<summary> Global electricity demand is amping up just as the push to reduce carbon emissions takes hold. And that’s making nuclear energy – known for its reliable, continuous clean power generation – especially attractive. At last year's COP28 climate conference, 22 nations committed to tripling the world’s nuclear power capacity by 2050. That’s expected to significantly boost demand for uranium and benefit companies developing the next generation of advanced nuclear technology, known as "small modular reactors" (SMRs).

Thesis

SMRs are small reactors designed to be built in factories, delivered by truck or train, and then assembled on-site, saving time and money. Compared to traditional reactors, SMRs are safer, require less frequent refueling, and, in some cases, are more fuel-efficient.

One of the biggest advantages of SMRs is their ability to be located close to where demand is, so they can directly provide clean electricity to facilities like data centers, which require a constant, 24/7 supply of power.

Big Tech companies are turning to SMRs to meet the massive energy needs of their data centers while staying aligned with their climate goals. In the past two months, Oracle, Amazon, and Google have all announced big commitments to SMRs, which could encourage other firms to follow suit.

There are only two publicly traded pure-play SMR companies: NuScale and Oklo. NuScale is further along in deploying its technology, but both stocks are still high-risk investments.

A potentially safer way to play the SMR theme is through Centrus Energy, which produces the specialized uranium fuel needed to power most SMRs, positioning it to benefit regardless of which firm successfully commercializes its reactor. Centrus also owns a stable, cash-flow-positive business with high barriers to entry, selling enriched uranium to global utilities.

Regardless of whether the next wave of nuclear power is driven mostly by SMRs or traditional reactors, one thing is certain: uranium demand is set to surge. But supply is tight right now, and the market is expected to face a shortfall in the next decade.

That could continue to keep uranium prices hot, which won’t necessarily curb consumption since demand for the heavy metal is mostly oblivious to price changes. Nuclear plants must run continuously at full capacity, after all, and uranium is a relatively minor part of their overall operating costs.

There are two main ways to invest in uranium: through the commodity itself or via mining firms. And a balanced approach that includes both could be the most sensible strategy.

Risks

SMRs are an early-stage technology, and there are none currently running commercially in the US. It’s possible that they’ll never be successfully deployed there, either because of operational issues or because the economic benefits fall short.

NuScale generates only a small amount of revenue, and Oklo generates none. They’re both burning cash, which could force them to issue more shares, diluting the value of their existing ones.

Centrus Energy’s stock has nearly doubled this year and it may be due for a short-term pullback.

Investing in uranium miners exposes you to company-specific risks, including operational issues, financial mismanagement, regulatory challenges, cost overruns, and mine accidents.

If a huge wave of projects gets announced in response to the metal’s big price run, the market could become oversupplied – which could send uranium prices lower again.

Bigger picture: all it would take is another serious accident – like the 2011 Fukushima incident in Japan – to seriously test folks’ newfound enthusiasm for nuclear power.

PART 1: THE CASE FOR NUCLEAR

Global electricity demand is soaring as the world builds more power-thirsty AI data centers, switches to EVs, uses more air conditioning, and electrifies heavy industries like steel production and water desalination. In its latest outlook, the International Energy Agency (IEA) said the world is entering a new “age of electricity” and predicted that global power demand will double by 2050. Between 2023 and 2035 alone, demand is expected to grow by almost 1,000 terawatt hours (TWh) annually – equivalent to adding the entire electricity consumption of Japan each year. Mind you, that’s based on existing government policies, not future pledges.

With power demand surging (so to speak) and policymakers cracking down on carbon emissions, nuclear energy is in a uniquely attractive position. Unlike renewables, nuclear plants provide a reliable and continuous source of electricity – 24/7, without interruption. They produce zero carbon emissions during their operational lives, which can span decades. Finally, these plants are highly efficient, churning out lots of electricity from relatively small amounts of fuel (uranium).

That last point is really important from an energy security perspective. European countries could build cheaper natural gas power plants, which also offer reliable, continuous electricity, but they would become even more dependent on gas imports from Russia or elsewhere. Plus, those plants spew carbon dioxide, which undermines the bloc's environmental goals.

Recognizing nuclear energy's crucial role in building up energy security and minimizing emissions, a coalition of 22 nations – including the US, Canada, the UK, Japan, and France – have set a goal of tripling global nuclear power capacity by 2050. And just last month, 14 of the world’s biggest banks and financial institutions pledged their support to help hit that target. That’s important: the difficulty and high cost of financing nuclear projects have been major barriers to building new plants.

