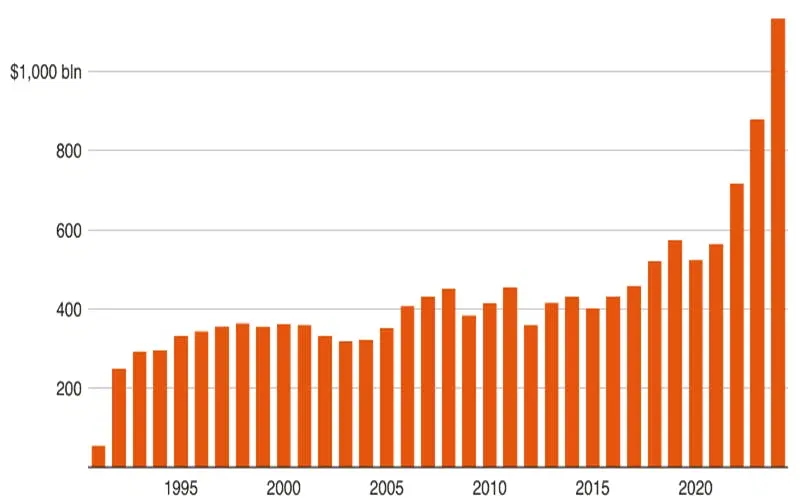

Koesterich’s concerns about the US budget deficit is also well-placed. Consider this: in fiscal 2024, which ended on September 30th, the deficit grew 8% to $1.8 trillion – its third-biggest level on record and its highest outside of the pandemic era. Relative to the size of the US economy, the deficit is now at 6.4% – more than three times the average of other advanced economies, according to the International Monetary Fund. And with the recent election resulting in a one-party sweep, the incoming administration is likely to splash out on tax cuts and pet projects, which could drive the deficit even wider.

In fiscal year 2024, the US budget deficit grew 8% to $1.8 trillion – the third-biggest on record. Source: Reuters.

Now, plugging the growing gap between the government’s outgoings and incomings has meant that the US Treasury has been forced to sell more bonds. And that’s not ideal, but here’s the bigger problem: increased bond issuance only exacerbates the US's already swelling debt pile at a time when interest rates are a lot higher. So the country is shelling out more in interest payments and watching its deficit widen. It’s a vicious cycle of even more bond sales, with even higher interest due, and so on. For example, in fiscal 2024, the US government spent $1.1 trillion solely on interest payments. Naturally, these factors have some investors feeling worried, and that’s bolstering demand for safe-haven assets like gold.

Interest on US federal debt topped $1 trillion in fiscal 2024. Source: Reuters.

As for Koesterich’s macro drivers, they might not unfold exactly as expected given the outcome of the recent presidential election. See, the president-elect has proposed a 10% minimum tariff on all imports and a 60% tax on all goods coming from China. That would have three big implications for the dollar – all of which would likely see it strengthen.

First, they would curb imports, resulting in fewer dollars “sold” to purchase foreign goods, which would bolster the currency over time. Second, they could push the Fed to slow its interest rate cuts or even increase borrowing costs to address rising inflation, resulting in "higher for longer" rates that would boost the dollar by making it more attractive to foreign investors and savers. Third, they could set off a sprawling, damaging trade war, ramping up safe-haven demand for the greenback.

And if the American currency strengthens, it could make gold, which is priced in dollars, more expensive to buyers around the world, reducing its demand. On the flip side, a damaging trade war that ramps up demand for safe-haven assets could benefit gold. And should the president-elect’s tariff proposals push up US inflation, real yields could fall, which would also support gold prices. But, here’s the thing: the direction of real yields also depends on what happens to nominal yields – the returns on Treasuries before adjusting for inflation. These could rise if a growing deficit forces the government to issue more bonds, increasing supply and pushing bond prices down. (Remember: bond yields move inversely to prices.)

In other words, the incoming administration’s plans might push both nominal yields and inflation higher, creating an uncertain effect on real yields. If inflation rises faster than nominal yields, real yields would fall, sending folks looking for gold. If the reverse happens, and nominal yields outpace inflation, real yields could rise, potentially sending gold prices lower.

Bottom line: while the macro outlook for gold is mixed, the long-term prospects are positive. Either way, in my opinion, investors should always own a small amount of gold as part of their strategic asset allocations. That’s because gold increases a portfolio’s diversification, provides a hedge against inflation, protects investors during times of economic or geopolitical turbulence, and offers an additional source of return that’s largely uncorrelated with major asset classes.

Gold has outperformed US stocks during drawdowns that were steeper than 15%. Source: State Street Global Advisors.

Here are the ETFs that could offer a good starting point.

For direct exposure to the commodity itself, you could consider the SPDR Gold MiniShares Trust (ticker: GLDM; expense ratio: 0.1%). For indirect exposure, the VanEck Gold Miners ETF (GDX; 0.51%), which tracks a bunch of the world’s biggest gold mining stocks, can be a good pick.

Investing in miners has some advantages. First, they offer leveraged exposure to gold prices, meaning that when the price of the metal goes up, miners’ shares often rise even more. And that’s great but they also tend to drop more sharply when gold prices fall. Second, miners can grow their earnings by expanding production or reducing costs – even if gold prices stay flat or dip. And third, some mature gold mining companies pay dividends, which could give you income alongside any gains you get on the stock prices. The biggest downside of investing in miners is that it exposes you to company-specific risks – things like operational issues, financial mismanagement, regulatory challenges, cost overruns, and mine accidents.

---

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.