PART 2: THE STATE OF NUCLEAR TODAY AND TOMORROW

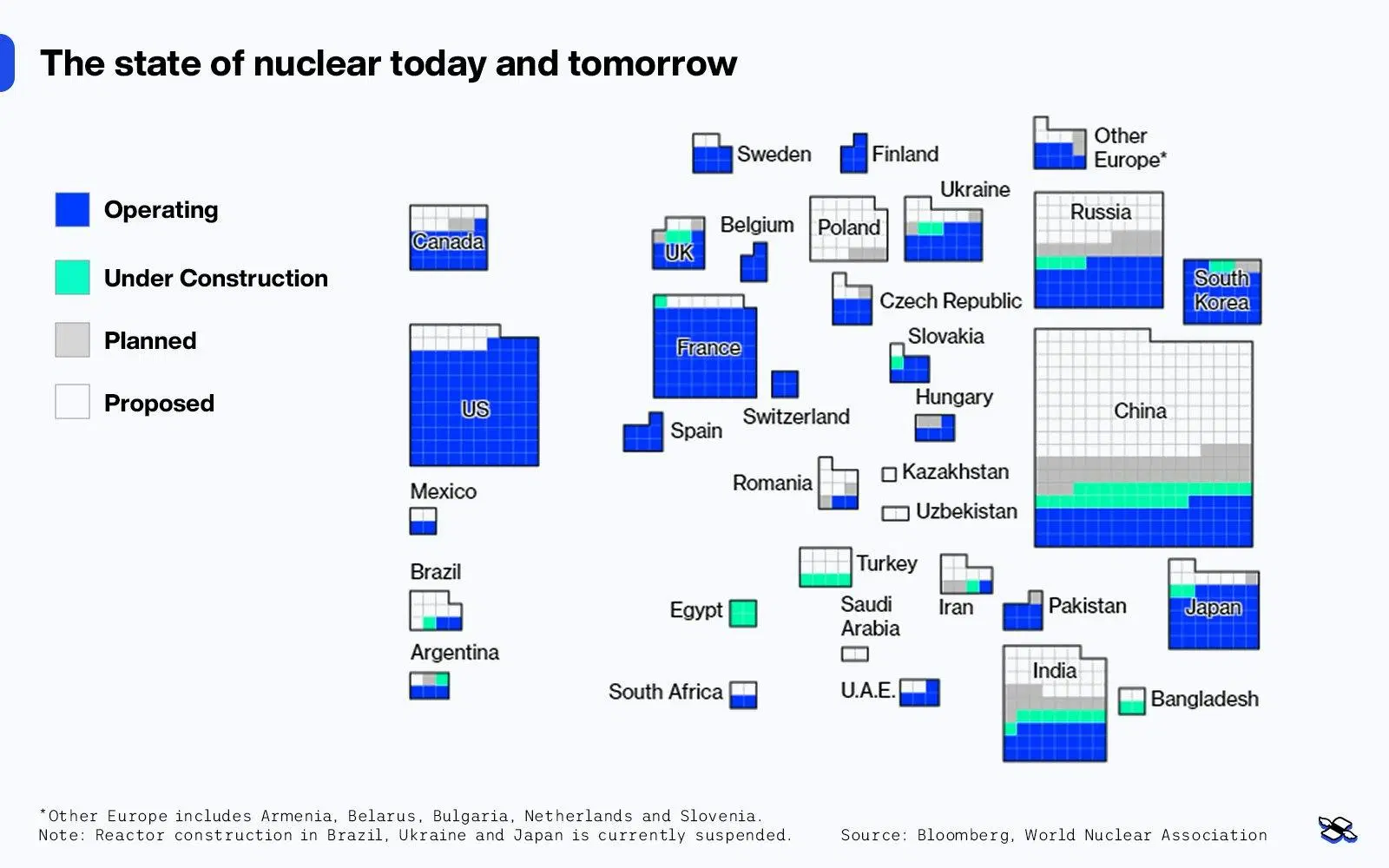

Today, 440 nuclear reactors operate in 32 countries with a combined power capacity of about 390 gigawatts (GW), according to the World Nuclear Association. In 2023, they produced 2,602 TWh of electricity – about 9% of the world's total. Another 60 reactors are currently under construction, with another 110 planned and over 300 proposed. Most of the ones in the construction or planning stages are in Asia.

Nuclear plants that are operating, under construction, planned, or proposed. Source: Bloomberg, World Nuclear Association.

The International Atomic Energy Agency’s latest projections see global nuclear power capacity expanding as much as 144% to 950 GW by 2050. At a minimum, capacity will jump by 32% to 514 GW. Now, here’s where things get interesting: the agency forecasts that “small modular reactors” (SMRs) will account for about a quarter of the capacity added in the bigger expansion scenario and 6% in the smaller.

Small modular reactors

SMRs are a burgeoning technology, widely regarded as the next frontier for nuclear energy. These small reactors, which have a maximum power capacity of 300 megawatts (MW), are designed to be built in factories, delivered by truck or train, and then assembled on-site, saving time and money. That’s very different from traditional nuclear reactors – massive facilities that take many years and tens of billions of dollars to build. SMRs also are safer, require less frequent refueling, and, in some cases, are more fuel efficient. Plus, their compact size allows customers to start with a single unit and add more as demand grows.

But one of the biggest advantages of SMRs is their ability to be located where demand is, directly supplying clean electricity to energy-intensive facilities like data centers, which require a constant, 24/7 supply of power. And, sure, wind and solar plants are cheaper to build than nuclear ones (whether traditional or SMR), but they need to be paired with massive battery packs to ensure a continuous energy stream. This means building renewable farms with far greater power capacity than those hungry data centers require, just to generate enough excess electricity for battery charging. It also requires installing more storage capacity than is needed on a typical day, just to mitigate the odd risk of prolonged periods without sufficient wind or sunlight. And when you factor all that in, renewables’ initial cost advantage quickly diminishes.

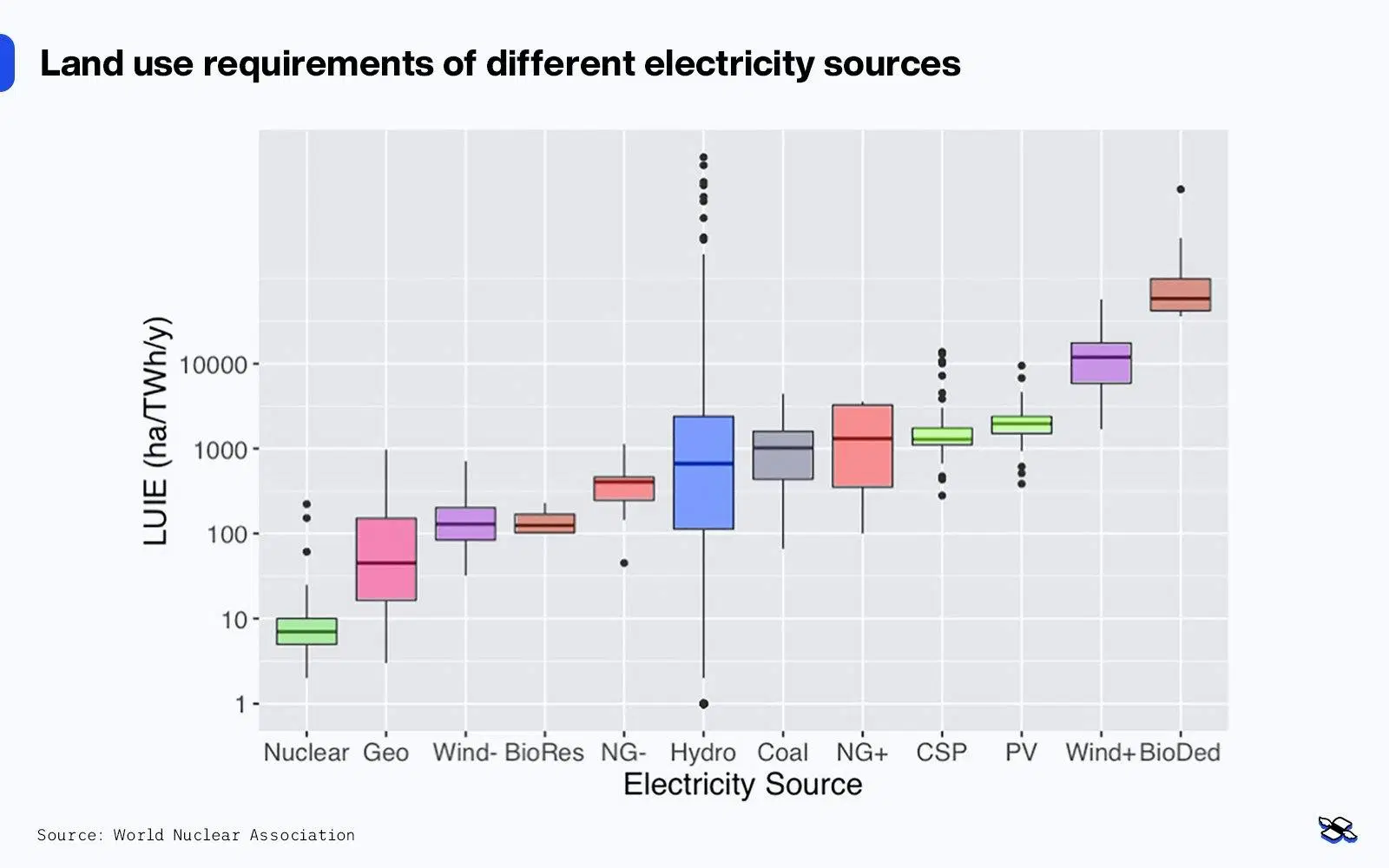

There’s also another issue: land. Some data centers are located in areas with poor wind and sun resources. After all, Big Tech typically chooses its locations based on things like access to major underwater fiber cables, skilled talent, and cheap electricity. State tax incentives also play a big role. Sometimes, even if a location has good wind or solar potential, the availability of land can cause a snag. One academic study found that solar facilities require 183 times more land and wind farms need 1,690 times more to generate the same amount of electricity as a nuclear plant. Using the study’s numbers, I calculated that a data center with around 115 MW of power needs would require a 13-square-kilometer solar farm or a 120-square-kilometer wind farm.

Land use requirements of different electricity sources, measured in hectares-per-terawatt-hours. One hectare equals 10,000 square meters or about 2.5 acres. “Wind-” accounts only for the area taken up by turbines, while “wind+” includes all land covered by a wind farm. Source: Lovering J, Swain M, Blomqvist L, Hernandez RR (2022).

All those factors explain why Big Tech has turned to SMRs to address one of its biggest challenges: staying aligned with their climate commitments while trying to meet the massive energy needs of their data centers. Consider this: Goldman Sachs forecasts that US power demand from data centers will expand at a 15% compound annual growth rate (CAGR) from now until 2030. That’ll leave them responsible for 8% of total US electricity demand by the end of the decade, up from about 3% now. Highlighting the strain this growth will place on existing infrastructure, the chair of Texas’s public utilities board recently said that new data centers should generate some or all of their own power, as the state’s massive grid can’t handle the additional demand.

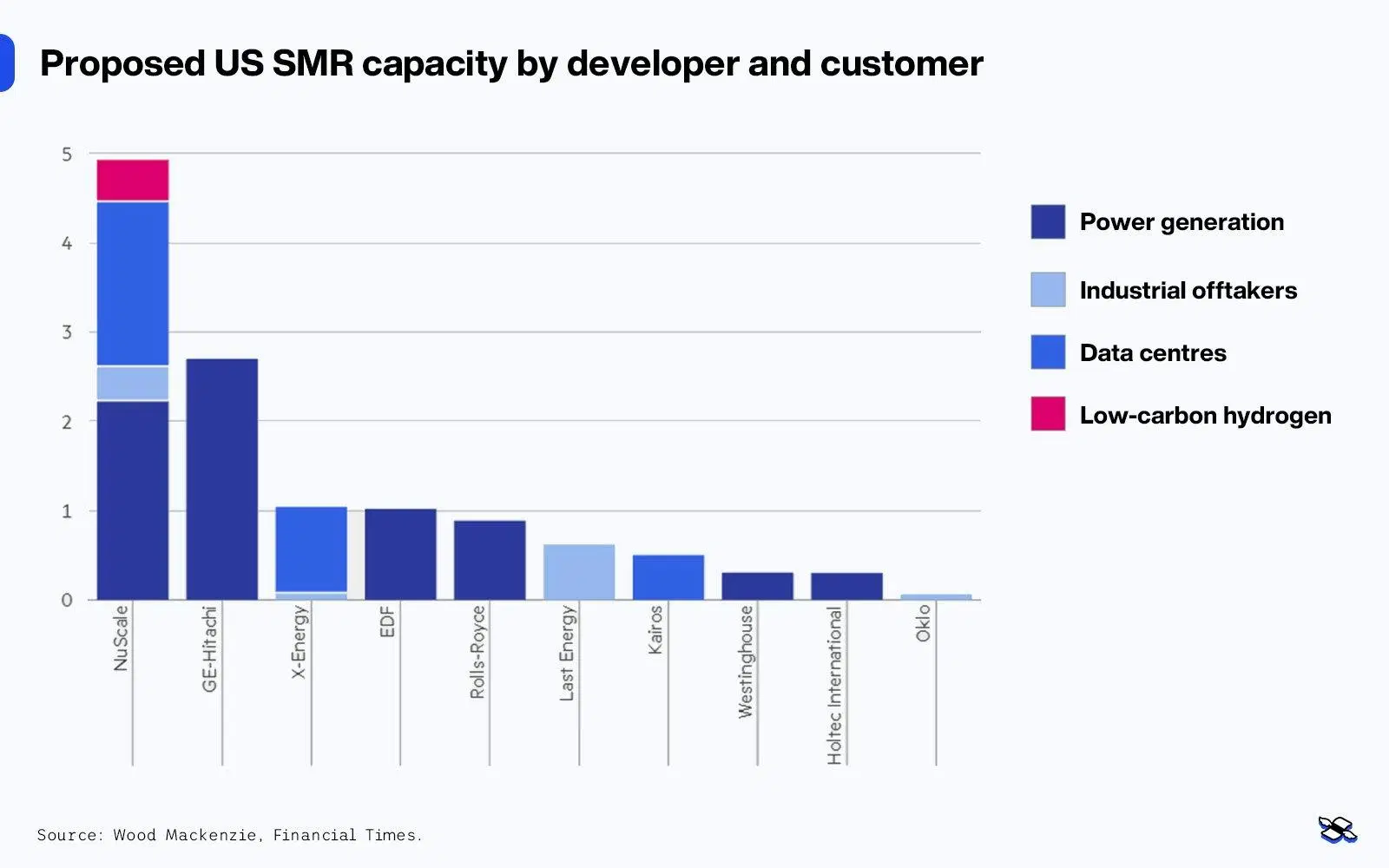

So it’s no coincidence that tech firms have recently announced some big commitments to SMRs, with data centers accounting for more than a quarter of the output of the proposed units, according to consultancy Wood Mackenzie.

Data centers make up 27% of the proposed SMR capacity in the US. Source: Wood Mackenzie, Financial Times.

I mean, just look at the announcements made in the past two months::

Oracle said it’s designing a data center that will require more than 1,000 MW of electricity powered by three SMRs.

Google signed an agreement with privately held Kairos Power to construct a series of SMRs to power the tech giant’s data centers. The deal, which is for 500 MW of power, will see the Kairos bring its first commercial reactor online by 2030, with additional ones through 2035.

Amazon invested in privately held nuclear developer X-energy, and together they announced a plan to bring more than 5 GW of SMR-generated power online by 2039.

What’s more, Amazon said it’s working with publicly traded utility firm Dominion to explore the deployment of SMRs in Virginia – by far the biggest US data center market.

Now, you may have noticed that the SMRs in these announcements won't be deployed for at least a few years. And that leads me to an important point: there are currently no commercial SMRs running in the US (though a few exist elsewhere, mainly in China and Russia). That’s partly due to the lengthy regulatory process from America’s Nuclear Regulatory Commission. But it’s also partly because, until now, potential US customers have been reluctant to commit to buying the first reactor, which is naturally more expensive and riskier than subsequent ones. That recent wave of deals by Big Tech firms should help alleviate this concern though. What’s more, the US government, which is eager to avoid falling behind its geopolitical rivals (China and Russia), is providing $900 million to get SMRs up and running at home.

PART 3: INVESTMENT OPPORTUNITIES

There are two main ways to invest in the nuclear energy renaissance, and each can be done in two different ways: uranium (via the commodity itself or miners) and SMRs (via pure-play developers or a company that produces the kind of fuel needed to power most SMRs).

First, the uranium opportunities

According to the IEA, global nuclear electricity generation is expected to hit an all-time high next year, fueling more uranium demand. Thing is, supply is tight. Mining tapered off sharply after the disastrous Fukushima nuclear accident in Japan in 2011. That resulted in fewer new mining projects, which means there’s less of the stuff being pulled from the ground. And there isn’t a quick fix here: new uranium projects typically take a decade or two before they begin producing. So uranium has been one of the top-performing commodities over the past five years, with spot and long-term contract prices rising by 160% and 217%, respectively.

Those big price points haven’t curbed consumption though, because a unique aspect of the uranium market is its “inelastic” demand. Put differently, demand for the metal is generally unaffected by price changes. That’s because nuclear plants require only a small amount of the stuff to generate huge amounts of electricity, making uranium a relatively minor part of their overall operating costs. What’s more, nuclear reactors are designed to run continuously at full capacity for long periods, and adjusting their output or turning them off is extremely difficult. Basically, nuclear plants can't simply lower production just because uranium costs went up. If anything, they’re incentivized to generate and sell as much electricity as possible to recoup their big initial investment.

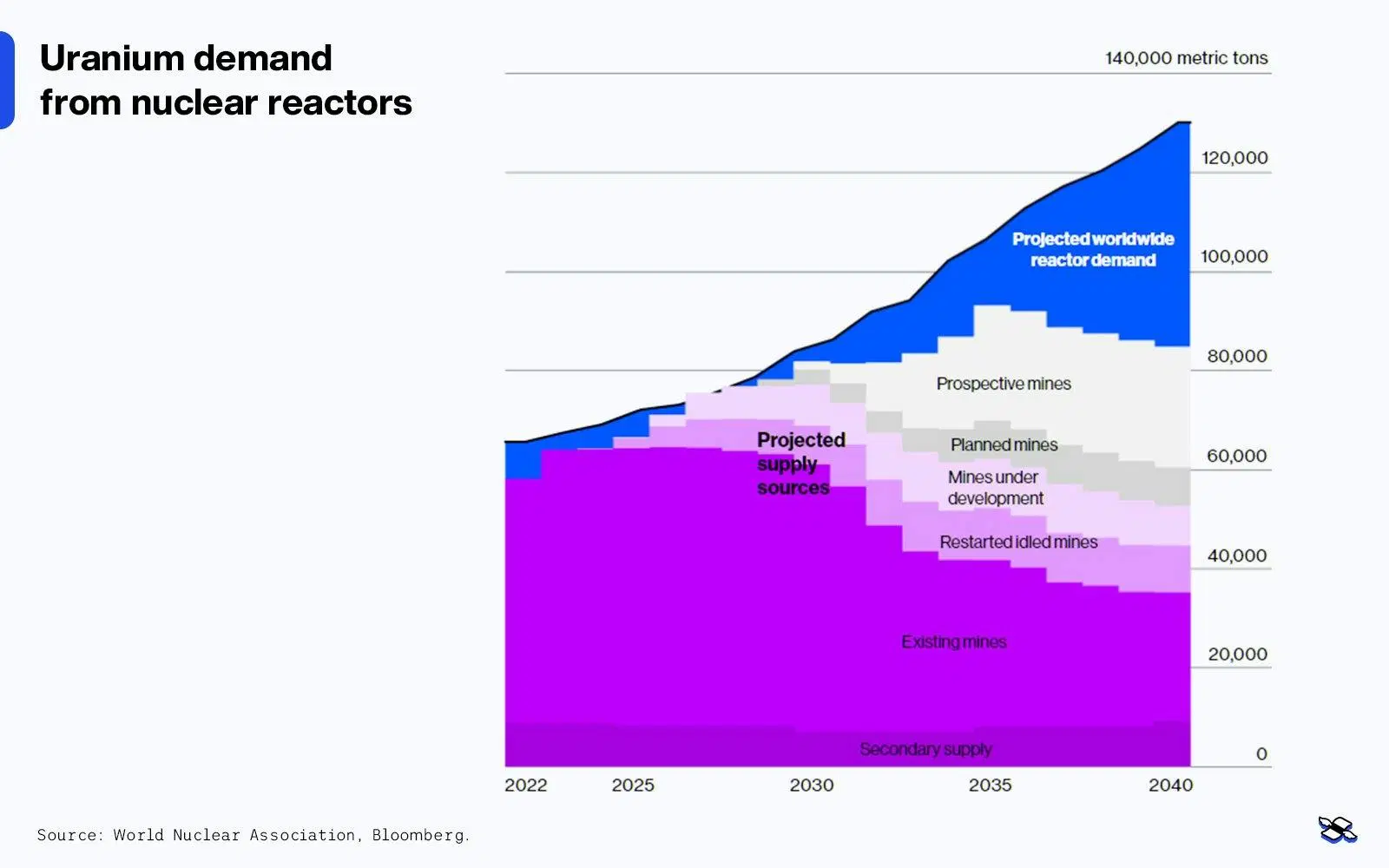

It’s possible that uranium supply and demand will temporarily converge at some point between 2026 and 2029, just before the market shifts back into deficit in the following decade, according to the World Nuclear Association. And that’s not even factoring in growing uncertainties in uranium supply – stemming from production cuts in Kazakhstan, political instability in Niger, and potential export bans from Russia. All told, the anticipated shortfall should continue to send uranium prices higher to incentivize miners to take action today, given the long lag between starting, restarting, or expanding projects and actual production.

Uranium demand from nuclear reactors is seen outpacing supply through 2040. Source: World Nuclear Association, Bloomberg.

Now, remember, you can invest in the commodity itself or in the firms that mine it. Personally, I think a balanced approach that includes both is the most sensible strategy.

The commodity

Investing directly gives you pure exposure to uranium – meaning your investment will fluctuate solely based on the commodity’s price. This eliminates company-specific risks associated with individual miners. What’s more, holding uranium can increase a portfolio’s diversification since the metal tends to move somewhat independently from stocks and bonds. Finally, investing directly in uranium is straightforward, and doesn’t require you to evaluate individual companies and their risks.

The easiest way to invest in the metal is through the Sprott Physical Uranium Trust Fund (ticker: UU; expense ratio: 0.6%), which owns physical uranium. Right now, it holds 66 million pounds of U3O8 (also known as "yellowcake"). That leads to an interesting point: by holding physical uranium for investment purposes, the fund actually reduces the supply that’s available to nuclear plant operators, potentially driving up the commodity’s price over time. And we’re not talking about small potatoes here: the fund’s 66 million pounds of uranium represents roughly 40% of the world’s annual demand.

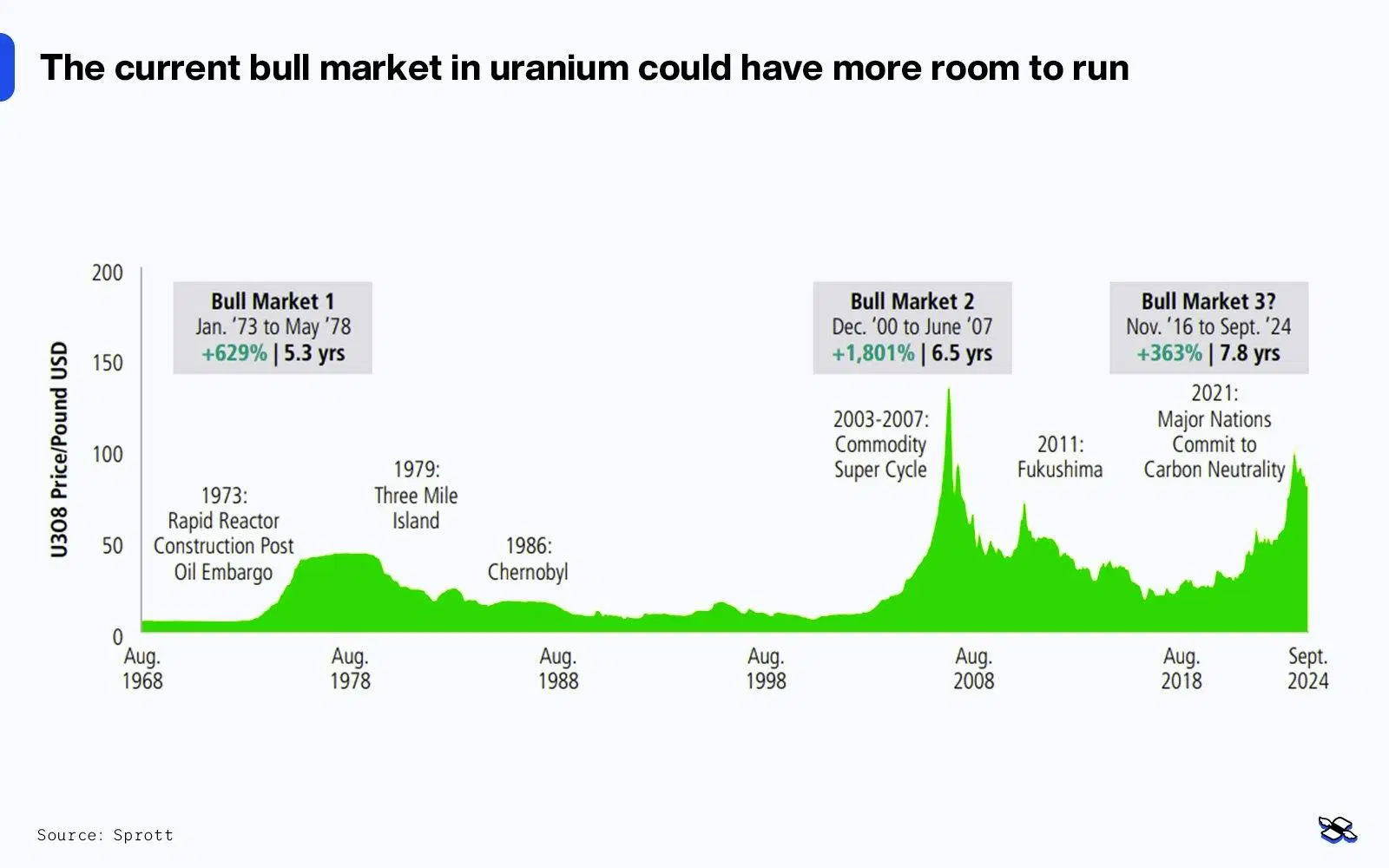

This next chart, from Sprott, highlights that the current bull market in uranium began back in November 2016, and the metal’s price has surged over 360% since then. Now, that might cause some investors to wonder whether it’s too late to buy in. Look back a bit further though, and you’ll see those price gains are still modest compared to previous bull markets, for example, when its price rose 629% in the 1970s and an astounding 1,801% between 2000 and 2007.

The current bull market in uranium could have more room to run. Source: Sprott.

The miners

Investing in miners also has its advantages.

First, they offer leveraged exposure to uranium prices, meaning that when the price of the metal goes up, miners’ shares often rise even more. The flip side is that they also tend to drop more sharply when uranium prices fall.

Second, miners can grow their earnings by expanding production or reducing costs – even if uranium prices stay flat or dip.

Third, some mature uranium mining companies pay dividends, which could give investors income in addition to capital appreciation. Case in point: Kazakhstan’s Kazatomprom, the world’s biggest uranium miner, currently offers a 6.4% annual dividend yield on its shares based on its most recent payout.

Finally, thanks to the lag between spot uranium prices and the long-term contracts miners sign, producers' profits are likely to rise in the coming years even if uranium prices don’t.

The biggest downside of investing in miners is that it exposes you to company-specific risks – things like operational issues, financial mismanagement, regulatory challenges, cost overruns, and mine accidents. That’s why, in my humble opinion, it’s wiser to buy the entire haystack rather than search for the needle, reducing exposure to a single firm’s potential troubles.

The Sprott Uranium Miners ETF (URNM; 0.75%) has a chunky $1.8 billion in assets and tracks almost 40 uranium miners worldwide. Around 30% of the fund is invested in Kazatomprom and Cameco, the world’s two biggest uranium miners, and an additional 10% is allocated to the Sprott Physical Uranium Trust.

Next, the SMR opportunities

And, again, there are two good ways to go here too. The first is to invest in pure-play SMR stocks, which present a high-risk, high-reward opportunity. The second is to buy shares in the only publicly listed company awarded a contract by the US Department of Energy (DoE) to produce the kind of fuel needed to power most SMRs. In my view, this is a relatively safer and better way to gain exposure to the SMR theme.

The pure-play developers

Now, pure-play SMR stocks are hard to find. Kairos Power (which has a deal with Google) and X-energy (which has a deal with Amazon) both are privately held. So is an SMR firm called Terrapower, which is backed by Bill Gates. Big industrial companies like Westinghouse, Rolls Royce, GE Vernova, and Hitachi, are all working on developing SMRs, but their stocks are far from pure plays on the theme.

That said, there are two publicly traded SMR firms. First is Oklo, which is chaired by OpenAI CEO Sam Altman. The company’s business model, on paper, seems quite sensible. Rather than just building SMRs, it plans to own and operate them, selling energy directly to customers under long-term contracts. This approach would generate recurring revenue and give Oklo a shot at capturing more profit if it can later reduce the cost of its operations. It also has developed a nuclear fuel recycling technology that can harness the remaining 95% of energy in spent uranium, reducing fuel costs. That said, Oklo is still in the development phase and has yet to make a dollar in revenue.

The other firm is NuScale, which is arguably a lot further ahead. That’s because it’s the only SMR developer to have received approval for its design from the Nuclear Regulatory Commission, and its project pipeline dwarfs that of its competitors. It’s also currently generating a small amount of revenue, mainly from engineering and licensing services to potential customers. However, NuScale faced a major setback last year when it canceled a project with a utility group in Utah. That came after cost overruns and delays in what would have been the first commercial SMR deployment in the US spooked the utilities that were intended to buy the project's power.

Personally, I see the cancellation as a reflection of the utility firms’ risk aversion and their nervousness about being early technology adopters, not a warning sign about the underlying economics of the project. NuScale said in 2021 that it would deliver power for $58 a megawatt-hour (MWh), but that figure was later raised by more than half to $89. For reference, the latest analysis from investment firm Lazard on the cost of different energy generation technologies estimates that the per-MWh cost of a solar plant paired with batteries ranges between $60 and $210. For onshore wind plus storage, it’s $45 to $133.

So potential SMR customers need to be realistic about the true cost of 24/7, zero-emissions power. And the recent announcements from Oracle, Google, and Amazon suggest that the tech industry recognizes the limitations of renewables paired with batteries in providing consistently stable and cost-effective power.

The fuel provider play

Uranium has to be enriched before it can be used in nuclear reactors because natural uranium contains only about 0.7% of uranium-235 – the isotope needed to make a reaction. Most conventional reactors use low-enriched uranium (LEU), enriched to 3% to 5% uranium-235. On the other hand, high-assay low-enriched uranium (HALEU) is enriched to 5% to 20% uranium-235, making it much more suitable for advanced reactors like SMRs since it offers higher efficiency and longer fuel cycles.

For the US and its allies, having domestic uranium enrichment capabilities is particularly important, because Russia dominates the market. What’s more, Congress passed a law this year banning the purchase of Russian uranium after 2027. That’s huge: more than a fifth of the enriched uranium needed to power both the US’s and Europe’s nuclear fleets comes from Russia. What’s more, Russia is the only country that currently produces HALEU in commercial volumes.

That’s why the US DoE has allocated $2.7 billion to bolster domestic production of enriched uranium by acting as a guaranteed buyer of American-made nuclear fuel. And as part of that package, the DoE awarded contracts to four firms last month to produce HALEU. Of the lot, only one is publicly listed: Centrus Energy. Interestingly, of the four, only two are currently licensed by the US Nuclear Regulatory Commission to produce HALEU, and Centrus is one of them. The other two are in the process of obtaining licenses.

And if that weren’t intriguing enough, Centrus is also the only company authorized to supply enriched uranium to the US government for national security purposes, because the other licensed firm is foreign-owned.

Centrus has two main businesses. The LEU segment acts as a broker, selling LEU to utility companies operating nuclear plants. The technical solutions business produces and sells HALEU and has the option to produce and sell LEU in the future. It also provides engineering, advanced manufacturing, and other technical services for commercial entities.

Centrus’s revenue grew by 9% in 2023, reaching $320.2 million, with the LEU segment contributing 84% of that total. Its net income rose by 62% to $84.4 million, resulting in a 26% profit margin. And it made almost $10 million in free cash flow.

These strong financials make Centrus a relatively safer way to gain exposure to the SMR theme. By investing in the firm, you get the LEU segment: a stable business with strong cash flows and significant barriers to entry, backed by long-term contracts with over 35 blue-chip utilities. And as nuclear generation grows, so will the demand for LEU. More importantly, investing in Centrus provides exposure to one of the few companies currently producing and selling HALEU, positioning it to benefit regardless of which SMR firm successfully commercializes its technology, as virtually all reactors in development will require its fuel to operate. And the company's stock is reasonably priced, trading at 16 times its earnings over the past 12 months.

Centrus already has existing relationships with SMR developers. Source: Centrus.

PART 4: CONSTRUCTING A NUCLEAR PORTFOLIO

It’s tempting to call this “the nuclear option”, but really it’s quite sensible.

Your first step is to decide what percentage of your stock allocation you want to shift to the nuclear theme. For instance, if 60% of your portfolio is invested in shares and you want nuclear to make up 10% of that, you would allocate 6% of your overall portfolio to the relevant shares (because 60% x 10% = 6%). It’s generally not savvy to concentrate your stock exposure too heavily on a single theme, nuclear or otherwise.

When splitting this allocation, you could, for example, divide it evenly between the uranium and SMR sub-themes. Within uranium, to keep things simple, you could further distribute your money evenly between the commodity itself and uranium miners. For the SMR sub-theme, you may want to consider making Centrus your core holding, supplemented by smaller allocations to NuScale and Oklo, given their higher risk profiles. (Just note that of the two, Oklo is further behind NuScale in deploying its SMR technology).

Here’s how you might split the atom, er, allocation:

25% in the Sprott Physical Uranium Trust Fund (ticker:UU; expense ratio: 0.6%)

25% in the Sprott Uranium Miners ETF (URN; 0.75%)

30% in Centrus

12% in NuScale

8% in Oklo

If you’d rather simply buy a single ETF to play the entire nuclear theme, have a look at the Range Nuclear Renaissance Index ETF (NUKZ; 0.85%).

Finally, I want to end with two important points. First, keep in mind that nuclear is a long-term, structural theme, so you’ll want to approach these investments with a long-term perspective. Second, always be aware of the risks. All it would take is another serious accident – like Fukushima – to seriously test the world’s newfound enthusiasm for nuclear power.

This is a new type of analysis: detailed research into investing strategies. Let us know your thoughts, and what you’d like to see next.

Capital at risk. Our analyst insights are for educational and entertainment purposes only. They’re produced by Finimize and represent their own opinions and views only. Wealthyhood does not render investment, financial, legal, tax, or accounting advice and has no control over the analyst insights content.